Crypto Token Liquidity Checker

Check Token Liquidity

Liquidity Analysis

Trade Impact Calculator

Estimate potential slippage for a $100 trade

Why Liquidity Matters

High liquidity means you can buy or sell quickly at fair prices. Low liquidity means:

- Large price jumps when buying or selling

- Difficulty finding buyers/sellers

- High risk of significant losses

- Unreliable trading experience

Remember: Liquidity is essential for safe trading. Never invest more than you can afford to lose.

When you hear "Cryptoforce," you might think of another big crypto exchange like Binance or Coinbase. But Cryptoforce isn’t that kind of platform. It’s a fragmented brand with two separate operations, a nearly worthless token, and almost no user reviews. If you’re considering trading on it, you need to know the truth - not the marketing.

Two Different Exchanges, One Name

There’s no single Cryptoforce exchange. There are two. One is based in Hyderabad, India. The other is in Dubai. They share the same name, but they operate under different rules, different regulators, and likely different teams. The Indian version used to be called Coinsbit India and launched in 2022. It targets Indian traders who want to buy crypto with INR. The Dubai version claims to be licensed by the Dubai Multi Commodities Centre (DMCC), which sounds official - but there’s no public proof of that license on DMCC’s official site.This naming mess is a red flag. Legitimate exchanges don’t confuse users by using the same brand across unrelated jurisdictions. If you sign up thinking you’re using the Indian platform, but your funds end up tied to the Dubai side, you could be stuck with no customer support and no clear path to withdraw.

What You Can Trade

The Indian Cryptoforce Exchange supports over 129 cryptocurrencies, including Bitcoin, Ethereum, Solana, Dogecoin, Cardano, and Shiba Inu. You can trade using Indian Rupees (INR) or USDT. That’s useful if you’re in India and want to avoid third-party payment processors. They also claim zero fees on your first three trades - no commissions, no network fees. Sounds great, right?But here’s the catch: no one outside the platform is verifying those claims. CoinMarketCap lists Cryptoforce’s trading volume as "untracked," meaning no independent data source can confirm how much is actually being traded. If the exchange is quiet, the "zero fees" might just be a tactic to lure in new users - then they’ll start charging later.

The platform operates Monday through Saturday, 9 AM to 7 PM IST, and is closed on Sundays. That’s unusual. Most global exchanges run 24/7. If you need to trade during a market spike on Sunday, you’re out of luck. That kind of schedule suggests limited infrastructure or low trading demand.

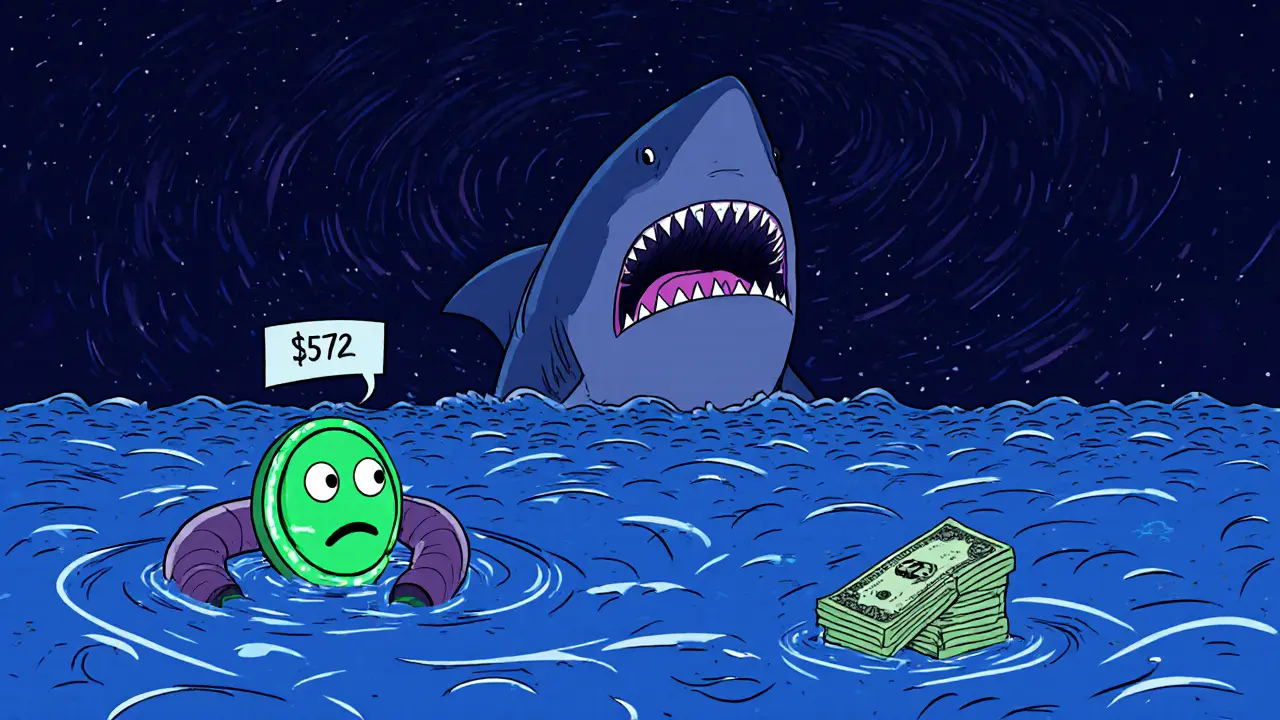

The COF Token: A Ghost Asset

Then there’s the Cryptoforce (COF) token. It’s an ERC-20 token on Ethereum, trading only on Uniswap V2. Its price is around $0.0000027. The 24-hour trading volume? Just $572. That’s less than what a single Bitcoin transaction costs on some networks. You can’t buy it on any major exchange. You can’t use it to pay for anything. It has no utility. It exists only because someone created it - and maybe dumped it.Don’t confuse the COF token with the exchange. They’re completely separate. Buying COF won’t give you discounts on the exchange. It won’t unlock features. It’s just a low-liquidity asset with no real reason to exist. If you see someone promoting COF as an "investment," walk away.

Security and Compliance - Or Lack Thereof

The Dubai side claims to follow FATF and FATCA rules and uses "advanced encryption." But claims without proof are just noise. There are no public audits, no bug bounty programs, no transparency reports. The Indian side says it’s 100% compliant with Indian regulations - but what does that mean? India’s crypto rules are still evolving. The government taxes crypto trades at 30% and has a 1% TDS on every transaction. Does Cryptoforce handle that automatically? Does it report to authorities? No one knows.Compare that to Binance or WazirX. Both have clear compliance pages, published security measures, and real-time incident reports. Cryptoforce has nothing. Not even a support email you can test. If your account gets hacked or frozen, you’re on your own.

Who’s Actually Using It?

The platform claims over 100,000 community members and 1,000 downloads. That sounds impressive - until you realize that Binance has over 100 million users. Coinbase has 110 million. Even smaller Indian exchanges like ZebPay and CoinSwitch Kuber have millions. Cryptoforce’s numbers are tiny. And there are zero verified reviews on Trustpilot, Reddit, or HackerNoon. No YouTube tutorials. No user stories. No complaints. No praise.That silence is louder than any review. If a platform has no user feedback, it’s either brand new (and untested) or deliberately avoiding scrutiny. In crypto, the second option is far more common.

Is It Worth It?

If you’re in India and want to trade crypto with INR, there are better options. WazirX, CoinSwitch Kuber, and ZebPay all offer lower fees, higher liquidity, 24/7 support, and proven track records. They’re regulated, audited, and trusted by millions.Cryptoforce doesn’t offer anything unique. No staking. No savings accounts. No NFT marketplace. No mobile app reviews on Google Play. No API for traders. Just a basic spot trading interface and a confusing brand.

The "zero fees for first three trades" sounds like a bait. Once you’re in, they’ll start charging hidden fees - or worse, delay withdrawals. The lack of transparency is the biggest risk here.

Final Verdict: Avoid Unless You’re Experimenting

Cryptoforce isn’t a scam - not yet. But it’s not a trustworthy exchange either. It’s a low-visibility platform with unclear ownership, unverified claims, zero user feedback, and a ghost token attached to it. If you’re looking to trade crypto seriously, this isn’t the place.Only consider Cryptoforce if you’re willing to risk your money on an unproven platform with no safety net. And even then, only use money you can afford to lose. For everyone else, stick with exchanges that have been tested by millions of users - not just a few hundred downloads.

Is Cryptoforce a legitimate crypto exchange?

Cryptoforce has two separate entities - one in India and one in Dubai - with no clear connection between them. Neither has publicly verifiable licenses, audits, or user reviews. While it’s not confirmed as a scam, its lack of transparency, untracked trading volume, and absence of third-party validation make it unreliable for serious trading.

Can I trade INR on Cryptoforce?

Yes, the Indian version of Cryptoforce allows trading with Indian Rupees (INR) and USDT. But the platform’s limited operating hours (9 AM-7 PM, Monday-Saturday) and lack of verified deposit/withdrawal methods make it less convenient than alternatives like WazirX or CoinSwitch.

What is the COF token, and should I buy it?

The COF token is an ERC-20 token on Ethereum with a price of $0.0000027 and a 24-hour volume of just $572. It trades only on Uniswap V2 and has no utility, no backing, and no adoption. Buying it is speculative at best and a high-risk gamble at worst. It is not connected to the Cryptoforce exchange in any meaningful way.

Is Cryptoforce regulated in India?

Cryptoforce claims to be 100% compliant with Indian regulations, but it has not published any official registration documents, tax handling details, or KYC/AML procedures. India requires exchanges to report to the Financial Intelligence Unit (FIU) and apply 1% TDS on trades. There is no public evidence Cryptoforce meets these requirements.

Why does CoinMarketCap list Cryptoforce as "untracked"?

CoinMarketCap marks exchanges as "untracked" when they don’t provide verifiable trading data through third-party sources. This usually means either the exchange is too small to generate meaningful volume, or it’s not transparent about its activity. In Cryptoforce’s case, both are likely true.

Are there better alternatives to Cryptoforce in India?

Yes. WazirX, CoinSwitch Kuber, and ZebPay are all established Indian exchanges with millions of users, 24/7 support, verified security, and clear compliance with Indian tax rules. They offer lower fees, faster withdrawals, and mobile apps with high ratings. There’s no reason to risk your funds on an unproven platform when better options exist.

Comments (17)

Kaitlyn Boone

November 22, 2025 AT 10:44

the whole thing smells like a shell company with a fancy website and a token no one wants

Natalie Reichstein

November 23, 2025 AT 08:46

let me guess-someone took a template from a crypto blog generator, slapped on two random locations, threw in a token with zero liquidity, and called it a day. this isn’t a platform, it’s a phishing page with a business card. if you’re dumb enough to deposit here, don’t cry when your funds vanish into the ether. i’ve seen this script a hundred times. the "zero fees"? that’s the candy before the trap.

Kris Young

November 24, 2025 AT 12:41

the lack of verifiable licensing is alarming. if you can't prove you're licensed, you're not licensed. period. the indian side claims compliance, but without published documentation, that's just marketing fluff. and the dubai side? no trace on dmcc's official registry. this isn't negligence-it's intentional obfuscation.

James Edwin

November 25, 2025 AT 03:40

you know what's wild? they're open 9am to 7pm, monday through saturday. in crypto? that's like opening a bank only on weekdays and closing during market crashes. if you're waiting for a price surge on sunday and you're stuck with this platform, you're already losing. this isn't a trading platform-it's a time capsule for your money.

LaTanya Orr

November 25, 2025 AT 10:54

the silence around this exchange is more telling than any review. no one's talking about it because no one's using it. or worse-everyone who tried it left without saying a word because they lost everything and didn't even have a support email to complain to. in crypto, absence of noise is the loudest warning sign.

Ashley Finlert

November 27, 2025 AT 07:53

the cof token is not merely worthless-it is a monument to speculative vanity. a digital ghost, haunting the ethereum blockchain with no purpose, no community, no utility. it exists not as currency, but as a psychological artifact: a monument to the delusion that anything with a ticker symbol can be an investment. to buy it is to believe in magic, not markets.

Marilyn Manriquez

November 28, 2025 AT 17:23

i appreciate the thorough breakdown. this is exactly why i avoid anything that doesn't have a public audit or a clear team. when an exchange hides behind vague claims like "advanced encryption" or "compliant with regulations," it's not security-it's smoke and mirrors. real platforms don't make you dig for proof. they put it front and center.

taliyah trice

November 29, 2025 AT 08:54

just dont use it

Peter Mendola

November 30, 2025 AT 09:47

the cof token's volume is less than the gas fee for a single eth transfer. this isn't a token-it's a joke with a smart contract. also, 100k "community members"? that's less than a single subreddit thread. and no reviews anywhere? that's not a startup. that's a ghost town with a domain name.

Norm Waldon

November 30, 2025 AT 10:48

this is a state-sponsored laundering front. the indian branch is a front for money moving out of india, and the dubai branch is the exit point. the "zero fees"? that's how they move dirty cash without triggering aml flags. they're not trying to make money from trading-they're making money from laundering. you're not investing-you're being used as a mule.

neil stevenson

November 30, 2025 AT 11:28

bro, i saw this exact setup last year on a forum. same name, same two countries, same ghost token. they disappeared after 3 months. someone posted a screenshot of their withdrawal request being ignored. the site just went dark. don't be the next one to get ghosted.

Samantha bambi

December 2, 2025 AT 10:53

thank you for writing this. i was almost tempted to try it because of the "zero fees"-but then i checked the token and realized how empty everything is. you're right, the silence is the loudest part. i'm sticking with coinswitch. they might charge a little more, but at least i know i can reach someone if something goes wrong.

sky 168

December 3, 2025 AT 20:19

the 1% tds thing is huge. if they're not auto-withholding it, you're on the hook for paying it yourself. and if they're not reporting to fiu, you're risking tax fraud just by using them. that's not a risk worth taking.

Devon Bishop

December 5, 2025 AT 12:35

the cof token is listed on uniswap v2? that's like putting your car up for sale on a bulletin board in a gas station. if you can't even get it on a major dex, it's not a real asset. and zero liquidity? that means you can't sell it even if you wanted to. it's digital wallpaper.

Khalil Nooh

December 6, 2025 AT 12:33

listen-crypto is risky enough without adding fake exchanges to the mix. this isn't a startup. this is a scam in slow motion. the "zero fees" is the hook. the ghost token is the distraction. the lack of support is the trap. and the silence? that's the sound of people who lost everything and realized too late that they should've walked away. don't be the next headline.

jack leon

December 6, 2025 AT 12:44

the cof token is a zombie asset-half-dead, still twitching, dragging its rotting corpse across the blockchain just to scare the gullible. and the exchange? it's a haunted house with a neon sign that says "safe deposit here." the lights are on, but no one's home. and if you step inside? you're not getting out.

Chris G

December 8, 2025 AT 05:34

coinmarketcap untracked means zero volume and zero credibility. end of story