Buying an ASIC miner isn’t like buying a new phone. You don’t plug it in and instantly see results. If you don’t run the numbers first, you could be spending thousands on hardware only to lose money every month. That’s where an ASIC miner profitability calculator comes in - it turns guesswork into facts.

Think of it as your mining financial advisor. It takes your hardware specs, your electricity bill, and the current price of Bitcoin, then tells you: Will this make money, or just eat your power bill? The answer isn’t obvious. A miner that looked profitable six months ago might now be a money pit. The market moves fast. Calculators help you stay ahead.

What Goes Into a Profitability Calculator?

It’s not magic. These tools use real data you provide. If you give bad numbers, you’ll get bad results. Here’s what you need:

- Hash rate - Measured in TH/s (terahashes per second). This tells the calculator how fast your miner solves Bitcoin puzzles. For example, the Antminer S19 Pro does 110 TH/s. The newer S21 hits 200 TH/s.

- Power consumption - In watts. Most home miners use rigs between 2,000W and 3,500W. The S19 Pro pulls 3,250W. Higher wattage means higher electricity bills.

- Electricity cost - Your rate per kWh. In the U.S., it’s usually between $0.08 and $0.15. If you’re paying $0.20 or more, mining gets much harder. Don’t guess - check your utility bill.

- Pool fees - Most miners join a mining pool. These charge 1% to 3% of your earnings. Some calculators hide this - make sure it’s included.

- Bitcoin price - This changes hourly. A $60,000 BTC price makes mining look great. At $30,000, it might not cover your power.

- Network difficulty - This adjusts every two weeks. As more miners join, it gets harder to earn Bitcoin. If your calculator doesn’t update this, it’s outdated.

- Block reward - After the April 2024 halving, miners earn 3.125 BTC per block, down from 6.25. This cut earnings in half overnight for many.

Missing any of these? Your estimate is just a guess. The best calculators let you adjust all of them manually. Don’t trust ones that lock in default values.

Top Calculators Compared - What Works in 2025?

Not all calculators are equal. Some are fast but shallow. Others are detailed but slow. Here’s how the main players stack up as of mid-2025:

| Calculator | Update Speed | Best For | Missing Features |

|---|---|---|---|

| ASICMinerValue.com | Every 60 seconds | Comparing 47+ ASIC models | No carbon impact tracking |

| WhatToMine | 5-10 minutes | Miners trying multiple coins | Outdated difficulty data after halvings |

| Mining Now | Every minute | Bitcoin-only miners who need speed | Only supports Bitcoin |

| EcoHash Cloud | Hourly | Solar/wind-powered miners | Complex interface for beginners |

| PowerMine Systems | Every 30 minutes | Long-term ROI projections | Slow updates miss price spikes |

Most home miners should use ASICMinerValue.com - it’s updated constantly, supports nearly every ASIC model, and shows live profit trends. If you’re using solar power, EcoHash Cloud adds value by showing how much CO2 you’re saving. If you’re only mining Bitcoin and want the fastest updates, go with Mining Now.

Stay away from calculators that don’t let you adjust network difficulty or that use fixed electricity rates. If it doesn’t let you change your local power cost, it’s not for you.

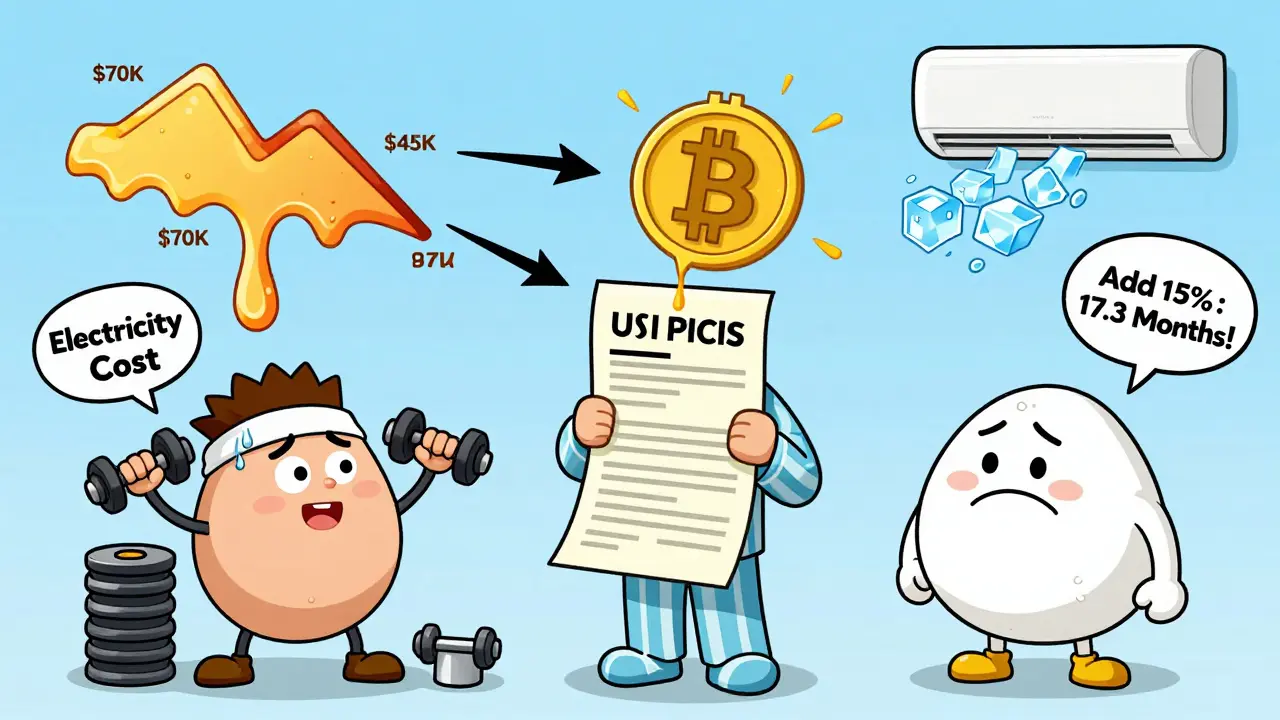

Why Most People Overestimate Their Profits

It’s not the calculator’s fault - it’s what people put into it. A 2024 study by Dr. Alex de Vries at VU Amsterdam found that most users underestimate their electricity costs by 15-25%. Why?

- They forget cooling. A miner doesn’t just use power - it heats up your room. Fans, AC, or even just running your house AC harder adds 10-15% to your real power bill.

- They assume the price won’t drop. Bitcoin can swing 20% in a day. A calculator showing $15/day profit at $70,000 BTC might show $3/day at $50,000.

- They ignore hardware wear. ASICs lose 5-10% efficiency over 18-24 months. A miner that starts at 110 TH/s might drop to 100 TH/s by year two. Most calculators assume perfect performance forever.

- They forget pool fees. Some tools show gross earnings, then hide the 2% fee. Always check the net profit line.

Here’s what works: Add 15% to your electricity cost. Reduce your hash rate by 8% after 12 months. Run the numbers at $45,000 BTC - not the current high. If it still makes money under those conditions, you’re safe.

Real-World Example: Antminer S19 Pro in Colorado

Let’s say you bought an Antminer S19 Pro for $2,800. You live in Colorado, where electricity is $0.11/kWh. You’re mining Bitcoin with a 2% pool fee.

Input these into a good calculator:

- Hash rate: 110 TH/s

- Power: 3,250W

- Electricity: $0.11/kWh

- Pool fee: 2%

- Bitcoin price: $62,000

- Block reward: 3.125 BTC

- Network difficulty: 850 TH (as of June 2025)

The calculator shows:

- Daily profit: $10.75

- Monthly profit: $322.50

- Electricity cost per month: $257

- Payback period: 10.8 months

That looks good. But now adjust for reality:

- Electricity with cooling: $0.11 × 1.15 = $0.1265/kWh

- Hash rate after 12 months: 110 × 0.92 = 101.2 TH/s

- Bitcoin price drop to $50,000

Now the calculator says:

- Daily profit: $5.40

- Monthly profit: $162

- Electricity cost: $295

- Payback period: 17.3 months

Still profitable? Yes. But you’re not making $322 a month anymore. You’re making $162. And if Bitcoin drops further? You’re barely breaking even.

Pro Tips from Experienced Miners

People who’ve been doing this for years know the tricks:

- Use two calculators - Compare ASICMinerValue and Mining Now. If they’re close, you’re likely accurate. If they’re wildly different, check your inputs.

- Update difficulty manually - After a halving or big difficulty spike, don’t wait for the calculator to catch up. Look up the current network difficulty on MiningPoolStats and enter it yourself.

- Watch for hidden costs - Are you paying for internet? Insurance? Maintenance? Some pros add $20-$50/month for these.

- Don’t buy just because a calculator says “profitable” - If the payback period is longer than 12 months, you’re taking big risk. Hardware gets obsolete fast.

- Track your actual earnings - After 30 days, compare what the calculator predicted vs. what you actually mined. Adjust your inputs next time.

One Reddit user, u/MiningMaster42, tracked his S19j Pro for 8 months. His actual earnings were within 4% of ASICMinerValue’s predictions - only because he updated the difficulty weekly and added 12% to his power cost.

What’s Next for Profitability Calculators?

The tools are getting smarter. By late 2025, the best calculators will:

- Use AI to predict difficulty changes 30 days ahead

- Factor in regional regulations - EU miners now must include MiCA compliance costs

- Show carbon footprint per Bitcoin mined - especially useful if you use solar or hydro

- Integrate with mining OS like Braiins OS+ to auto-adjust settings for max profit

But here’s the truth: no calculator can predict the future. Bitcoin’s price, regulation, and technology will keep changing. The best calculators are just tools to help you make better decisions - not to make them for you.

Use them. Trust them - but verify. Always.

Can I use an ASIC miner profitability calculator for other coins like Ethereum?

No. ASIC miners are built only for Bitcoin and a few SHA-256 coins. Ethereum switched to proof-of-stake in 2022, so ASICs can’t mine it. Tools like WhatToMine support other coins, but only if you’re using GPUs or other hardware. For Bitcoin mining, stick to ASIC-specific calculators.

How accurate are ASIC miner profitability calculators?

With accurate inputs, top calculators are 95-98% accurate for the next 30 days. But beyond that, things change: Bitcoin price swings, network difficulty jumps, and hardware degrades. Most errors come from users entering wrong electricity rates or ignoring cooling costs. Always add a 10-15% buffer to your power cost for better accuracy.

Do I need to pay for a profitability calculator?

No. The best ones - like ASICMinerValue.com, Mining Now, and WhatToMine - are free. Enterprise tools from BlockForge or PowerMine Systems charge for advanced features like thermal modeling or multi-site management, but those are for mining farms with hundreds of machines. For a single miner, free tools are more than enough.

What’s the minimum electricity cost to make mining profitable?

For a modern ASIC like the S19 Pro or S21, you need electricity below $0.10/kWh to make solid long-term profits. At $0.12/kWh, you’re barely breaking even after 12-18 months. Above $0.15/kWh, most home miners lose money unless Bitcoin surges above $100,000. If your rate is above $0.18, don’t bother.

How often should I re-calculate my mining profitability?

Run a new calculation every 2-4 weeks. Re-check after major events: Bitcoin halvings, big price moves (over 15%), or if your electricity rate changes. Also recalculate after 6-12 months to account for hardware degradation. Don’t set it and forget it - mining economics shift fast.

Final Thought: Profitability Isn’t Permanent

ASIC mining isn’t a get-rich-quick scheme. It’s a high-stakes energy game. The calculator doesn’t guarantee profit - it just tells you if you’re likely to win or lose under current conditions. The real skill is knowing when to walk away.

If your miner is barely covering costs, don’t wait for Bitcoin to save you. Sell it. Buy a new one. Switch to a cheaper power plan. Or stop entirely. The market doesn’t wait. Your calculator shouldn’t either.