Luno Fee Calculator

Calculate Your Luno Purchase Cost

Get an accurate estimate of fees for buying Bitcoin on Luno based on your country and budget.

When you're new to cryptocurrency and live in South Africa, Nigeria, or Malaysia, finding a safe, simple place to buy your first Bitcoin isn't easy. Many exchanges feel like trading floors for experts - full of charts, complex orders, and confusing jargon. Luno was built for people who just want to buy crypto without the headache. But is it still the best choice in 2025? This review cuts through the noise and shows you exactly what Luno offers, what it lacks, and who it’s really for.

What Is Luno, Really?

Luno isn’t just another crypto exchange. Founded in 2013, it was designed from the ground up to serve users in countries where banking systems don’t easily connect to crypto. Unlike Binance or Coinbase, which target global traders, Luno focuses on emerging markets. It’s regulated in 10 countries, including South Africa, Nigeria (before the ban), Malaysia, Indonesia, and Singapore. That means your money isn’t just sitting on some random server - it’s protected under local financial laws.

As of early 2025, Luno has over 12 million users. In South Africa alone, it handles 87% of all crypto trading volume. That’s not because it’s the cheapest - it’s because it’s the most trusted. Most users are beginners. In fact, 63% have less than a year of crypto experience. That’s why the app feels like a calculator, not a stock terminal.

How Easy Is It to Get Started?

Signing up takes less than five minutes. You need an email, phone number, and a government ID. Verification usually takes 12 to 48 hours, depending on your country. Once approved, you can link your local bank account. In South Africa, if you bank with Standard Bank or FNB, you can deposit and withdraw in minutes. That’s rare in crypto.

You don’t need to understand order books or limit orders. You just tap “Buy Bitcoin,” enter how much you want to spend - say, R500 - and confirm. That’s it. No decimals, no slippage, no guessing. The price is locked in, and your Bitcoin arrives in your wallet within seconds.

The mobile app (iOS and Android) is clean, fast, and works even on older phones. It’s rated 4.7 out of 5 on both stores. People say it’s “the only crypto app my mom can use.” That’s not an exaggeration.

What Cryptocurrencies Can You Trade?

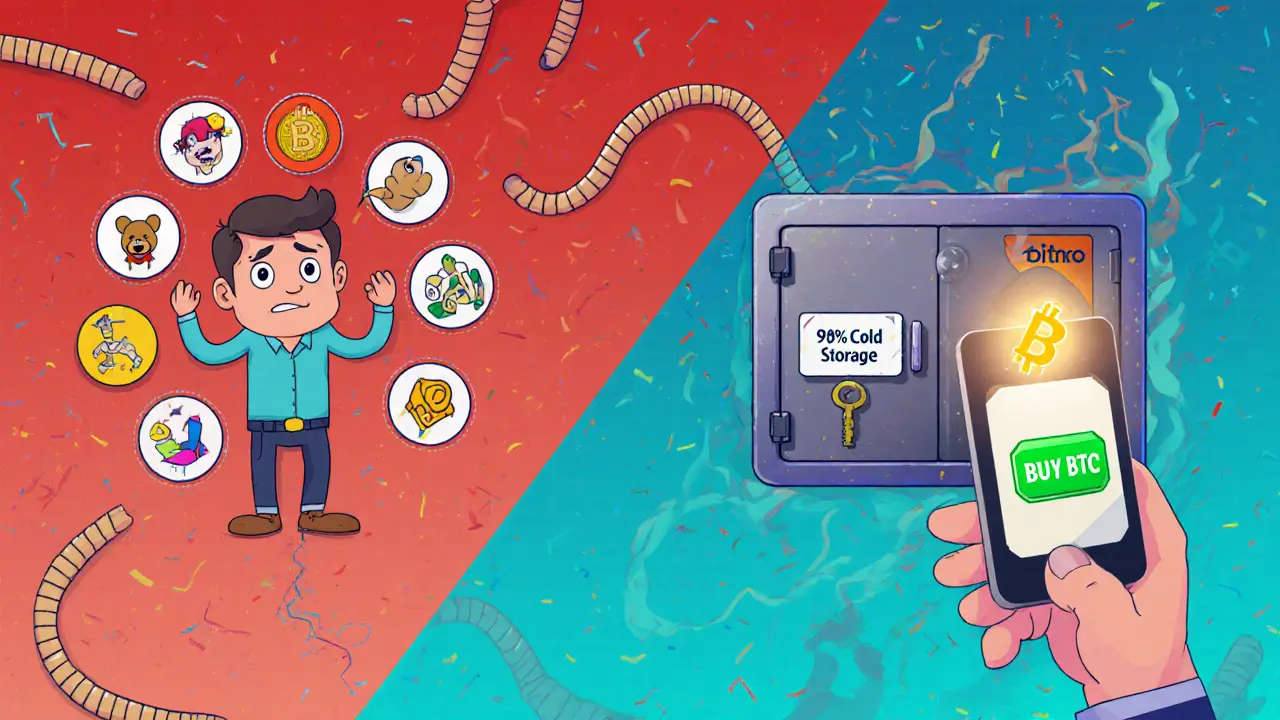

Luno supports five coins: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Bitcoin Cash (BCH). That’s it. No Dogecoin. No Solana. No Shiba Inu. No altcoins with 100,000% pumps.

That’s by design. Luno doesn’t chase trends. It sticks to the most stable, widely accepted coins. For beginners, that’s actually a good thing. You’re not getting sucked into gambling on random tokens. You’re learning with the real stuff.

But here’s the problem: in 2024, competitors added over 15 new coins. Luno added one - Bitcoin Cash. That’s a red flag if you’re planning to hold more than just BTC or ETH long-term. If you want to trade Cardano or Polkadot, you’ll need another exchange.

Fees: Are They Fair?

Luno’s fee structure has two sides: instant buys and exchange trading.

Instant Buy/Sell Fees: These are fixed and range from 1.5% to 3.5%, depending on your country. In South Africa, it’s usually 1.5%. In Nigeria, it’s closer to 3.5% - partly because of banking restrictions. Compare that to Coinbase’s 1.49%-3.99% and Yellow Card’s 3.5%-5%. Luno is competitive in Africa, but not the cheapest.

Exchange Trading Fees: If you use Luno’s trading platform (not instant buy), fees are 0.1% for makers and 0.2% for takers. That’s standard. But here’s the catch: most users never use this. They just buy and hold. So the trading fees rarely matter.

One major complaint? Withdrawal fees. Some users report being charged up to 10% to move crypto out of Luno to another wallet. That’s not true for all users - it’s usually a misunderstanding. Luno charges network fees (like Bitcoin miner fees), which vary based on blockchain congestion. But if you see a 10% fee, you likely tried to sell your entire wallet balance manually - and accidentally triggered a high fee due to the way the app works.

Security: Is Your Money Safe?

Luno takes security seriously. 95% of customer funds are stored in offline cold wallets. These are locked away, physically disconnected from the internet. Only the remaining 5% are kept online for fast withdrawals.

They use multi-signature wallets. That means two keys are needed to move money. One key is held by Luno. The other is held by BitGo, a top-tier institutional custodian. Even if Luno gets hacked, the hackers can’t touch the money without BitGo’s approval.

Two-factor authentication (2FA) is mandatory. You can use SMS or an authenticator app like Google Authenticator. The app also supports fingerprint and face unlock. No one can log in without your phone or biometrics.

There’s never been a major breach. That’s rare in crypto. In fact, a 2025 study from the University of Cape Town found that 78% of first-time crypto users in Sub-Saharan Africa chose Luno because they felt it was the safest option.

What’s Missing?

Luno isn’t for traders. If you want stop-loss orders, trailing stops, futures, leverage, or staking - forget it. There’s no button for any of that.

There’s no way to sell your entire wallet balance with one click. You have to type the exact amount. That’s frustrating. One Reddit user called it “a design flaw that makes no sense.”

There’s no peer-to-peer trading in Nigeria yet - even though the central bank banned crypto in 2022. Luno promised a P2P solution by Q3 2025, but so far, Nigerian users can’t sell crypto to other users. They can only buy. That’s a huge gap.

And no US stocks. Wait - actually, they just added that in March 2025. But only in select markets like Singapore and South Africa. You can now buy fractional shares of Apple or Tesla. That’s a smart move. But it’s still limited.

Customer Support: Do They Answer?

Luno offers 24/7 live chat. Response time is usually under 18 minutes. That’s fast. Email support takes 24 to 48 hours - typical for most exchanges.

Their help center has 47 video tutorials and 23 written guides. One popular guide is called “Crypto 101.” It explains blockchain, wallets, and how to avoid scams. 42% of new users finish it. That’s high. Most exchanges don’t even offer this.

Who Should Use Luno?

Use Luno if:

- You live in South Africa, Nigeria, Malaysia, Indonesia, or Singapore

- You’re new to crypto and want to buy Bitcoin or Ethereum safely

- You prefer a simple app over a complex trading platform

- You value regulatory protection over advanced features

Don’t use Luno if:

- You want to trade altcoins like Solana or Dogecoin

- You’re an active trader who needs stop-losses or futures

- You live in the US, Europe, or Canada (Luno doesn’t serve you)

- You want to move crypto in and out of your wallet daily

Luno vs. the Competition

Here’s how Luno stacks up against Binance and Coinbase:

| Feature | Luno | Binance | Coinbase |

|---|---|---|---|

| Supported Countries | 10 (focused on Africa/SE Asia) | 190+ (but only 6 fully licensed) | 100+ (limited in Africa) |

| Coins Available | 5 | 500+ | 200+ |

| Instant Buy Fee | 1.5%-3.5% | 0.5%-1.5% | 1.49%-3.99% |

| Advanced Trading | No | Yes | Yes |

| Staking | No | Yes | Yes |

| Bank Integration (Africa) | Excellent | Poor | None |

| Beginner Friendliness | Excellent | Low | Good |

Luno wins on simplicity and local banking. Binance wins on features and price. Coinbase wins on global reach. But if you’re in Nigeria or South Africa and just want to buy Bitcoin without stress - Luno is still the easiest path.

The Bottom Line

Luno isn’t perfect. It’s slow to add new coins. It lacks advanced tools. Its fees can feel high if you’re trading often. But it’s not trying to be Binance. It’s trying to be your first crypto app.

For beginners in emerging markets, it’s still the best option. It’s regulated. It’s secure. It’s simple. And it works with your local bank. In places where crypto is new and risky, that’s worth more than a thousand trading features.

If you’re ready to buy your first Bitcoin and don’t want to get lost in a sea of charts - start with Luno. Once you’re comfortable, you can always move to a bigger exchange. But for that first step? Luno makes it possible.

Is Luno safe to use in 2025?

Yes, Luno is one of the safest crypto platforms for beginners, especially in Africa and Southeast Asia. It holds 95% of customer funds in offline cold storage, uses multi-signature wallets with BitGo as a custodian, and requires mandatory two-factor authentication. There has never been a major security breach. It’s also regulated in 10 countries, meaning it follows local financial laws.

Can I trade altcoins like Solana or Dogecoin on Luno?

No. Luno only supports five cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Bitcoin Cash (BCH). It doesn’t offer Solana, Dogecoin, Cardano, or any other altcoin. If you want to trade more coins, you’ll need to use another exchange like Binance or Coinbase.

How much does Luno charge to buy Bitcoin?

Luno charges a fixed fee of 1.5% to 3.5% for instant Bitcoin purchases, depending on your country. In South Africa, it’s usually 1.5%. In Nigeria, it’s closer to 3.5%. These are higher than Binance’s trading fees but lower than local competitors like Yellow Card. There’s also a small network fee when withdrawing Bitcoin to another wallet.

Can I withdraw Bitcoin from Luno to another wallet?

Yes, you can withdraw Bitcoin and other supported coins to any external wallet. But you’ll need to enter the exact amount manually - there’s no “sell all” button. You’ll also pay a small network fee based on blockchain congestion. This fee is not set by Luno - it’s determined by the Bitcoin network.

Is Luno available in the United States?

No, Luno does not operate in the United States, Canada, or most of Europe. It’s focused exclusively on emerging markets - primarily South Africa, Nigeria, Malaysia, Indonesia, and Singapore. If you’re in the US, use Coinbase, Kraken, or Gemini instead.

Does Luno offer staking or earning interest on crypto?

No, Luno does not offer staking, yield farming, or interest accounts. You can only buy, sell, and hold crypto. If you want to earn interest on your Bitcoin or Ethereum, you’ll need to move your assets to a platform like Coinbase, Binance, or a decentralized finance (DeFi) app.

How long does it take to verify my Luno account?

Verification usually takes 12 to 48 hours. You need to upload a government ID (passport or driver’s license) and sometimes a proof of address. In some countries, like South Africa, verification can be faster if your ID is already linked to your bank. If your documents are unclear, it may take longer.

Can I use Luno to buy US stocks?

Yes, but only in select markets. As of March 2025, Luno began offering fractional US stock trading in Singapore and South Africa. You can buy shares of Apple, Tesla, or Amazon with as little as $1. This feature is not available in Nigeria, Indonesia, or Malaysia yet.