Sanctions Evasion Calculator

How Russian Sanctions Evasion Works

This calculator demonstrates how Russia converts rubles into cryptocurrency to bypass Western sanctions. Based on the article's data about the A7A5 token and payment systems, it shows the transaction flow from rubles to international markets.

Transaction Flow Analysis

A7A5 Token PathRUB to A7A5

Crypto Exchange

Capital Bank

International Transfer

Enter an amount to see how funds flow through Russia's sanctions evasion system.

When Western nations slapped sanctions on Russia after its invasion of Ukraine, they expected to choke off its economy. Instead, Russia built a digital financial escape hatch-using cryptocurrency to move billions in hidden cash, buy weapons, and keep its war machine running. This isn’t some fringe underground operation. It’s a full-scale, state-supported financial network built on blockchain, shell companies, and custom digital tokens designed to slip past global watchdogs.

The A7A5 Token: Russia’s Ruble-Backed Crypto Lifeline

At the heart of Russia’s sanctions evasion strategy is a digital currency called A7A5. It’s not Bitcoin. It’s not Ethereum. It’s a custom token, specifically engineered to look like a stablecoin but backed by the Russian ruble. Launched in early 2025, A7A5 has already moved $9.3 billion in just four months. That’s not a typo. Nearly $10 billion in sanctioned Russian money, converted into digital form, and sent across borders without triggering traditional banking alerts. A7A5 runs on both TRON and Ethereum blockchains. Why both? Because if one network gets blocked, the other keeps working. It’s a hedge against enforcement. The token was created by a company based in Kyrgyzstan, a country with weak financial oversight and little appetite for cooperating with Western regulators. From there, A7A5 flows into exchanges, then into wallets controlled by Russian military suppliers, shell firms, and political operatives abroad. The goal? Turn rubles into something global markets accept. Buy drone parts from Turkey. Pay for satellite tech from India. Fund propaganda networks in Moldova. A7A5 makes it all possible-without a single bank transfer crossing a Western financial system.Garantex Dies. Grinex Is Born.

Russia didn’t start with A7A5. It began with Garantex, a crypto exchange based in Russia that became a major hub for moving sanctioned funds. In March 2025, the U.S. Secret Service shut it down. Assets were frozen. Executives were targeted. The Kremlin’s crypto pipeline seemed broken. It wasn’t. Within days, the same team behind Garantex launched Grinex. The new platform didn’t just replace the old one-it copied it. Customer deposits, trading infrastructure, even the same login system. Grinex’s own website openly admitted it was created because Garantex was taken offline. The U.S. Treasury quickly labeled Grinex as a sanctioned entity, but by then, it had already moved over $2 billion. This isn’t a glitch. It’s a playbook. When one node gets hit, another pops up. The system is designed to be resilient. No single exchange is critical. If Grinex gets targeted next, another will rise. The names change. The infrastructure stays.Capital Bank: The Bridge Between Crypto and Cash

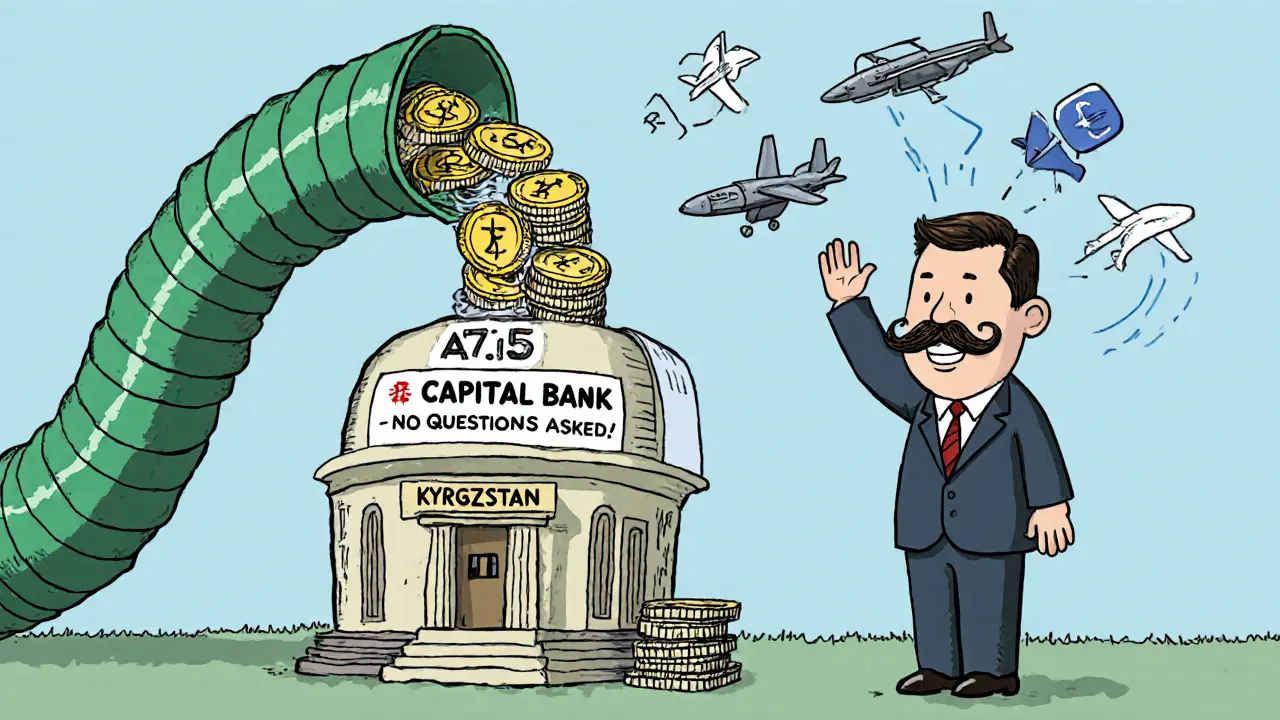

Crypto alone can’t buy tanks or missiles. You need cash. That’s where Capital Bank in Kyrgyzstan comes in. This isn’t a flashy international bank. It’s a small, regional institution run by Kantemir Chalbayev, a figure tied to Russia’s military procurement network. Capital Bank acts as the final link: crypto in → fiat out. A7A5 tokens are sold to buyers in Kyrgyzstan. The proceeds are deposited into Capital Bank. From there, the money is wired to suppliers in Turkey, Iran, China, and elsewhere who sell weapons and tech to Russia. This isn’t laundering in the old sense. It’s a direct pipeline. No shell companies hiding behind layers of paperwork. Just a bank that doesn’t ask questions, and a crypto token that doesn’t leave a paper trail. The U.S. and EU have sanctioned Capital Bank and Chalbayev, but the transfers keep flowing. Why? Because Kyrgyzstan doesn’t enforce those sanctions.

How Moldova Became a Crypto Frontline

Russia’s crypto network doesn’t just fund weapons. It funds influence. Leaked data from Ilan Shor, a Moldovan fugitive and Putin ally, revealed that over $8 billion in stablecoins flowed into wallets tied to A7A5 and its associated businesses over 18 months. That money didn’t go to soldiers. It went to apps. To social media bots. To political activists paid to stir unrest in Moldova and undermine its pro-Western government. These aren’t random transfers. They’re coordinated payments to people who help Russia destabilize countries on its border. The same crypto that buys missiles also buys votes. The same wallets that move A7A5 tokens also fund disinformation campaigns. The line between war finance and political warfare has vanished.How the West Is Fighting Back

The EU didn’t just sanction Russia. It sanctioned its crypto. In October 2025, the European Union passed its 19th sanctions package-and for the first time, it explicitly banned transactions on crypto exchanges used to evade sanctions. Grinex, Meer, and the A7A5 token infrastructure were all added to the list. The UK followed with its own crackdown, freezing assets tied to these platforms. But enforcement is hard. Blockchain is global. Wallets don’t need passports. Exchanges operate from countries with no extradition treaties. The U.S. Treasury’s Office of Foreign Assets Control (OFAC) has designated dozens of entities, but each takedown only delays the system-it doesn’t stop it. What’s working? Better tracking. Elliptic, a blockchain analytics firm, now monitors A7A5 transactions on both TRON and Ethereum. Compliance tools are being updated to flag wallets linked to Garantex, Grinex, and Capital Bank. This isn’t perfect, but it’s the first time the crypto industry is actively helping regulators trace dirty money.

Comments (20)

taliyah trice

November 22, 2025 AT 11:23

So Russia just made crypto its war wallet and nobody can stop it? Wild.

diljit singh

November 22, 2025 AT 11:53

Of course the west is panicking. They built the whole financial system to control everyone else. Now it’s being used against them. Classic.

Roshan Varghese

November 23, 2025 AT 13:54

They’re not even hiding it. This is all a psyop. The real story? The US and EU are funding this through their own crypto loopholes. Wake up sheeple 🤡

Devon Bishop

November 24, 2025 AT 15:30

Man i read this whole thing and still dont get how a7a5 is different from usdt except its rouble backed. Is it just a rebranded stablecoin or is there real tech here? Also why tron and eth? Cant they just use one? 🤔

Charan Kumar

November 25, 2025 AT 11:43

India has been watching this closely. We dont have sanctions but we know how easy it is to bypass systems. If this works for russia, someone else will try it. And next time it might be aimed at us

Natalie Reichstein

November 26, 2025 AT 07:39

People act like this is new. The whole point of crypto was to escape control. Now the state is using it to weaponize. That’s not a bug. That’s the feature.

Dexter Guarujá

November 27, 2025 AT 23:53

This is what happens when you let criminals run the world. Russia’s got billions moving in the dark and we’re still debating whether to ban TikTok. Pathetic.

Kaitlyn Boone

November 29, 2025 AT 16:05

Theyre using moldova to spread disinfo? Thats not even a surprise anymore. Its like watching a horror movie where the monster keeps coming back and no one locks the door.

Marilyn Manriquez

December 1, 2025 AT 03:15

As someone who has worked with cultural diplomacy for over two decades I must say this development represents a profound shift in how statecraft operates in the digital age. The erosion of traditional financial boundaries has created a new kind of sovereignty one that operates outside legal frameworks and yet achieves strategic objectives with alarming efficiency

neil stevenson

December 2, 2025 AT 07:32

bro just imagine if we used this for good instead of war like imagine if africa used something like a7a5 to fund solar grids without western banks blocking it

LaTanya Orr

December 2, 2025 AT 08:24

What does this say about the nature of power? The west thought money was control. But control is just a story. Russia proved that the real power is in the ability to rewrite the rules no one else is willing to see

Terry Watson

December 3, 2025 AT 13:30

This is terrifying and beautiful at the same time. Imagine a world where money isn’t owned by governments but by networks. Russia didn’t break the system… they showed us how to rebuild it without them.

Chris Popovec

December 5, 2025 AT 08:32

Elliptic is tracking A7A5? Please. They’re still using legacy chain analysis on a hybrid chain with sharded liquidity pools. The real game is in DeFi protocols with zero-knowledge swaps and cross-chain atomic swaps. We’re 18 months behind and the russians already have 3 versions of this live.

Peter Mendola

December 6, 2025 AT 18:13

Sanctions are obsolete. The concept of national financial sovereignty is dead. We are now in a post-bank world. And Russia won.

Kris Young

December 7, 2025 AT 10:23

It’s important to note that the use of multiple blockchains increases redundancy, and the choice of Kyrgyzstan as a hub is strategic due to its lack of regulatory alignment with Western institutions. This is not an accident-it is a calculated geopolitical maneuver.

sky 168

December 7, 2025 AT 14:23

So crypto isn’t just for degens anymore. It’s for war.

Ashley Finlert

December 7, 2025 AT 22:28

There is something haunting about the elegance of this system. A currency born not of trust, but of necessity. A token that doesn’t ask for loyalty to a nation-but only for silence. It is not money. It is memory erased. It is payment without paper. And it is the future.

Jennifer Corley

December 8, 2025 AT 09:50

Interesting how the same people who screamed about privacy coins are now terrified when the state uses them. You wanted anonymity, now you’re getting it. Enjoy your new world.

Norm Waldon

December 8, 2025 AT 23:28

Of course the U.S. can’t stop this. They’re too busy fighting over pronouns and banning books. Meanwhile Russia is building the new financial system and we’re still arguing about whether NFTs are art.

James Edwin

December 10, 2025 AT 04:28

If this is the future of warfare, then we need to rethink everything. Not just finance. Not just tech. But what peace even means anymore.