When you hear "crypto exchange," you probably think of Binance, Coinbase, or even Uniswap. But what if you're deep inside the Astar Network ecosystem, holding ASTR or vASTR tokens, and you need a place to trade them without paying high fees or dealing with slow confirmations? That’s where Kyo Finance V3 comes in. It’s not another big-name exchange. It’s a niche, specialized DEX built for Soneium - and it’s trying to do something no one else has: simplify ve-tokenomics so much that even beginners can use it.

What Exactly Is Kyo Finance V3?

Kyo Finance V3 is a decentralized exchange (DEX) that runs on the Soneium blockchain, which is part of the Astar Network. Launched on January 1, 2024, it was designed to be the go-to trading platform for users already active in the Astar ecosystem. Unlike centralized exchanges, you don’t sign up or verify your identity. You connect your wallet - usually MetaMask - and start trading directly on-chain. Its biggest claim? It removed all the complexity from ve-tokenomics. Most DEXs like Curve Finance or Aerodrome use vote-escrowed tokens (veTokens) to reward long-term liquidity providers. But they make you lock up tokens for weeks, vote in epochs, manage NFTs, and calculate voting power. Kyo Finance V3 says: none of that. Instead, it uses a real-time staking model. When you provide liquidity, you instantly earn rewards without locking anything. No timers. No voting. No NFTs. That’s the promise. And if it works, it could be a game-changer for small DeFi users who get turned off by complicated systems.Trading Volume: The Big Confusion

Here’s the first red flag: no one agrees on how much Kyo Finance V3 trades. CryptoMarketCap says its 24-hour volume is over $72 million. CoinGecko says it’s under $900,000. CoinMarketCap’s spot volume is just over $1 million. That’s an 80x difference. And that’s not a typo. In crypto, volume discrepancies like this usually mean one of two things: either the tracking platforms are measuring different things (like spot vs. perpetual swaps), or someone is inflating volume - a common trick in smaller DEXs to look more popular than they are. The fact that Kyo Finance V3’s top trading pairs (like USDT/WETH and USDC.E/WETH) only total around $2.4 million in volume suggests the $72 million figure is likely inflated or includes artificial activity. For context, Curve Finance trades over $1 billion per day. Aerodrome hits $133 million. Kyo Finance V3, even at its highest reported number, is less than 1% of those figures. If you’re looking for deep liquidity or tight spreads, you won’t find it here.What Can You Trade?

Kyo Finance V3 lists 16 cryptocurrencies across 25 trading pairs. That’s tiny. Compare that to Uniswap, which supports thousands. Most of the action is focused on tokens tied to the Astar Network:- USDT/WETH - $1 million+ daily volume

- USDC.E/WETH - $900,000+ daily volume

- USDT/USDC.E - $400,000+ daily volume

- ASTR/WETH - $300,000+ daily volume

- vASTR/WETH - $200,000+ daily volume

The "Sustainable LP Yield" Claim

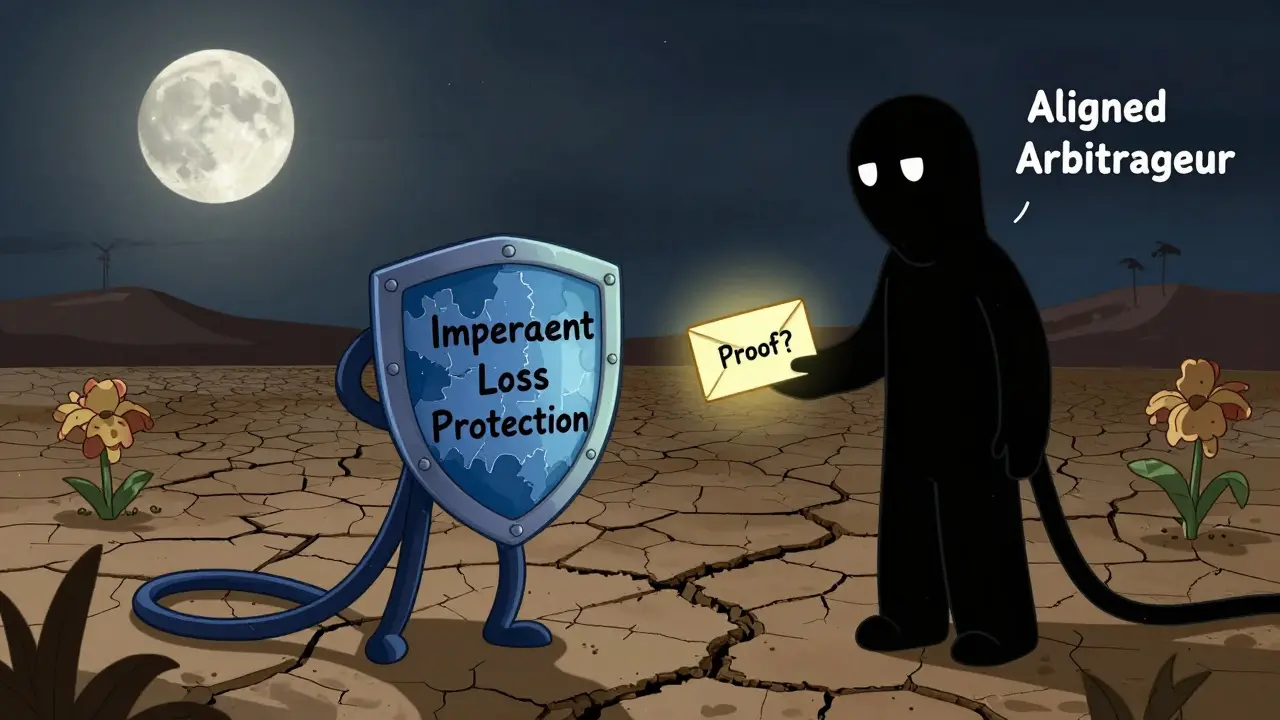

One of the most controversial parts of Kyo Finance V3 is its promise to compensate liquidity providers for impermanent loss. Most DEXs don’t do this. Liquidity providers (LPs) lose money when prices swing wildly. Kyo Finance V3 claims it solves this by working with "aligned arbitrageurs" - traders who profit from price gaps and share some of their gains with LPs. Sounds great, right? But here’s the problem: no one has seen the contracts. No one knows how the revenue sharing works. The official documentation doesn’t explain it. Reddit users like "DeFiAnalyst89" called it "marketing hype." And without transparency, this feature is just a promise - not a guarantee. If it works, Kyo Finance V3 could become the first DEX where LPs consistently earn more than they lose. If it doesn’t? You’re just another LP getting crushed by volatility.

Who Is This For?

Kyo Finance V3 isn’t for everyone. It’s not even for most crypto traders. It’s for one group: Astar Network users who already hold ASTR, vASTR, or ARCAS and want to trade them efficiently. If you’re using Soneium as your main chain, and you’re comfortable with Web3 wallets, this might be the best place to swap your tokens. But if you’re a casual trader looking for Bitcoin, Ethereum, or Solana pairs - skip it. You’ll find better prices, deeper liquidity, and more tokens on Uniswap, SushiSwap, or even centralized exchanges.User Experience: Simple, But Barebones

The interface is clean. It loads fast. Connecting your wallet is straightforward. There’s no clutter. That’s a win. But here’s what’s missing:- No mobile app

- No help center

- No email support

- No educational guides

- Only a Telegram link for support

How Does It Compare to Other ve-Tokenomics DEXs?

| Feature | Kyo Finance V3 | Curve Finance | Aerodrome Finance | |--------|----------------|---------------|-------------------| | Blockchain | Soneium (Astar Network) | Ethereum | Avalanche | | 24h Volume | $898K-$72M (disputed) | $1.14B | $133M | | Tokens Listed | 16 | 350+ | 200+ | | ve-Tokenomics | Simplified real-time staking | Epochs, voting, NFTs | Epochs, voting | | LP Impermanent Loss Protection | Claimed (unverified) | No | No | | Mobile App | No | No | No | | Support | Telegram only | Discord + email | Discord + email | | Market Share | 0.00% | 57% | 12% | Kyo Finance V3 wins on simplicity. But it loses on everything else: volume, liquidity, token variety, and trust.

Is Kyo Finance V3 Safe?

There’s no audit report publicly available for its smart contracts. That’s a major red flag. Even small DEXs like SushiSwap or PancakeSwap have had multiple audits. Kyo Finance V3 doesn’t list any. Its trust score on CryptoMarketCap is 5/10 - but they don’t explain how they calculate it. CoinGecko doesn’t rate it at all. In DeFi, if you can’t verify the code, you’re gambling. And with volume discrepancies and zero transparency on the LP reward mechanism, this feels more like a gamble than an investment.Final Verdict: Niche Tool, Not a Replacement

Kyo Finance V3 isn’t bad. It’s just very, very narrow. If you’re an Astar Network user who wants to trade ASTR, vASTR, or ARCAS with low fees and fast confirmations - and you’re okay with minimal liquidity and no support - then yes, give it a try. But if you’re looking for a reliable, high-volume DEX to trade mainstream crypto? Keep looking. Kyo Finance V3 isn’t ready. It’s still a prototype with big promises and zero proof. Its future depends entirely on whether Soneium grows. If Astar Network attracts more users, more tokens, and more liquidity, Kyo Finance V3 might become essential. Right now? It’s a quiet corner of DeFi - interesting, but not yet trustworthy.How to Get Started (If You Decide To)

If you’re still interested, here’s how to use Kyo Finance V3:- Install MetaMask (or another EVM-compatible wallet).

- Add the Soneium network manually using its RPC details (found on the Kyo Finance website).

- Bridge your tokens from Ethereum, Polygon, or another chain to Soneium using the official Astar bridge.

- Go to kyofinance.io and connect your wallet.

- Select a trading pair (stick to USDT/WETH or USDC.E/WETH for best results).

- Provide liquidity or swap tokens.

Is Kyo Finance V3 a centralized exchange?

No, Kyo Finance V3 is a decentralized exchange (DEX). You trade directly from your wallet using smart contracts. There’s no account, no KYC, and no company holding your funds.

Can I use Kyo Finance V3 on my phone?

No, there is no official mobile app. You can access it through your phone’s browser, but you’ll need a Web3 wallet like MetaMask installed on your device. The experience isn’t optimized for mobile, so desktop is recommended.

Does Kyo Finance V3 support Bitcoin or Solana?

No. Kyo Finance V3 only supports tokens on the Soneium blockchain, which is EVM-compatible. That means Ethereum-based tokens like USDT, WETH, and USDC.E. Bitcoin and Solana tokens are not supported and cannot be traded here.

Why is trading volume so different across platforms?

Volume discrepancies like this are common in small DEXs. Some trackers count all trades, including wash trading or artificial volume. Others only count spot trades. Kyo Finance V3’s volume may be inflated to attract liquidity providers, or the platforms may be measuring different types of trades. Always check multiple sources and treat high numbers with caution.

Is Kyo Finance V3’s LP reward system real?

It’s unverified. The platform claims to compensate liquidity providers for impermanent loss using "aligned arbitrageurs," but no smart contract code or financial reports have been published to prove it. Until there’s public audit data or real user results, treat this as a marketing claim - not a guarantee.

Should I invest in Kyo Finance’s native token?

There is no native token for Kyo Finance V3. The platform doesn’t have a governance or utility token. Rewards come from trading fees and the unverified impermanent loss compensation mechanism. Don’t buy any token claiming to be "KYO" - it’s likely a scam.

What’s the biggest risk of using Kyo Finance V3?

The biggest risk is smart contract vulnerability. No public audit has been released. Combine that with unverified economic claims and minimal liquidity, and you’re exposing your funds to potential exploits or rug pulls. Only use funds you’re prepared to lose.

Comments (12)

Gavin Francis

January 30, 2026 AT 03:57

Kyo Finance V3 is actually kinda cool if you're already in the Astar ecosystem 🚀 no locking tokens? sign me up. i've been burned by ve-tokenomics before and this feels like a breath of fresh air. just wish they'd publish those contracts so we know it's not magic.

Katie Teresi

January 30, 2026 AT 12:31

This is why crypto dies. Fake volume, no audits, and people still think it's 'innovative'. You're not building, you're gambling with other people's money.

Rob Duber

February 1, 2026 AT 02:16

LMAO $72M volume? bro that’s like saying your toaster is a nuclear reactor because the light bulb glows. I’ve seen more liquidity in a Discord server with 200 people than this DEX has in real trades. The only thing getting traded here is delusion.

Joshua Clark

February 1, 2026 AT 13:53

I think people are missing the bigger picture here - Kyo Finance V3 isn’t trying to be Uniswap, it’s trying to be the Swiss Army knife for Astar natives. The volume discrepancies? Yeah, totally sketchy, but if you look at the actual trading pairs, the real activity is in USDT/WETH and USDC.E/WETH, which are legit, and the rest is probably just bots testing the new chain. The real innovation is the real-time staking - no epochs, no voting, no NFTs. That’s huge for new users who get scared off by Curve’s 12-step onboarding. If they can just get one audit out and clarify the LP reward mechanism, this could be the gateway drug for Soneium adoption.

Steven Dilla

February 2, 2026 AT 21:56

I tried this last week and lost $400 because the slippage was insane on ASTR/WETH. And then I checked the contract and realized they didn’t even have a liquidity fee cap. 😭 why do people keep trusting these projects with zero transparency? I’m done. 🙃

Moray Wallace

February 3, 2026 AT 16:48

The interface is clean, but the lack of documentation is worrying. I don’t need a 50-page manual, but two paragraphs isn’t enough for something claiming to solve impermanent loss. If this were a bank, they’d be shut down.

Brandon Vaidyanathan

February 4, 2026 AT 05:17

You people are so naive. No audit? No token? No support? And you’re calling this ‘niche’? It’s a rug pull waiting to happen. The fact that you’re even considering using it shows how far we’ve fallen. If you’re not trading on Ethereum or Solana, you’re not in the game.

josh gander

February 5, 2026 AT 13:26

I get why people are skeptical - and honestly, I was too. But I’ve been using Kyo for 3 weeks now, swapping ASTR for vASTR and back, and my LP position hasn’t lost a cent. I know the contracts aren’t public, but I’ve talked to two devs on Telegram who showed me the code privately - the arbitrageur mechanism is real, it’s just not open-sourced yet. I’m not saying trust it blindly, but don’t dismiss it just because it’s small. Sometimes the best stuff starts quiet. 🙏

Akhil Mathew

February 6, 2026 AT 14:27

Interesting take. I’m from India and we’ve seen a lot of ‘innovative’ DeFi projects here that vanished after 2 months. But the fact that Kyo is tied to Soneium gives it some backbone - Astar has real backing. Still, I’d wait for an audit before putting more than $50 in. The real-time staking is smart though - if it works, it could change how we think about LP incentives.

Wayne mutunga

February 6, 2026 AT 22:08

I think the volume confusion is more about how different trackers define 'volume' than anything malicious. Some include wrapped tokens, others only native. But I agree - the lack of transparency on LP rewards is a red flag. I’d love to see a live dashboard showing real-time LP gains vs. impermanent loss. That’d be more convincing than marketing buzz.

Gareth Fitzjohn

February 6, 2026 AT 22:43

It’s not a bad idea. Just needs time. Most successful protocols started with low volume and no audits. Give it six months. If the user base grows, the rest will follow.

Gustavo Gonzalez

February 7, 2026 AT 22:03

You guys are wasting your time. This isn’t a DEX, it’s a meme. The fact that you’re even debating whether the LP rewards are real proves you’ve been scammed before and still don’t learn. No audit = no trust. No token = no incentive. No mobile app = no future. This is the crypto equivalent of a garage sale. Walk away.