Sanctions Compliance Risk Calculator

How to Use This Tool

Select your country and business activity to assess compliance risk based on U.S. sanctions regulations for 2025. This tool uses information from the article "International Sanctions and Crypto Restrictions in Syria and Cuba in 2025".

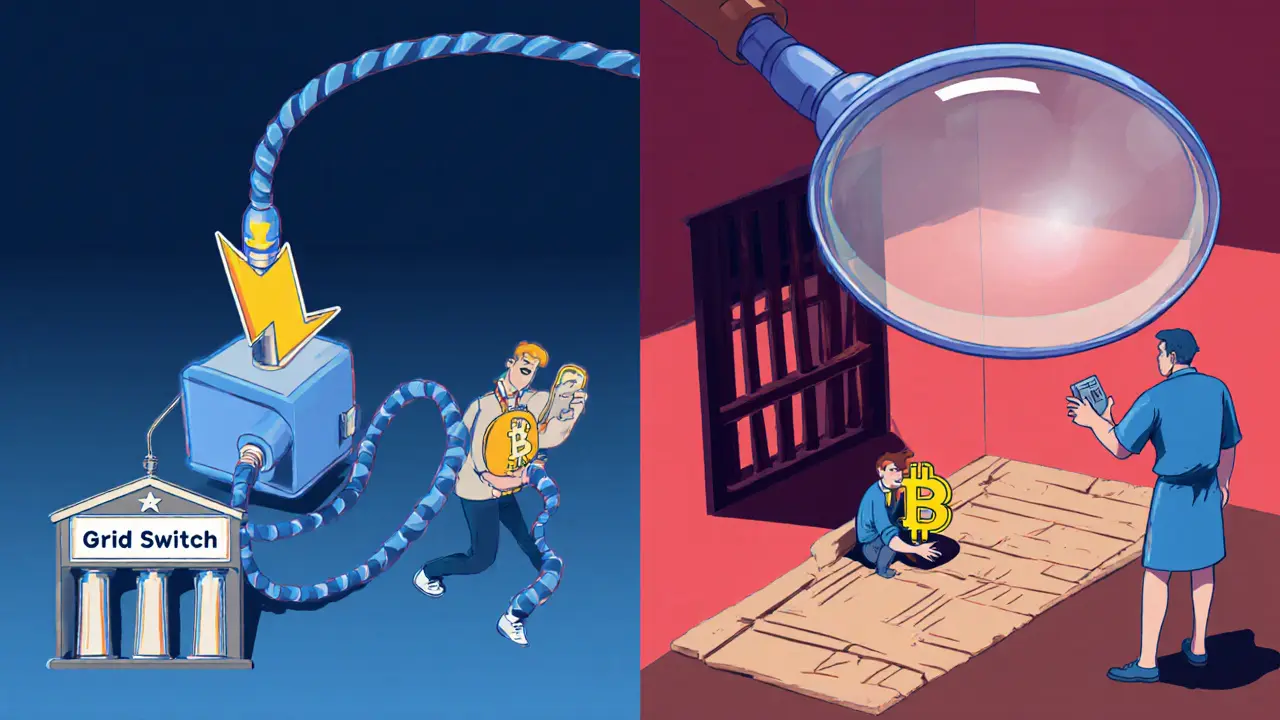

When the U.S. lifted comprehensive sanctions on Syria on July 1, 2025, it didn’t just open a door-it flipped a switch. For the first time in over two decades, American banks could legally send money to Syrian institutions. Crypto exchanges like Binance could list Syrian traders without fear of violating U.S. law. But in Cuba, the opposite happened. Sanctions got tighter. The same administration that freed Syria doubled down on isolating Cuba. And in both places, cryptocurrency became the wild card no one fully understood.

What Changed in Syria?

On June 30, 2025, President Trump signed Executive Order 14312. It didn’t tweak sanctions. It wiped them out. Six executive orders dating back to 2004 were revoked. The national emergency declared after 9/11 that justified blocking Syrian assets? Terminated. The Central Bank of Syria? Removed from the OFAC Specially Designated Nationals (SDN) List. Overnight, U.S. financial institutions could open accounts with Syrian banks. American companies could invest. Software could be exported. Even humanitarian aid flows became simpler. But it wasn’t a clean slate. The Assad family, key military officials, and people tied to the captagon drug trade stayed on sanctions lists. If you were doing business in Syria, you still had to check every counterparty against OFAC’s updated list. One wrong transaction-a payment to a shell company owned by a sanctioned general-and you could be fined millions. The real shift? Trust. Before July 2025, international banks avoided Syria like the plague. Even if a transaction wasn’t technically illegal, the risk of being caught in a future enforcement action was too high. After the revocation, banks started asking: Who’s on the list? Not Can we do this? That’s the difference between fear and compliance.Crypto in Syria: Legal Gray Zone

Syria has no law that says cryptocurrency is legal. No law that says it’s illegal. That’s not a loophole-it’s a vacuum. Before July 2025, Syrians used crypto mostly as a survival tool. Bitcoin and USDT helped families receive money from relatives abroad when traditional remittance channels collapsed. But after sanctions lifted, things changed. Major exchanges no longer blocked Syrian accounts. Local crypto traders started seeing volume spike. Binance reported a 300% increase in Syrian user registrations in the first month after the sanctions were lifted. But here’s the catch: Syria’s AML/CFT rules are outdated and unenforced. There’s no licensing for crypto exchanges. No KYC requirements. No reporting obligations. That means while Syrians can trade crypto freely, international businesses still hesitate. A U.S.-based fintech company might want to partner with a Syrian logistics firm that accepts crypto payments. But if that firm’s owner has even a distant family tie to a sanctioned individual? The deal dies. Companies like Lightspark have built workarounds. Their Grid Switch system lets institutions send fiat payments across borders using the Lightning Network as a settlement layer-without ever touching crypto on their balance sheet. It’s a bridge for the cautious. For now, most serious players are watching. Waiting. Not because they can’t enter Syria-but because they don’t know how to enter safely.Cuba: Sanctions Tightened, Not Loosened

While Syria opened up, Cuba got locked down harder. In July 2025, the Trump administration issued National Security Presidential Memorandum 5 (NSPM-5), reversing Biden’s 2023 easing measures. U.S. companies can no longer send remittances through third-country intermediaries. Travel for educational or cultural exchanges? Banned. Even non-U.S. subsidiaries of American firms can’t ship goods to Cuba without explicit OFAC permission. The message was clear: Cuba is still an enemy. The proof? The $608,825 settlement with Key Holding, LLC. The company, based in Delaware, had a subsidiary managing 36 freight shipments from Colombia to Cuba. They didn’t hide anything. They reported the violation themselves. Still, OFAC hit them with a fine. Why? Because the Cuba Assets Control Regime (CACR) treats any indirect support as a violation-even if the company had no intent to break the law. Cuban citizens still use crypto. But it’s harder now. Exchanges like Binance and Kraken still block Cuban IP addresses. Peer-to-peer trading exists, but liquidity is thin. Bitcoin ATMs? None operate legally in Cuba. The government doesn’t ban crypto outright-but it doesn’t help either. It’s a silent blockade: no official ban, but no support. And without banking access, crypto becomes a tool for the desperate, not the ambitious.

Why the Difference?

Why lift sanctions on Syria but crush Cuba? It’s not about human rights. Syria’s regime still commits atrocities. Cuba’s still a one-party state. The difference is geopolitics. Syria’s shift came after President Ahmed al-Sharaa’s government broke ties with Iran-backed militias, cracked down on the captagon trade, and publicly dismantled Hay’at Tahrir al-Sham (HTS). The U.S. responded by revoking HTS’s terrorist designation and lifting sanctions. It was a strategic trade: stability for access. Cuba? No such deal. The Cuban government still hosts Russian military advisors. It still sends oil to Russia in exchange for weapons. It still refuses to allow independent elections. The U.S. sees Cuba as a foothold for adversarial powers-not a partner. In short: Syria earned relief by changing its behavior. Cuba didn’t. And the U.S. is rewarding one while punishing the other.What This Means for Crypto Users

If you’re in Syria and you use crypto, you’re now in a rare position: you can trade with the world. But you still can’t trust the system. Banks won’t cash out your crypto. Payment processors won’t touch your business. You’re free to send money-but not to spend it easily. In Cuba, crypto is still a lifeline. But the lifeline is fraying. Fewer people can send you dollars. Fewer exchanges will let you trade. And if you’re caught using crypto to bypass sanctions, you could face jail time-or worse, your assets seized by the state. For investors? Syria is a gamble with upside. Cuba is a gamble with no upside. The legal risk in Cuba is sky-high. The return? Minimal. In Syria, the risk is still there-but the opportunity is real. The market is rebuilding. Infrastructure is returning. People are starting businesses again.

What Comes Next?

The U.S. isn’t done with sanctions. Iran and Russia are next in line for more pressure. Venezuela is already under fire again. And as crypto adoption grows, regulators will demand more transparency. Expect to see:- More crypto compliance tools designed for sanctioned markets-like Lightspark’s Grid Switch

- OFAC issuing new guidance on how to screen crypto addresses linked to Syria

- Cuba cracking down harder on peer-to-peer crypto traders

- International banks slowly re-entering Syria, but only after months of internal compliance reviews

Comments (12)

Natalie Reichstein

November 22, 2025 AT 03:07

This is pure hypocrisy wrapped in economic diplomacy. Syria’s regime still tortures people, yet we reward them with financial access? Meanwhile, Cubans are starving and we make it harder for them to get help through crypto? The U.S. doesn’t care about human rights-it cares about control. And now we’re letting crypto become the new colonial tool.

James Edwin

November 22, 2025 AT 23:03

The real story here isn’t Syria or Cuba-it’s how crypto is exposing the absurdity of U.S. sanctions. If you can’t trust banks, you turn to Bitcoin. If you can’t trust the state, you turn to peer-to-peer. This isn’t about freedom-it’s about necessity. And the U.S. is too blind to see it.

LaTanya Orr

November 23, 2025 AT 06:09

What does it mean to be free if you can’t spend what you earn? Syrians can trade crypto but can’t buy a laptop. Cubans can’t trade at all but still find ways. Maybe freedom isn’t about permission-it’s about persistence. And that’s something no sanctions list can take away.

Ashley Finlert

November 23, 2025 AT 07:19

There is a profound irony in the fact that while Western institutions preach transparency, they simultaneously create systems so opaque that even well-intentioned actors are paralyzed by fear. Syria’s crypto vacuum is not a loophole-it is a mirror. It reflects the hollowness of a policy regime that rewards political theater over human dignity. Cuba, meanwhile, is not merely sanctioned-it is erased from the economic imagination. And in that erasure, we find the true cost of geopolitical dogma.

Chris Popovec

November 24, 2025 AT 21:41

Let’s be real-this is all a distraction. The U.S. didn’t lift sanctions on Syria because it changed. It did it because Russia’s oil pipeline deal with Damascus fell through and they needed a proxy to destabilize Iran’s supply chain. And Cuba? They’re still the last Soviet relic. The crypto angle? Just cover for deeper games. You think Binance is acting out of principle? They’re just following the money-and the DOJ’s latest enforcement memo.

Peter Mendola

November 24, 2025 AT 22:28

OFAC’s new crypto screening guidelines are coming. Expect SDN-listed wallet addresses to be tagged by geolocation, transaction volume, and contact graph analysis. Syria’s traders are already being flagged. Cuba’s? They’re being blocked preemptively. This isn’t enforcement. It’s pre-crime.

Sunita Garasiya

November 26, 2025 AT 04:45

So Syria gets a gold star for stopping captagon? Cool. Meanwhile, Cuba’s government is still in power and we’re mad? Let me get this straight: we punish people for not being as evil as their neighbors? What a moral compass.

Mike Stadelmayer

November 28, 2025 AT 04:07

It’s wild to think that in 2025, the only thing keeping families alive in both countries is a blockchain. No banks. No governments. Just a phone and a seed phrase. Maybe the real revolution isn’t in the streets-it’s in the wallets.

neil stevenson

November 29, 2025 AT 18:48

Bro, I just used a crypto bridge to send $200 to my cousin in Havana last week. No one asked questions. No one cared. The system’s broken, but the people? They’re still figuring it out. That’s all that matters.

Samantha bambi

November 30, 2025 AT 18:26

It’s interesting how the same administration that claims to support financial inclusion is actively preventing Cubans from accessing the tools they need to survive. Is this really the future of global finance? Exclusion disguised as compliance?

Anthony Demarco

December 2, 2025 AT 02:36

Let’s cut the crap-Syria’s regime is still a dictatorship. Cuba’s is too. But we’re rewarding the one that bows to us and punishing the one that doesn’t? That’s not policy. That’s imperialism with a blockchain twist. America doesn’t want freedom-it wants obedience. And crypto is just the new leash

Jack Richter

December 4, 2025 AT 00:28

Yeah ok