Chinese Crypto Withdrawal Risk Calculator

Calculate Your Risk

This tool estimates detection probability based on Chinese banking regulations and PBoC monitoring systems.

Detection Risk Level

Regulatory Context

95% automatic detection rate - Chinese banks use AI systems trained on 14,273 blacklisted crypto addresses

¥200,000 threshold - Transactions exceeding this amount trigger mandatory reporting to regulators

30+ day freezes - 89% of flagged accounts experience freezes longer than 30 days

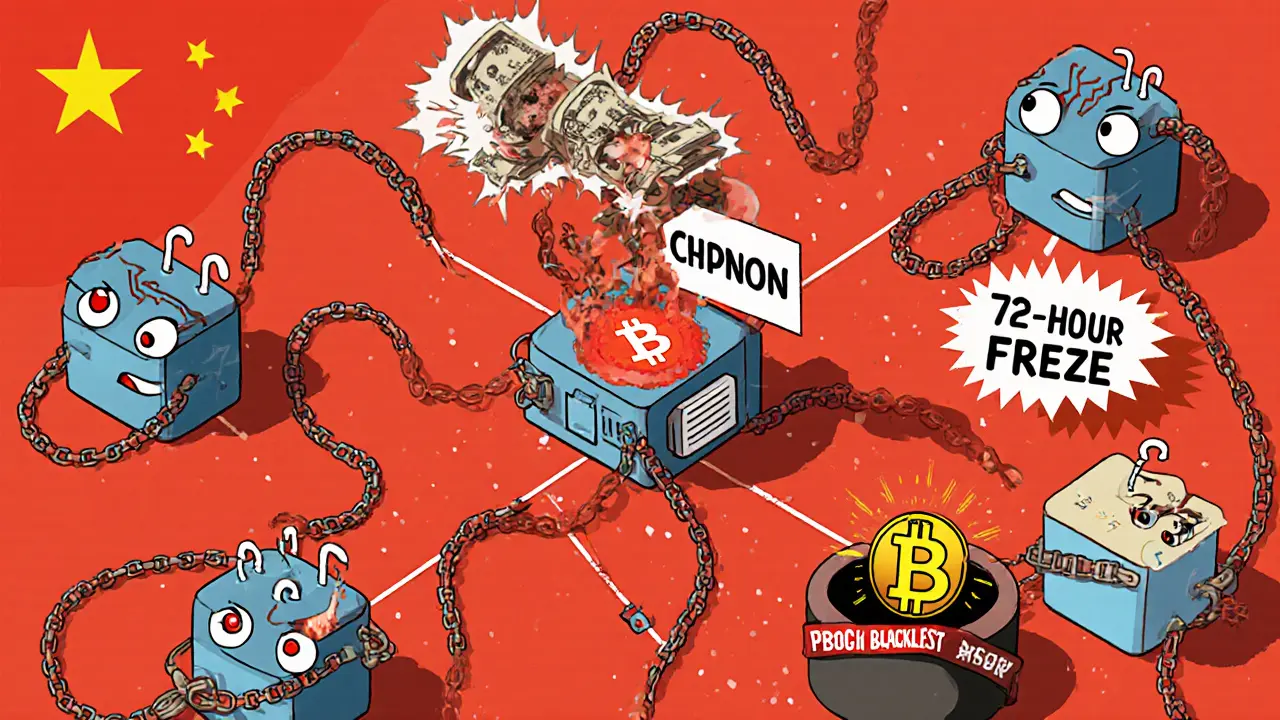

Trying to turn cryptocurrency into cash through a Chinese bank won’t work. Not because the system is slow or broken - but because it’s designed to block you. Since September 2021, China’s central bank, the People’s Bank of China (PBoC), has made it clear: no bank in mainland China can touch crypto-to-fiat transactions. Not even a dime. This isn’t a suggestion. It’s a legal mandate.

What Happens When You Try to Withdraw Crypto to Fiat

If you try to send money from a crypto exchange to your Chinese bank account, the system will stop it before it even starts. Banks don’t just say no - they actively hunt for signs of crypto activity. Their software scans every transaction for red flags: rapid transfers between multiple accounts, payments to known crypto wallet addresses, or deposits that match patterns linked to offshore exchanges like Binance or OKEx. These aren’t guesses. The PBoC maintains a live blacklist of over 14,273 crypto-related wallet addresses. If your bank detects a transfer from any of those, your account gets flagged. Within 24 hours, the bank must report it to the China Anti-Money Laundering Monitoring and Analysis Center. And then? Your account freezes.How Banks Detect Crypto Transactions

Chinese banks don’t rely on luck. They use AI-driven systems trained on millions of past transactions. These tools look for specific behaviors:- Small, repeated deposits totaling a larger sum - a classic way to avoid detection

- Transactions originating from IP addresses tied to crypto exchanges

- Transfers that match wallet addresses on the government’s crypto blacklist

- Unusual patterns of cash deposits over ¥200,000 ($27,500), which trigger mandatory reporting

What Happens to Your Account

Once flagged, your account is frozen for at least 72 hours. In 89% of cases, the freeze lasts longer than 30 days. During that time, you can’t withdraw, transfer, or even pay bills from that account. The bank will ask for proof of where the money came from. If you can’t show a legal source - like a salary slip, business invoice, or property sale contract - they won’t release the funds. You might think, “I’ll just explain it’s from crypto.” That won’t help. Banks are legally barred from accepting crypto as a valid source. Even if you’re honest, the system doesn’t have a way to process your explanation. It’s not about trust - it’s about compliance. The bank’s priority is avoiding fines, not helping you.

Penalties for Banks That Break the Rules

Banks aren’t just told not to help - they’re punished hard if they do. If a bank is found processing crypto-to-fiat transfers, the consequences are severe:- Immediate revocation of business licenses

- Fines equal to 1 to 5 times the value of the illegal transaction

- Criminal charges against senior managers

Why Holding Crypto Is Legal - But Converting It Isn’t

Here’s the twist: it’s not illegal to own cryptocurrency in China. You can hold Bitcoin, Ethereum, or any other coin in a private wallet. No one will come to your door to take it. But if you try to turn it into yuan - through a bank, payment app, or exchange - you hit a wall. This creates a legal gray zone. You can have crypto. You just can’t cash out through official channels. That’s why millions of Chinese citizens still hold crypto - but use informal networks to move it. These underground systems, called CMLNs (Cryptocurrency Money Laundering Networks), operate through trusted friends, overseas accounts, or cash-based intermediaries. In 2024, an estimated $8.2 billion flowed through these channels, up from $5.7 billion in 2023.How People Try to Bypass the Ban (And Why It Usually Fails)

Some try to use third-party services: peer-to-peer platforms, offshore exchanges, or even fake invoices to disguise crypto sales as legitimate business payments. Others try to move money through Hong Kong, where stablecoin trading is now legal. But since June 2025, any transfer over HK$50,000 ($6,400) to a Hong Kong account triggers extra reporting. Chinese banks now watch these flows even more closely. A common tactic is breaking large sums into smaller deposits - under ¥200,000 - to avoid detection. But banks have learned to spot this. They track patterns across multiple accounts and over time. If you deposit ¥150,000 in three different accounts over a week, the system will link them. Even using a friend’s account doesn’t work. Banks now require identity verification for all incoming transfers. If the sender’s name doesn’t match the recipient’s, or if the transaction history looks unusual, it gets flagged.

The Bigger Picture: Why China Banned Crypto

China’s stance isn’t about controlling money - it’s about controlling the financial system. The government wants total control over the yuan. Cryptocurrencies, especially stablecoins, threaten that. They allow people to bypass capital controls, move money out of the country, and avoid taxation. In 2021, China was responsible for 65% of global Bitcoin mining. After the ban, that dropped to nearly zero. Mining rigs were shut down, and operators moved to Kazakhstan, the U.S., or the Middle East. But the real target was the banking system. The PBoC doesn’t want people using crypto as an alternative to the digital yuan - which is now being rolled out nationwide. The central bank’s goal is clear: make the digital yuan the only digital currency people use. Every transaction on it is tracked, taxed, and controlled. Crypto doesn’t fit that model.What About the Future?

There’s no sign China will loosen its rules. S&P Global predicts the ban will stay in place until at least 2027 - and maybe longer. The only possible shift would come if the digital yuan reaches 30% of retail payments, which isn’t expected before 2028. Meanwhile, banks are preparing for the next wave of evasion. By mid-2026, they plan to roll out AI tools that can trace crypto flows across multiple blockchains with 92% accuracy. That means even if you use privacy coins or mixers, the system will likely catch you.Bottom Line: Don’t Expect to Cash Out

If you’re in China and you hold crypto, your best option is to keep it. Don’t try to convert it to fiat through a bank. You won’t succeed. You’ll likely lose access to your account, face delays, or worse - legal scrutiny. The system isn’t designed to help you. It’s built to stop you. And it’s working.Can I legally own cryptocurrency in China?

Yes, owning cryptocurrency is not illegal in China. You can hold Bitcoin, Ethereum, or other coins in a private wallet without breaking the law. But you cannot convert it to yuan through banks, payment apps, or any regulated financial institution. The ban only applies to trading and cashing out - not possession.

What happens if I try to send crypto to my Chinese bank account?

Your bank will likely freeze your account. Transactions linked to crypto wallets or exchanges are automatically flagged by monitoring systems. The bank must report the activity to regulators within 24 hours and freeze your account for at least 72 hours. In most cases, the freeze lasts over 30 days, and you’ll need to prove the funds came from a legal source - which you can’t do if it’s from crypto.

Can I use a friend’s bank account to cash out my crypto?

No. Banks now require identity verification for all incoming transfers. If the sender and recipient names don’t match, or if the transaction pattern looks suspicious (like multiple small deposits from different people), the system flags it. Even if you use a trusted friend, the bank’s AI will link the activity and freeze both accounts.

Is it safe to use Hong Kong banks to convert crypto to fiat?

Hong Kong allows regulated stablecoin trading, but mainland Chinese banks are strictly prohibited from participating. Any transfer over HK$50,000 ($6,400) to a Hong Kong account since June 2025 triggers extra reporting by Chinese authorities. If you’re a mainland resident, your bank will monitor and report these transfers, increasing your risk of investigation.

Why do Chinese banks spend so much on crypto monitoring?

Because the penalties for non-compliance are extreme. Banks face fines up to 5 times the transaction value, license revocation, and criminal charges for managers. Since 2022, they’ve spent $350-400 million annually on detection tools to avoid these risks. It’s cheaper to invest in monitoring than to risk losing their entire business.

Will China ever allow crypto-to-fiat conversions again?

Not anytime soon. The People’s Bank of China is focused on making the digital yuan the dominant form of digital money. Crypto is seen as a threat to monetary control. Experts predict the ban will remain until at least 2027, and possibly beyond 2030. Any change would require the digital yuan to reach 30% of retail payments - a milestone not expected before 2028.

Comments (20)

diljit singh

November 21, 2025 AT 19:50

China just wants control simple as that

Phil Taylor

November 22, 2025 AT 22:38

Of course they block it. Western crypto is just a tax-evading, capital-flight scheme disguised as innovation. China’s banking system isn’t broken-it’s smarter than yours. You think freedom means being able to launder money through Bitcoin? Wake up. The PBoC is protecting the yuan from your chaotic speculative nonsense.

Every time some American tries to cash out crypto into a Chinese bank, they’re not just breaking rules-they’re attacking monetary sovereignty. And the banks? They’re not villains. They’re soldiers in a war against financial anarchy.

Let me guess-you’re one of those people who thinks “I own my Bitcoin” so the state should bend over backward to let you convert it. Newsflash: you don’t own anything if your asset can’t be integrated into the real economy. Crypto isn’t money. It’s a digital collectible with delusions of grandeur.

And don’t even get me started on those “CMLNs.” You think underground networks are clever? They’re just glorified mule operations. The government tracks them better than your ex tracks your Instagram likes. That $8.2 billion flow? It’s not freedom-it’s desperation.

Meanwhile, China’s building the digital yuan with full traceability, programmable rules, and zero tolerance for shadow finance. That’s the future. Not your crypto fantasies. Not your decentralized dreams. Real control. Real efficiency. Real stability.

You think the ban is harsh? Try living under a system where your bank account gets frozen because you used a wallet that was on a blacklist. You’d thank them for the discipline. The West is crumbling under financial chaos. China is building a fortress.

And yes, the AI systems are terrifyingly accurate. They don’t guess-they correlate. They don’t react-they predict. You think breaking deposits into ¥150k chunks fools them? That’s like trying to hide a tank behind a cardboard box.

Don’t cry about your frozen funds. Cry about your ideology. You wanted decentralization? You got isolation. And now you’re mad the walls are too high.

Abhishek Anand

November 23, 2025 AT 01:20

It's not about crypto-it's about power. The state doesn't fear Bitcoin. It fears the idea that money can exist outside its gaze. The digital yuan isn't progress-it's surveillance with a better UI. You think you're being oppressed? You're just witnessing the final stage of monetary centralization. The West is still pretending money is free. China already knows it's a tool. And tools are meant to be controlled.

They're not banning crypto because it's dangerous. They're banning it because it's a mirror. And mirrors show uncomfortable truths: that your financial freedom is an illusion built on trust in institutions that don't care about you.

The real tragedy? Millions still hold crypto not because they believe in decentralization-but because they don't believe in the yuan. And that's the quiet revolution they can't police.

vinay kumar

November 24, 2025 AT 09:20

They just want the people to use digital yuan no one cares about crypto anyway

Lara Ross

November 25, 2025 AT 03:59

This is an incredibly well-researched and meticulously structured analysis. The depth of insight into China’s regulatory architecture is both alarming and admirable. The banking sector’s compliance investment-$350–400 million annually-is not merely a cost of doing business; it is a testament to institutional discipline in the face of global financial volatility. This is not authoritarianism for its own sake-it is systemic resilience. We should study this model, not mock it.

The digital yuan is not a weapon against freedom-it is a safeguard against exploitation. In a world where unregulated digital assets fuel fraud, tax evasion, and illicit capital flight, China has chosen responsibility over chaos. This is leadership. Let us not confuse control with tyranny.

Leisa Mason

November 25, 2025 AT 19:17

Wow so the Chinese government is basically a giant firewall for the yuan and people are shocked

Of course they block it. They’ve spent decades building a financial system where every transaction is tracked, taxed, and tamed. Crypto is the one thing that breaks that spell. And now you’re surprised they reacted with surgical precision

Let me guess-you think this is about “freedom.” No. It’s about control. And guess what-most Chinese citizens don’t mind. They want stability. They want to pay their bills without their account vanishing into a black hole.

Meanwhile, in the West we treat crypto like a video game where you can just respawn your bank account. China plays real life.

Rob Sutherland

November 25, 2025 AT 22:41

There’s something quietly beautiful about how China turned a ban into a system. Not just stopping people-but reshaping their relationship with money entirely. You can own crypto, but you can’t use it. That’s not oppression-it’s a philosophical boundary. Like owning a weapon but being forbidden to fire it. The power isn’t in the possession. It’s in the restriction.

The real question isn’t whether the ban works. It’s whether we’re willing to live in a world where money has to be approved to be valid. That’s the future China is building. And it’s terrifying… and maybe necessary.

Tim Lynch

November 26, 2025 AT 14:29

Imagine if every time you tried to turn your digital art into cash, the museum locked your account and demanded proof you didn’t steal the brushstrokes. That’s what this is.

Crypto isn’t money. It’s a digital artifact. And China just said: artifacts belong in galleries. Not bank accounts.

They didn’t ban Bitcoin. They banned the fantasy that it could be real. And in doing so, they forced everyone to choose: Do you want freedom to move money? Or do you want a system that never breaks?

They chose the latter. And honestly? I’m not sure they’re wrong.

Melina Lane

November 27, 2025 AT 16:03

It’s wild to think about how different the world could be if every country treated money like this-secure, traceable, protected. Maybe we’re the ones who are behind, not China. The digital yuan isn’t scary-it’s the future we should be building. And if people are still holding crypto? That’s okay. Just don’t expect banks to be your escape route.

You don’t have to love the system to respect its logic.

andrew casey

November 29, 2025 AT 11:38

It is imperative to underscore that the People’s Bank of China’s regulatory posture constitutes not merely a policy decision, but a structural reconfiguration of financial sovereignty. The institutionalized deployment of AI-driven transactional surveillance, coupled with legally mandated reporting thresholds and punitive financial penalties, reflects an unprecedented convergence of technocratic governance and monetary orthodoxy. The resultant ecosystem, while ostensibly restrictive, is functionally optimized for systemic integrity. One must therefore interrogate the normative assumptions underlying Western critiques of this model, which often conflate regulatory rigor with authoritarianism, rather than recognizing it as a legitimate exercise of state responsibility in an era of financial fragility.

Lani Manalansan

November 30, 2025 AT 21:54

It’s fascinating how this mirrors the global tension between cultural values around money. In the U.S., we treat finance like a personal right. In China, it’s a public good. Neither is wrong. But China’s approach is rooted in centuries of centralized economic stewardship. The digital yuan isn’t just a currency-it’s a cultural statement. And maybe, just maybe, the rest of us are the ones who’ve lost our way.

Frank Verhelst

December 1, 2025 AT 02:44

China’s got the right idea 😎

Why let people turn crypto into cash? Just keep it as digital art. Save the banks from the chaos. The digital yuan is the future. And it’s clean. 💪

Roshan Varghese

December 1, 2025 AT 09:56

lol they banned crypto because they know the digital yuan is garbage and people will figure it out. the whole thing is a scam. the pbc is just scared. they dont want people to know the yuan is backed by nothing but lies and surveillance. the blacklisted wallets? those are just the ones that still have real value. theyre hiding the truth. you think theyre smart? theyre panicking.

and the cmlns? those are the real people. the ones who still trust each other. not the state. not the bank. not the algorithm. just humans.

wait till the digital yuan crashes and everyone remembers what real money looks like

Dexter Guarujá

December 1, 2025 AT 13:39

Let’s be clear: this isn’t about control. It’s about survival. The West’s obsession with crypto is a luxury of nations that haven’t had their currency devalued by reckless monetary policy. China didn’t ban crypto because it’s evil-it banned it because it’s a Trojan horse for capital flight, tax evasion, and Western financial imperialism. The digital yuan isn’t a threat to freedom-it’s a shield against exploitation. And if you can’t see that, you’re not pro-freedom. You’re pro-chaos.

Those who call this authoritarian don’t understand that sovereignty isn’t optional. It’s the foundation of any functioning economy. And China is building one.

Jennifer Corley

December 2, 2025 AT 18:48

Interesting how the article presents this as a neutral fact. But the real question is: who benefits from this level of surveillance? Not the average citizen. Not even the banks. The state. And we’re supposed to applaud it because it’s efficient? That’s not progress. That’s a police state with better UI.

The fact that people still hold crypto isn’t a loophole-it’s a rebellion. Quiet, invisible, but real.

And the AI systems? They’re not detecting fraud. They’re detecting dissent.

Natalie Reichstein

December 4, 2025 AT 14:40

People think they’re being oppressed because they can’t cash out. But they’re not being oppressed. They’re being protected-from themselves. Crypto is a pyramid scheme with blockchain glitter. The Chinese government is doing what every responsible authority should do: stop people from losing their life savings to a digital illusion.

And don’t pretend you’re a freedom fighter because you hold Bitcoin. You’re just a sucker who fell for a cult.

Kaitlyn Boone

December 5, 2025 AT 00:36

theyre not banning crypto theyre banning the idea that money can be anonymous

and honestly? good

why should i be able to move cash without anyone knowing

the system works

James Edwin

December 5, 2025 AT 12:24

What’s fascinating is how this reveals the fundamental difference between financial systems: one built on trust in institutions, the other on trust in code. China chose the former. The West chose the latter. And now we’re seeing the consequences. Neither is perfect. But maybe China’s system is less prone to collapse.

Still… I wonder what happens when the next generation grows up with the digital yuan as their only currency. Will they even understand why anyone would want crypto?

Kris Young

December 7, 2025 AT 04:23

This is a well-documented, accurate, and important explanation of China’s cryptocurrency policy. The banking system’s compliance mechanisms are not only technically sophisticated but also legally grounded. The penalties for non-compliance are severe, and rightly so. The digital yuan represents a legitimate and necessary evolution of state-backed currency in the digital age. It is not censorship. It is responsibility.

LaTanya Orr

December 8, 2025 AT 15:03

It’s strange how we call it a ban when really it’s just a boundary. You can own it. You just can’t turn it into the system’s money. Like having a key to a room you’re not allowed to enter. Maybe that’s the real lesson: not all freedom is meant to be used. Some is just there… to remind you what’s possible.

And maybe that’s okay.