Block rewards used to be the lifeblood of blockchain networks. Every time a miner solved a puzzle or a validator confirmed a batch of transactions, they got paid in new coins. That was the deal. But that deal is changing - fast. By 2030, the way blockchains pay their guardians will look nothing like it does today. And if you’re still thinking of block rewards as just ‘mining coins,’ you’re already behind.

The Bitcoin Halving Is Just the Beginning

Bitcoin’s block reward started at 50 BTC per block. It halved to 25, then 12.5, then 6.25. In 2024, it dropped again to 3.125 BTC. That’s not a glitch - it’s by design. The total supply of Bitcoin is capped at 21 million. Once that limit is hit - expected around 2140 - no new coins will be created. That means block rewards will vanish entirely. What happens then? Miners won’t shut down. They’ll rely on transaction fees. Right now, fees make up less than 5% of miner income on Bitcoin. By 2030, that number could hit 80% or higher. That’s not a small shift. It’s a complete economic reboot. This isn’t theoretical. We’ve already seen what happens when fees matter more. During the 2021 crypto boom, Bitcoin transaction fees spiked to over $60 per transaction. People paid it because they had to. Networks don’t work without incentives. If fees stay too low, miners leave. If they stay too high, users leave. The balance is delicate.Modular Blockchains Are Rewriting the Rules

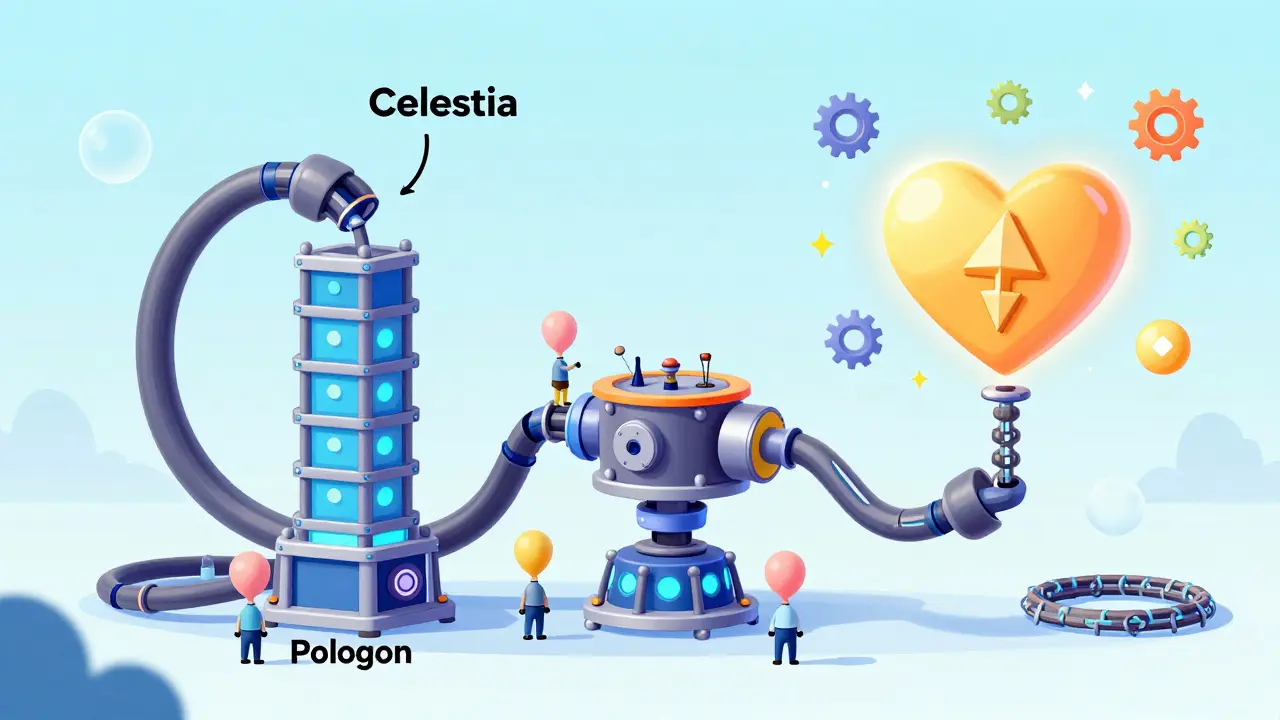

Old blockchains tried to do everything: store data, execute smart contracts, reach consensus. That made them slow and expensive. New ones are breaking apart. Think of them like a car factory where one company builds engines, another builds wheels, and a third assembles the final product. Celestia is the first blockchain built just to handle data availability - nothing else. It doesn’t execute transactions. It just proves they happened. That lets other chains, like Polygon 2.0 or Arbitrum, focus on speed and cost. Each layer gets its own reward system. Celestia pays for data storage. Polygon pays for execution. EigenLayer lets you stake ETH once and earn rewards from multiple services at once. This changes everything. Instead of one big reward pool, you get many smaller ones. A validator can earn from securing Ethereum, a zk-rollup, and a decentralized oracle - all at the same time. That’s not just more money. It’s more resilience. If one layer slows down, others keep running.Liquid Staking Is Turning Stakers Into Investors

Staking used to mean locking up your ETH for months. You earned rewards, but you couldn’t trade or use your tokens. Liquid staking changed that. Now, when you stake ETH with Lido or Rocket Pool, you get a token like stETH in return. That token trades on exchanges. You can lend it, use it in DeFi, or even buy NFTs with it - while still earning staking rewards. This isn’t just convenience. It’s economic leverage. Your ETH works harder. And because you can move it freely, more people are willing to stake. That means more security for the network. Projects like Babylon are taking this further, letting Bitcoin holders stake their BTC on Ethereum-based chains without giving up custody. Bitcoin’s security is now being rented out to other networks. By 2027, over 40% of all staked ETH could be liquid. That’s not a trend. It’s the new standard.

Real Assets Are Bringing Old Finance Into Blockchain

Think of a $10 million office building. Now imagine it’s split into 10,000 digital tokens. Each token represents 0.01% ownership. That’s real estate tokenization. And it’s not just a demo - companies like RealT and Securitize are doing it right now. These tokens don’t just trade. They pay out. Rent collected from the building? Distributed as rewards. Interest from bonds? Paid in crypto. Suddenly, blockchain isn’t just about speculative coins. It’s about replicating traditional financial yields - but faster, cheaper, and open to anyone with an internet connection. This creates hybrid reward systems. You’re not just securing a blockchain. You’re earning from a physical asset. That pulls in institutional money - pension funds, hedge funds, family offices - who’ve stayed away from crypto because of volatility. Now, they’re coming in for the yield.Zero-Knowledge Proofs Are Making Rewards Cheaper and Private

Ethereum’s Dencun upgrade in 2024 slashed Layer 2 transaction costs by 90%. How? Zero-knowledge rollups. These tech tools let thousands of transactions be bundled into one proof - verified on Ethereum without revealing details. Why does that matter for rewards? Lower costs mean smaller participants can still profit. Before, you needed expensive hardware to mine or stake. Now, you can run a validator node on a $50 Raspberry Pi. That opens up participation to people in Nigeria, Indonesia, or rural Texas - not just big mining farms in Texas or Kazakhstan. Plus, ZK tech lets you earn rewards without exposing your transaction history. You can prove you did your job without saying what you did. That’s huge for privacy-focused networks and regulated industries like banking or healthcare.DeFi and AI Are Adding New Layers of Reward

DeFi isn’t dead. It’s evolved. Yield farming gave way to liquidity mining, which gave way to automated strategies powered by AI. Now, bots scan dozens of protocols and shift your funds automatically to maximize returns. You don’t need to understand the math. The AI does it. And it’s not just about swapping tokens. AI agents are being paid to provide real services: verifying data, running simulations, or even writing smart contracts. Projects like SingularityNET and Fetch.ai pay users in tokens for contributing computing power or labeled datasets. That’s not mining. It’s micro-tasking on a blockchain. By 2030, up to 30% of blockchain rewards could come from non-traditional sources - AI labor, data contributions, or automated DeFi strategies. The wallet isn’t just holding coins anymore. It’s earning from services.

CBDCs and Regulation Are Changing the Game

Governments aren’t sitting still. The ECB, BoE, and People’s Bank of China are testing digital currencies. By 2030, 15 central banks could launch their own CBDCs. But here’s the twist: CBDCs won’t use block rewards. They’ll use central bank interest rates. If the Fed wants to stimulate the economy, it could pay 1% interest on digital dollars. If it wants to cool inflation, it might charge 0.5% - a negative yield. That’s the opposite of Bitcoin’s deflationary model. This creates a split. One path: decentralized, permissionless, incentive-driven blockchains. Another: centralized, regulated, policy-driven digital currencies. Both will exist. And both will need different reward structures.What Happens When Miners Leave?

The biggest fear? Network insecurity. If Bitcoin’s block reward drops to zero and transaction fees don’t rise enough, miners will shut down. Less hashing power means more vulnerability to 51% attacks. But history shows networks adapt. After the 2022 Ethereum Merge, mining rigs vanished overnight. Yet Ethereum stayed secure - because staking replaced mining. The same will happen with Bitcoin. The network will find new ways to attract security providers. Maybe it’s through bonded validators. Maybe it’s through insurance pools. Maybe it’s through cross-chain security sharing, like EigenLayer already does. The key isn’t to panic. It’s to understand: security isn’t tied to mining. It’s tied to economic alignment. If the incentives are right, people will still protect the network - even without new coins.What This Means for You

If you’re a holder: Stop thinking of your crypto as a store of value alone. Think of it as a participation ticket. Your coins can earn through staking, lending, or even renting out security. If you’re a developer: Don’t build another monolithic chain. Build a layer. Focus on one thing - data, execution, or privacy - and plug into existing reward ecosystems. If you’re an investor: Look beyond Bitcoin and Ethereum. Watch Celestia, EigenLayer, and Babylon. These aren’t just tokens. They’re new economic engines. The future of block rewards isn’t about bigger payouts. It’s about smarter systems. More layers. More flexibility. More ways to earn. The old model is fading. The new one is already here - and it’s more powerful than ever.Will Bitcoin still be secure after block rewards end?

Yes, but only if transaction fees rise enough to cover mining costs. Bitcoin’s security depends on miners staying profitable. If fees stay too low, fewer miners will participate, making the network vulnerable. However, historical trends show that as block rewards shrink, fees tend to increase - especially during high-demand periods. Network upgrades, like Schnorr signatures and Taproot, also help reduce fee pressure by making transactions more efficient. The real test will be whether users are willing to pay more for security - and whether alternative security models, like EigenLayer’s restaking, can step in.

What’s the difference between block rewards and transaction fees?

Block rewards are new coins given to miners or validators for adding a block to the chain. They’re inflationary - they increase the total supply. Transaction fees are payments made by users to prioritize their transactions. They’re not new coins - they’re just transfers from user to miner. Block rewards are predictable and scheduled. Fees are variable and depend on network demand. In the future, fees will replace block rewards as the main income source for network security.

Can I still earn rewards if I don’t mine or stake?

Absolutely. You can earn through DeFi protocols by providing liquidity, lending crypto, or participating in yield farming. You can earn by contributing data or computing power to AI-blockchain hybrids like Fetch.ai. You can even earn by using apps that reward you for completing tasks - like verifying location data or validating content. Block rewards are just one way to earn. The future is multi-source income across decentralized networks.

Are block rewards the only reason people mine?

No. Early miners were drawn by speculation - buying low, selling high. But today, many miners are institutional players focused on long-term infrastructure. They see mining as a utility business, like running a power plant. They care about consistent cash flow, not just coin price. That’s why some miners are signing long-term power contracts or partnering with data centers. Even if Bitcoin’s price drops, they’ll keep running if fees cover their costs. The incentive has shifted from speculation to operation.

How will CBDCs affect decentralized blockchains?

CBDCs won’t replace decentralized blockchains - they’ll coexist. CBDCs are centralized, government-controlled, and use different tech. But they’ll push innovation. If people see that CBDCs offer better interest rates or faster payments, decentralized networks will need to respond. That means better yields, lower fees, and more user-friendly interfaces. CBDCs act like a benchmark - forcing crypto to improve. They’re not competitors. They’re catalysts.

What’s the biggest risk to the future of block rewards?

The biggest risk is economic misalignment. If transaction fees don’t rise fast enough to replace block rewards, miners will leave. That weakens security. If liquid staking becomes too concentrated - say, one provider controls 70% of staked ETH - it creates a single point of failure. Regulatory crackdowns could also stifle innovation. The real danger isn’t technology. It’s failing to design incentives that keep participants aligned with the network’s long-term health.

Comments (17)

Shamari Harrison

January 27, 2026 AT 16:36

Block rewards are fading, but the real shift is in how we think about value. It's not about coins anymore-it's about participation. Staking, liquidity provision, even contributing data to AI agents-those are the new mining. The network's security is now distributed across multiple economic layers, not just hash power. This is way more resilient than the old model.

And honestly? It's democratizing. A guy in Lagos can run a validator on a Raspberry Pi now. No need for a warehouse full of ASICs. That’s the future-open, accessible, and layered.

Bitcoin’s fee model will work if users understand they’re paying for security, not just speed. We’ve seen it before-when fees spiked in 2021, people paid. They’ll pay again. The market will adjust.

Stop thinking of crypto as a speculative asset. Think of it as infrastructure. And infrastructure needs maintenance. Fees are the toll.

Also, EigenLayer is underrated. Restaking ETH across multiple services? That’s the real innovation. It turns security into a tradable commodity.

Jennifer Duke

January 27, 2026 AT 19:48

Wow, so now we’re just gonna let random people in Nigeria run nodes on a $50 pi and call it ‘decentralization’? Cute. Meanwhile, real security comes from institutional miners with megawatts and legal compliance. This whole ‘everyone can participate’ fantasy is why crypto will never be taken seriously by actual finance.

CBDCs are the future. At least they’re backed by something. Your ‘decentralized’ network is just a glorified lottery with extra steps.

Linda Prehn

January 29, 2026 AT 17:47

so like… block rewards are dying and now we’re all just gonna earn from renting out our eth to other chains and calling it a day?

cool i guess

but like… what if no one wants to pay fees

what then

just saying

also i heard celestia is like… just a data highway

no one’s actually driving on it

just saying

Adam Lewkovitz

January 30, 2026 AT 20:10

Let me get this straight-you’re telling me we’re gonna trust a network that depends on users voluntarily paying fees instead of just printing new coins? That’s not innovation, that’s desperation.

Bitcoin was supposed to be digital gold, not a pay-to-play service. Now we’re turning it into a toll road for the rich. And you call that progress?

Meanwhile, the U.S. is building CBDCs with real oversight. At least there, your money doesn’t vanish because some guy in Indonesia ran a bot that drained a liquidity pool.

Clark Dilworth

February 1, 2026 AT 05:23

The paradigm shift here is non-trivial: we’re moving from a monolithic consensus layer with a single incentive mechanism to a modular, compositional stack where economic security is atomized across verticals-data availability, execution, settlement, and oracle services.

Each layer has its own tokenomics, its own risk profile, its own validator set. This enables capital efficiency via restaking protocols like EigenLayer, where the same collateral can secure multiple services simultaneously-essentially creating a yield-bearing security market.

This is the first time in blockchain history that security has become a fungible, tradable asset class. That’s not an upgrade. It’s a structural evolution.

Brenda Platt

February 1, 2026 AT 15:10

Y’all are overcomplicating this 😊

Think of it like this: before, you got paid in new coins just for showing up.

Now, you get paid for actually DOING something useful-securing data, running AI tasks, lending your ETH, even just keeping your node online.

It’s like going from getting a paycheck for showing up to work… to getting paid for the actual work you do.

That’s not bad. That’s growth.

And yes, you CAN earn without mining or staking. Try DeFi, try yield aggregators, try helping train AI models with your data. The door’s open. Walk through it 🌱

Mark Estareja

February 1, 2026 AT 20:45

Modular blockchains? Restaking? ZK rollups? All these buzzwords mean nothing if the network collapses because fees don’t scale.

I’ve seen this movie before. Everyone’s excited about the new tech until the first 51% attack happens. Then it’s all ‘well, maybe we should’ve just stuck with Bitcoin.’

And don’t get me started on liquid staking. Lido controls 30% of ETH. That’s not decentralization. That’s a centralized ponzi with a fancy whitepaper.

Catherine Hays

February 2, 2026 AT 06:51

Block rewards ending is just the beginning of the end for crypto

Miners will leave

Fees will be too high

Users will flee

And the whole thing will collapse under its own weight

Meanwhile the fed is printing digital dollars with interest rates you can actually predict

Who’s winning again

Just saying

Chidimma Catherine

February 3, 2026 AT 15:59

I am from Nigeria and I want to say thank you for this post

Because before I thought crypto was only for rich people with big machines

Now I see I can run a node with my phone and earn from staking and data tasks

Even if I make only 2 dollars a day

That is more than my job pays

So please do not say crypto is dead

It is alive and it is helping people like me

Thank you

God bless

Nathan Drake

February 5, 2026 AT 14:04

What if the real question isn’t how we pay miners, but why we need to pay them at all?

What if the incentive structure isn’t the solution-it’s the symptom of a deeper problem? That we’ve built networks that require constant monetary inflation to survive?

Maybe the goal shouldn’t be to replace block rewards.

Maybe it should be to design systems that don’t need them in the first place.

Melissa Contreras López

February 6, 2026 AT 01:16

Ohhh I love this so much 💖

It’s like crypto went from a wild west saloon to a fancy tech startup with multiple departments and revenue streams

Now you don’t just mine-you contribute, you lend, you validate, you babysit AI agents, you stake your ETH and still spend it like cash

It’s beautiful

And yes, the old guard will scream about ‘centralization’ and ‘fees’

But guess what? The people who actually use this stuff? They’re smiling.

Because they’re earning.

And that’s the whole point.

Mike Stay

February 6, 2026 AT 10:01

The transition from block rewards to fee-based security is not merely an economic recalibration-it represents a fundamental redefinition of the social contract between network participants and the protocol itself.

Whereas prior models relied on exogenous inflationary subsidies to align incentives, the emerging paradigm demands endogenous, market-driven value extraction through transactional demand, multi-layered staking, and compositional security protocols.

This shift necessitates a cognitive evolution in user behavior: from passive holder to active economic actor. The individual no longer merely receives value; they must actively produce, contribute, and optimize.

The implication is profound: blockchain security is no longer a public good funded by monetary expansion, but a private good commodified through layered market mechanisms.

And while regulatory pressures from CBDCs may appear adversarial, they serve as a catalytic counterforce, forcing decentralized systems to mature, optimize, and prove their superiority through efficiency, not ideology.

What we are witnessing is not the death of crypto.

It is its adolescence.

Taylor Mills

February 6, 2026 AT 16:38

lol so now we’re all just gonna ‘earn from AI’? like some dude in his basement training a bot to trade for him and calling it ‘work’?

and celestia? bro it’s just a data dumpster with a token

and eigenlayer? yeah sure let’s stake eth on 12 different chains and hope none of them get hacked

this whole thing is one big ponzi with extra steps

and the fact that people actually buy this? that’s the real tragedy

Kevin Pivko

February 7, 2026 AT 17:42

block rewards dying? lol. the whole thing is a pyramid scheme. you think fees are gonna cover it? nah. the only reason bitcoin still works is because people still believe in it. as soon as the price drops below mining cost + fees? game over.

and liquid staking? lido’s got 30% of eth. that’s not decentralization. that’s a single point of failure with a cute logo.

you’re not building a future. you’re building a house of cards.

and when it falls? you’ll be the first to say ‘i told you so’

😭

Jessica Boling

February 8, 2026 AT 06:12

so the future of blockchain is… paying more for transactions so miners don’t quit

and also letting people stake their eth on other chains

and also letting ai bots do your trading

and also tokenizing office buildings

so… we turned crypto into a giant financial supermarket

and nobody’s buying the milk

just saying

Tammy Goodwin

February 8, 2026 AT 17:58

I think people are missing the quiet revolution here.

It’s not about who gets paid.

It’s about who gets to decide what ‘value’ means.

Before, the protocol dictated the reward.

Now, users, developers, even AI agents can create new reward pathways.

That’s power.

And that’s why this isn’t just a technical upgrade.

It’s a cultural one.

Shamari Harrison

February 9, 2026 AT 06:21

Replying to @1731: You say CBDCs are ‘real finance’-but they’re controlled by a single entity that can freeze your account, track every purchase, and devalue your money with a click.

Bitcoin’s fee model may be messy, but at least you own your money. No central bank can take it. No politician can tax your transactions. That’s not ‘fantasy.’ That’s freedom.

And as for miners? They’re not vanishing. They’re evolving. Some are becoming infrastructure providers. Others are bundling mining with renewable energy projects. The business model is changing, not dying.

CBDCs might be safe. But safety isn’t the same as sovereignty.