HTX Fee Calculator 2025

Calculate Your HTX Trading Fees

Estimate your trading fees based on your volume and VIP tier. HTX offers discounts from 0.20% base fee down to 0.02% for top VIPs.

VIP Tiers & Benefits

- VIP 1 - Base fee (0.20%)

- VIP 3 - $50,000+ HTX holdings (0.08%)

- VIP 8 - $1,000,000+ HTX holdings (0.02%)

HTX Crypto Exchange Review 2025: Features, Fees, and Real User Experience

If you're looking for a crypto exchange with deep altcoin liquidity, a powerful mobile app, and zero-cost futures trading, HTX is one of the top platforms you should consider. But it’s not for everyone. While HTX (formerly Huobi Global) has grown into the world’s 4th largest exchange by trading volume, its complexity, regional restrictions, and regulatory gaps make it a mixed bag depending on where you live and what you need.

Launched in 2013 and rebranded to HTX in 2023, the exchange moved its headquarters from China to Seychelles after facing heavy regulatory pressure. Today, it serves over 10 million users globally, with 58% of its user base in Asia and just 9% in North America. That’s not an accident - U.S. users can’t even access the full platform. They’re redirected to Huobi US, which offers only 50 coins versus HTX’s 712. If you’re outside the U.S. and trade altcoins regularly, HTX could be a game-changer. If you’re new to crypto or live in a strict regulatory region, you’ll hit roadblocks fast.

What You Can Trade on HTX

HTX offers one of the widest selections of cryptocurrencies on the market. As of July 2025, the platform supports 712 tradable assets and 847 trading pairs. That’s more than Binance and far ahead of Coinbase, which only lists around 200. You’ll find everything from Bitcoin and Ethereum to obscure tokens from Southeast Asia, Africa, and Eastern Europe that you won’t find anywhere else.

One standout feature is its deep order book liquidity - especially for altcoins like XRP, LTC, and SOL. Independent tests by BeInCrypto showed HTX’s order book depth for these tokens is 22% thicker than KuCoin’s, meaning you can trade larger amounts without slippage. This makes HTX ideal for traders who move big positions or rely on technical analysis.

The exchange also offers spot trading, futures (with zero funding rates), margin trading, staking, and a new RWA (real-world asset) marketplace launched in May 2025. You can trade tokenized stocks, bonds, and commodities through this section - something few other exchanges offer yet.

Fees and Pricing Structure

HTX’s fee structure is straightforward but layered. The base fee is 0.20% for both makers and takers. That’s average compared to industry leaders like Binance (0.10% for makers) and Kraken (0.16%). But here’s the catch: HTX offers volume-based discounts that can slash fees down to 0.02% - if you’re a heavy trader.

To get the lowest tier (VIP 8), you need to hold at least $1,000,000 in HTX tokens and maintain high 30-day trading volume. Most casual users won’t hit this, but even VIP 3 (requiring $50,000 in HTX holdings) drops fees to 0.08%. That’s still better than most exchanges for active traders.

Fiat deposits are supported in 57 currencies, including USD, EUR, GBP, RUB, and UAH. You can deposit via bank transfer (1-3 business days), credit/debit card (3.5% fee via Banxa), Apple Pay, and regional systems like SEPA and iDEAL. Withdrawals are slower - bank transfers can take up to 5 days in Europe, and some users report delays with SEPA payments. Crypto withdrawals are fast, typically under 10 minutes.

Security and Insurance

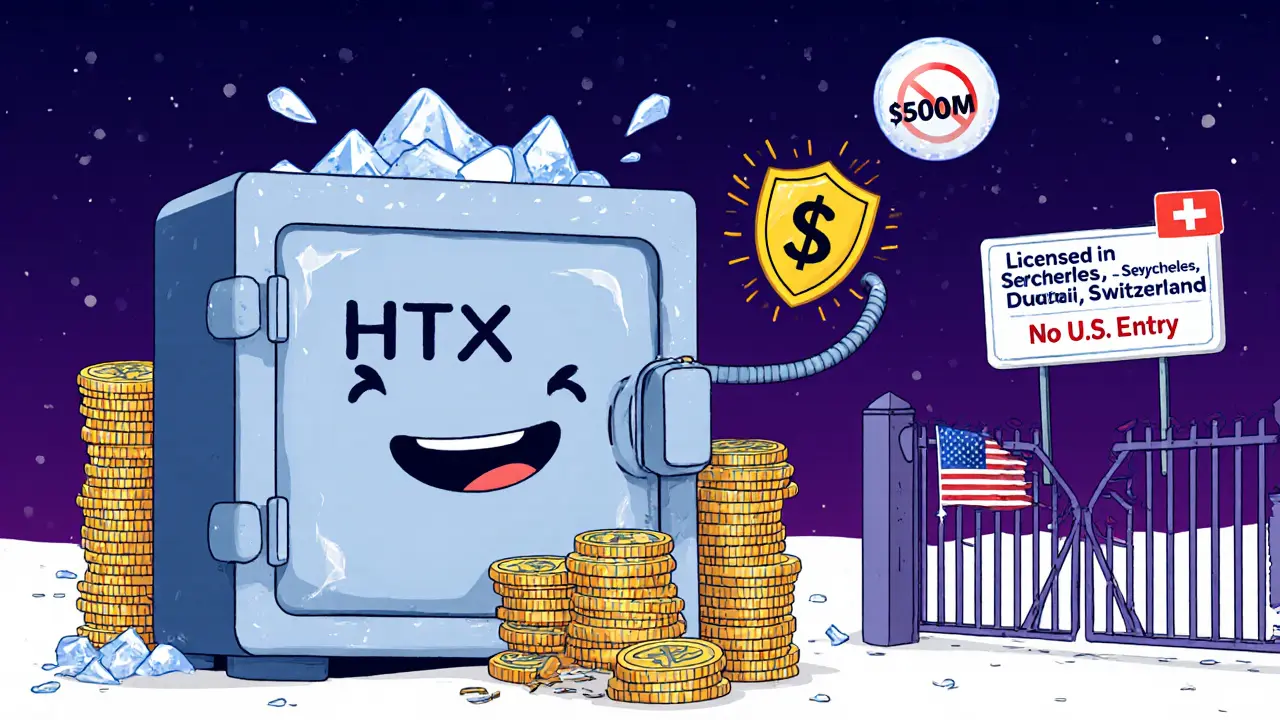

HTX’s security has improved dramatically since its 2019 breach. Today, 98% of user funds are stored in cold wallets. The platform uses multi-signature technology, real-time monitoring, and mandatory 2FA for all withdrawals. In Q4 2024, HTX boosted its insurance fund from $300 million to $500 million, covering losses from hacks or system failures.

Independent audits show 20 consecutive months without a security incident as of June 2025. Their proof-of-reserve reports are published monthly and verified by third parties. Chainalysis, which once flagged HTX for weak AML controls, now rates its anti-money laundering score at 7.3 out of 10 - up from 5.8 in 2023. That’s still below Coinbase’s 8.9, but it’s a clear improvement.

For most users, HTX’s security is now on par with top-tier exchanges. The bigger risk isn’t hacking - it’s regulatory uncertainty. HTX holds licenses only in Seychelles, Dubai, and Switzerland. It’s blocked in the U.S., Canada, and parts of Europe. If you’re in a restricted region, you’re on your own if something goes wrong.

Mobile App and User Experience

HTX’s mobile app is where it truly shines. Coin Bureau rated it 4.7 out of 5 - higher than Binance’s 4.2. The interface is clean, fast, and packed with features: real-time charts, one-tap trading, social trading feeds, and built-in trading bots. You can set price alerts, copy trades from top users, and even access live market sentiment data without leaving the app.

It’s optimized for Android 8.0+ and iOS 14+, and runs smoothly even on older phones. Trade execution speed averages 1.2 milliseconds during peak hours, according to CryptoNinjas’ testing. That’s faster than most desktop platforms.

But here’s the problem: the desktop version feels cluttered. New users often get lost in the menus. Coin Bureau gave the web interface a 2.3/5.0 for usability - worse than Binance’s 3.1. Beginners need about 2.7 hours to learn the basics, compared to 1.9 hours on Coinbase. If you’re just starting out, HTX’s learning curve is steep.

Customer Support and Community

HTX offers 24/7 customer support in 15 languages. Live chat response time averages 2.4 minutes - faster than Kraken and nearly as quick as Binance. Email support takes about 12.7 hours, which is acceptable for a global exchange. VIP users get phone support, which is rare among crypto platforms.

The community is large and active. The official Telegram group has 487,000 members, Discord has 124,000 active users, and the r/HTX subreddit has 86,000 subscribers. Most users praise the altcoin selection and app performance. But complaints are common too: KYC verification takes 48 hours on average, and fiat withdrawals in some countries are slow or blocked.

HTX also offers 147 help articles, 32 video tutorials, and 89 pages of API documentation. If you’re willing to read, you’ll find answers. But if you’re looking for instant hand-holding, you’ll be frustrated.

Who Should Use HTX - And Who Should Avoid It

HTX is ideal for:

- Experienced traders who need deep liquidity for altcoins

- Users in Asia, Europe, or the Middle East with access to fiat on-ramps

- Those who want zero-cost futures trading with no funding rates

- Investors looking to stake stablecoins at up to 12% APY

- Institutional traders - HTX’s institutional volume grew from 18% to 34% of total trading between 2023 and 2025

HTX is NOT ideal for:

- U.S. residents - you’re locked out of the main platform

- Beginners who want simple, guided onboarding

- Users who need built-in tax reporting tools (HTX doesn’t offer them)

- People who prioritize regulatory compliance in the U.S. or EU

If you’re in the U.S., stick with Coinbase or Kraken. If you’re outside the U.S. and trade frequently, HTX’s low fees and altcoin depth make it worth the learning curve.

Future Roadmap and Trends

HTX isn’t standing still. In June 2025, they launched HTX Social - a decentralized social feed where users can share trade ideas and follow top performers. They’ve also expanded their zero-cost futures to 15 new coins.

Their roadmap includes:

- A decentralized exchange (DEX) aggregator by Q4 2025

- Fiat on-ramps for 75 currencies by 2026

- AI-powered trading assistants in Q2 2026

Analysts are split. Standard Chartered thinks HTX could jump to #3 globally if it gets U.S. approval. Bernstein warns that regulatory barriers could cap its growth. One thing’s clear: HTX is betting big on its native HTX token. It powers 38% of their revenue through fee discounts, staking rewards, and governance. That’s risky - if the token crashes, so does user incentive.

Final Verdict: Is HTX Worth It in 2025?

HTX is a powerhouse for experienced traders outside the U.S. Its liquidity, mobile app, and zero-cost futures are unmatched by most competitors. The security upgrades are real, and the fee discounts for heavy traders are generous.

But it’s not user-friendly. The interface is overwhelming. The KYC process is slow. And if you’re in the U.S., you’re out of luck.

If you’re trading altcoins regularly and don’t need hand-holding, HTX is one of the best exchanges you can use. If you’re new, or you want simple, compliant, U.S.-friendly trading - look elsewhere.

For those who fit the profile, HTX delivers on its promise: deep markets, fast execution, and a mobile experience that feels ahead of its time.

Is HTX a safe exchange to use in 2025?

Yes, HTX is considered safe for experienced users as of 2025. It stores 98% of assets in cold wallets, has a $500 million insurance fund, and uses multi-signature security. The platform has gone 20 consecutive months without a security breach, verified by independent audits. However, its regulatory status is limited - it only holds licenses in Seychelles, Dubai, and Switzerland. Users in the U.S., Canada, or strict EU countries should avoid the main platform due to legal risks.

Can I use HTX if I live in the United States?

No, U.S. residents cannot access the main HTX platform. Due to regulatory restrictions, American users are redirected to Huobi US, which offers only 50 cryptocurrencies and lacks key features like zero-cost futures and advanced trading tools. If you’re in the U.S., consider Coinbase, Kraken, or Gemini instead for full compliance and better support.

What are the trading fees on HTX?

HTX charges a base fee of 0.20% for both makers and takers. However, users can reduce fees down to 0.02% by reaching VIP 8 status, which requires holding $1,000,000+ in HTX tokens and maintaining high trading volume. For most active traders, even VIP 3 (with $50,000 in HTX holdings) reduces fees to 0.08%. This makes HTX one of the most cost-effective platforms for high-volume traders.

Does HTX offer zero-cost futures trading?

Yes, HTX offers zero-cost futures trading with no funding rates - a rare feature among major exchanges. As of June 2025, this feature supports 32 cryptocurrencies and has attracted $8.3 billion in open interest, making it one of the most popular futures offerings on the platform. This gives traders a significant edge over competitors like Bybit and KuCoin, which charge funding fees.

How long does KYC verification take on HTX?

KYC verification on HTX typically takes 48 hours on average, based on user reports from WalletInvestor and Trustpilot. Level 1 verification (email and phone) is instant but limits trading to $5,000/day. Level 2 (ID upload) increases the limit to $50,000/day. Level 3 (video verification) unlocks $500,000/day. Delays often occur during high-volume periods or if documents are unclear.

What’s the difference between HTX and Huobi Global?

HTX is the rebranded version of Huobi Global. The name changed in 2023 as part of a strategic shift away from its Chinese origins toward a global, regulatory-compliant platform. Functionally, they’re the same exchange - same platform, same assets, same team. The rebranding was mostly symbolic, signaling a new direction after regulatory pressure in China. Users should treat HTX as the current, updated version of the old Huobi Global.

Comments (15)

diljit singh

November 22, 2025 AT 14:46

HTX is just another crypto casino with a fancy app. Why do people still trust exchanges that aren't US-regulated? The fees are trash unless you're a whale. I'd rather use Coinbase and sleep at night.

Phil Taylor

November 23, 2025 AT 07:49

You're all clueless. HTX has more liquidity than Binance in RSI-based altcoins. The zero funding rates alone make it the only viable platform for serious traders. If you're too scared to use a Seychelles-based exchange, go back to your ETFs and cry into your Starbucks. This isn't for beginners.

vinay kumar

November 24, 2025 AT 01:57

KYC takes 48 hours really I thought it was faster

Leisa Mason

November 25, 2025 AT 23:38

The mobile app is the only reason this platform still exists. Everything else is a dumpster fire. The web interface looks like it was designed by a 12-year-old with a fever. No wonder Americans can't use it. They'd have a stroke trying to find the buy button.

Roshan Varghese

November 26, 2025 AT 10:28

HTX is a CIA front. They're pushing HTX token to drain your wallet before the Fed shuts them down. 98% cold storage? Yeah right. The real assets are in offshore shell companies. I saw a whistleblower tweet this last week. The audit reports are faked. They're using AI to generate them.

Dexter Guarujá

November 27, 2025 AT 16:43

If you're not in the US you're either a tax evader or a criminal. HTX thrives because it caters to people who want to avoid oversight. This isn't innovation. It's evasion. And you're all proud of it. Sad.

Rob Sutherland

November 29, 2025 AT 08:28

I used HTX for six months. The app is incredible. The charts load faster than my coffee brews. But the desktop site? It's like trying to assemble IKEA furniture blindfolded. Took me weeks to figure out how to withdraw. But once I did? The altcoin depth saved me during that Solana pump. Worth the pain.

Frank Verhelst

November 30, 2025 AT 02:43

This exchange is 🔥 for serious traders 🚀 But if you're new? Start with Coinbase. HTX isn't a playground. It's a battlefield. And the battlefield doesn't hand out lollipops. 💪

Chris Popovec

November 30, 2025 AT 10:07

The RWA marketplace is the real play here. Tokenized bonds from Southeast Asia? That's not just innovation - it's systemic disruption. HTX is quietly building the infrastructure for the next financial paradigm. The altcoin stuff is just the bait. The real value is in the institutional-grade asset tokenization. Most users don't even realize they're trading legacy finance wrapped in blockchain.

Jennifer Corley

November 30, 2025 AT 13:20

You all talk about liquidity like it's a virtue. But what about the lack of compliance? HTX doesn't report to FinCEN. That means your funds aren't protected if they get seized. You think you're trading crypto? You're trading legal risk. And you're celebrating it. That's not smart. That's suicidal.

Charan Kumar

December 1, 2025 AT 13:25

HTX mobile app is best in class no doubt but why do they make the website so complicated I just want to buy solana

Lani Manalansan

December 1, 2025 AT 13:38

I'm from the Philippines and HTX was the only way I could trade PHIN tokens without paying 10% in fees. The app works even on my 5-year-old Android. The KYC took 3 days but they actually responded to my email. That's more than I can say for Binance. For us in the Global South? This is the only exchange that feels like it sees us.

Lara Ross

December 2, 2025 AT 11:48

I understand the appeal of HTX for experienced traders, but I must emphasize the critical importance of regulatory compliance in financial ecosystems. The absence of U.S. access is not merely a limitation-it is a structural vulnerability that exposes users to systemic legal and financial risk. We must prioritize investor protection over speculative advantage.

Abhishek Anand

December 2, 2025 AT 12:55

The real question isn't whether HTX is safe or efficient. It's whether we've become so addicted to liquidity that we've forgotten what trust means. A $500 million insurance fund doesn't replace institutional accountability. A 4.7-star app doesn't fix a broken ethos. We're not trading crypto anymore. We're trading faith in invisible architectures. And the more we optimize for speed and depth, the more we blind ourselves to the fact that the foundation is sand.

Tim Lynch

December 2, 2025 AT 15:24

I've used HTX, Binance, Kraken, Coinbase... HTX's mobile app is the only one that doesn't make me want to delete it after 10 minutes. The charts are clean, the execution is instant, and the altcoin selection? Unmatched. But yeah, the website is a mess. I use the app for everything. Desktop is just for checking my wallet balance and crying about the fees I didn't qualify for.