Blockchain Energy Calculator

Energy Comparison Calculator

See how much energy different blockchain transactions consume. Based on real-world data from Ethereum and Bitcoin.

Equivalent to 60-watt lightbulbs running for 1 hour

Equivalent to energy used by U.S. households for 1 hour

Data source: Ethereum Energy Comparison (2024) and Bitcoin Energy Consumption Index

1 transaction (PoW): 830 kWh | 1 transaction (PoS): 0.036 kWh

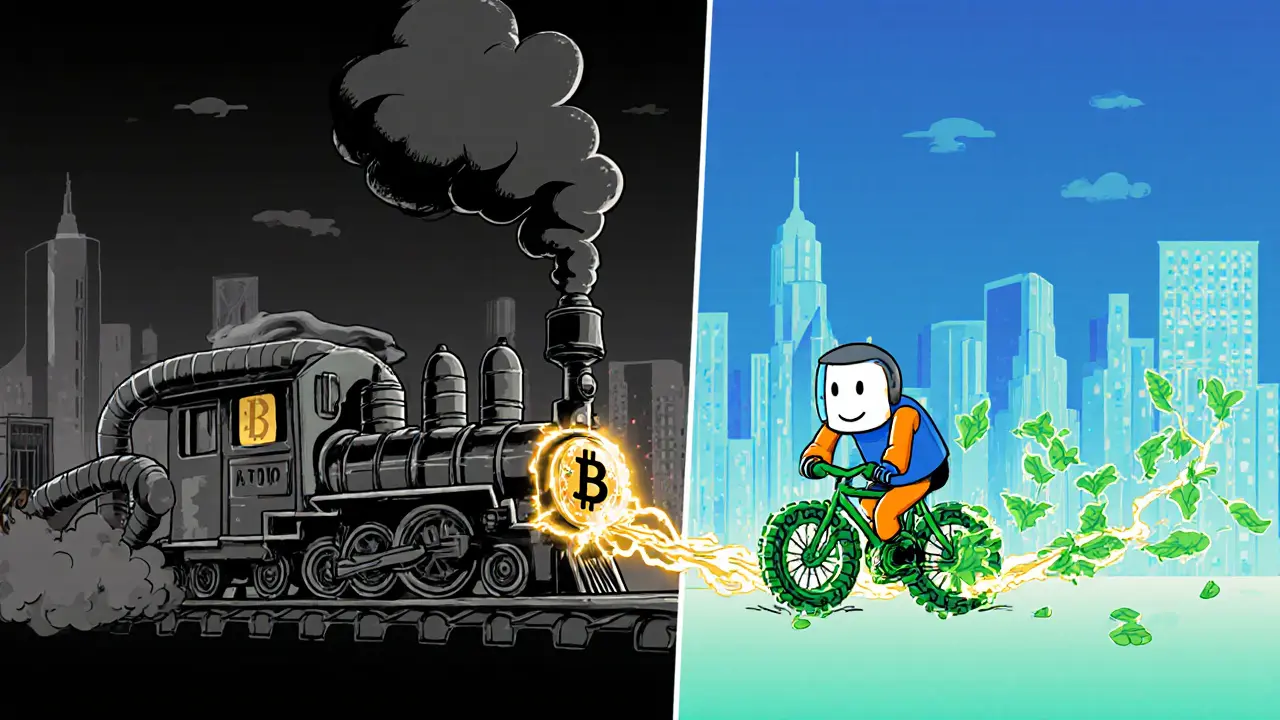

Proof of Stake isn't just a new way for blockchains to verify transactions-it’s a radical shift in how we think about energy in digital systems. Before 2022, most people assumed blockchain = massive electricity use. Bitcoin mining consumed more power than entire countries. Then Ethereum switched to Proof of Stake. Overnight, its energy use dropped by 99.95%. That’s not a small improvement. That’s like replacing a freight train with a bicycle.

How Proof of Stake Works (Without the Power Drain)

Proof of Work, the original system used by Bitcoin, is like a global competition where miners race to solve math puzzles. The faster your computer, the more electricity you burn. These machines-called ASICs-run 24/7, often in warehouses with industrial cooling systems. A single Antminer S21 Hydro uses over 5,000 watts. That’s more than a typical home air conditioner. Proof of Stake throws that model out. Instead of mining, you stake. You lock up your cryptocurrency-like 32 ETH on Ethereum-as collateral to become a validator. The network picks validators randomly, but the more you stake, the higher your chance of being chosen. If you try to cheat, you lose your stake. No mining rigs. No overheating chips. Just a regular computer with 8 GB of RAM and a decent internet connection. This isn’t theory. It’s real. After Ethereum switched in September 2022, its power use went from 5.13 gigawatts to just 2.62 megawatts. That’s 1,957 times less energy. To put that in perspective: Bitcoin still uses as much electricity as Norway. Ethereum’s entire PoS network now uses less than 200 American homes.The Numbers Don’t Lie: PoS vs PoW Energy Comparison

Here’s what the data says when you compare real-world usage:| Metric | Proof of Work (Bitcoin) | Proof of Stake (Ethereum) |

|---|---|---|

| Annual Energy Use | 112.06 TWh | 0.00262 TWh (2.62 GWh) |

| Energy per Transaction | 830 kWh | 0.036 kWh |

| Carbon Emissions (Annual) | 62.51 million tonnes CO2e | ~1.2 million tonnes CO2e (combined PoS networks) |

| Hardware Required | ASIC miners ($5K-$20K) | Standard PC (8GB RAM, 64GB storage) |

| Transactions per Second | ~5 | 15-45 (up to 100,000+ with sharding) |

The difference isn’t just big-it’s civilization-level. One Bitcoin transaction uses enough electricity to power an average U.S. home for over a month. One Ethereum transaction uses less than a single lightbulb for an hour.

Why This Matters Beyond the Environment

It’s easy to think this is just about saving the planet. But the real impact is economic and institutional. Before Ethereum switched, banks and pension funds wouldn’t touch crypto. Too much energy. Too much risk. Too many headlines about coal-powered mining. After The Merge, Fidelity, Grayscale, and others publicly cited energy efficiency as the key reason they started investing. The same shift happened with corporations. By 2024, 73% of companies holding crypto prioritized PoS assets for ESG compliance-up from 28% in 2021. Regulators noticed too. The European Union’s MiCA rules treat PoS validators differently from PoW miners, giving them clearer legal standing. In the U.S., Senators Lummis and Gillibrand introduced the Pro-Proof-of-Stake Act in 2023 to protect and encourage PoS development. This isn’t just tech-it’s policy now.

Who Can Participate? Lower Barriers, More Access

PoW mining became a game for corporations with access to cheap power and massive capital. If you didn’t have $10,000 for a mining rig and a warehouse, you were out. PoS flipped that. You don’t need a warehouse. You don’t need a power plant. You just need ETH. The minimum is 32 ETH-around $100,000 as of late 2024. But you don’t have to buy that much. Services like Lido, Coinbase, and Kraken let you stake as little as $10. They pool your ETH with others, and you earn a share of the rewards. No technical skills needed. In Q1 2024 alone, Coinbase added 1.2 million new stakers. That’s not just tech-savvy users. That’s teachers, nurses, small business owners. People who care about crypto but not about cooling systems.What About Centralization Risks?

Critics say PoS favors the rich. If you have more ETH, you get chosen more often. That’s true in theory. But in practice, no major PoS network has become centralized. Ethereum’s validator distribution is spread across thousands of independent operators. Even though Lido and Coinbase together control about 32% of staked ETH, that’s still far from control. The network is designed so no single entity can dominate. And if one did, they’d risk losing their entire stake-making it economically irrational. Compare that to Bitcoin, where 80% of mining hash rate is controlled by just five mining pools, mostly in countries with cheap, often non-renewable power. That’s real centralization. PoS doesn’t have that problem.

What’s Next for Proof of Stake?

PoS isn’t standing still. Ethereum’s Dencun upgrade in February 2024 cut per-transaction energy use by another 10%. The upcoming Verkle Trees upgrade in 2025 will make data storage even more efficient. That means even less energy for the same work. New networks are building on PoS too. Solana’s Proof-of-History, Cardano’s Ouroboros, Algorand’s Pure PoS-all use staking as the core. Together, they now make up 38% of the total crypto market cap, up from under 20% in 2020. Gartner predicts that by 2027, 95% of enterprise blockchains will use PoS or a variant. Why? Because ESG isn’t a buzzword anymore-it’s a requirement. Investors won’t fund carbon-heavy tech. Regulators won’t allow it. And consumers won’t buy it.Is Proof of Stake the Future?

It already is. The energy advantage isn’t a side benefit. It’s the main reason PoS exists. Every major blockchain project launched since 2023 uses PoS. The ones still clinging to PoW-like Bitcoin-are becoming outliers. The switch wasn’t easy. It took years of testing, code audits, and community debate. But the result? A blockchain that’s faster, cheaper, and uses less energy than your smartphone charger. You don’t need to be a programmer to see the shift. You just need to look at the numbers. Bitcoin’s energy use is growing. Ethereum’s is shrinking. And the rest of the industry is following. The question isn’t whether Proof of Stake is better. It’s why anyone would still choose the old way.How much less energy does Proof of Stake use than Proof of Work?

Proof of Stake uses about 99.95% less energy than Proof of Work. Ethereum’s transition in 2022 cut its energy use from 5.13 gigawatts to just 2.62 megawatts. That’s a 1,957x reduction. Bitcoin still uses more electricity annually than Norway, while Ethereum’s entire PoS network uses less than 200 U.S. households.

Can I stake crypto without buying a lot of it?

Yes. While Ethereum requires 32 ETH to run a full validator, services like Coinbase, Lido, and Kraken let you stake as little as $10. These platforms pool small stakes together, so you still earn rewards without needing expensive hardware or technical knowledge.

Is Proof of Stake more secure than Proof of Work?

Yes, in different ways. Proof of Work relies on computational power to secure the network-so if someone controls 51% of mining hash rate, they could attack it. Proof of Stake relies on economic penalties: if you try to cheat, you lose your staked coins. This makes attacks far more expensive and less likely. No major PoS network has ever been successfully attacked.

Why did Ethereum switch to Proof of Stake?

Ethereum switched to solve three problems: energy waste, slow transaction speeds, and high fees. PoW was using as much power as a small country. PoS slashed that by 99.95%. It also paved the way for future upgrades like sharding, which will make Ethereum faster and cheaper to use. The switch, called The Merge, was completed in September 2022.

Do other blockchains use Proof of Stake?

Yes. Cardano, Solana, Polkadot, Tezos, and many newer chains use Proof of Stake. In fact, 78% of all new blockchain projects launched in 2023-2024 use PoS. Ethereum’s success made it the standard. Bitcoin is the only major chain still using Proof of Work.

Is Proof of Stake better for the environment?

Absolutely. Combined, all major PoS networks emit between 33 and 934 tonnes of CO2e annually. Bitcoin alone emits 62.5 million tonnes-over 65,000 times more. PoS networks use roughly the same energy as 200 U.S. homes. Bitcoin uses more than a small country. The environmental case for PoS isn’t close.

Comments (11)

Kaitlyn Boone

November 20, 2025 AT 19:08

proof of stake is just crypto bros pretending theyre green while still hoarding eth like its gold. the energy savings are fake because the validators still need servers and cooling and electricity. its all smoke and mirrors.

Dexter Guarujá

November 22, 2025 AT 02:32

you people dont get it. america built the internet with real power, not some fancy staking fairy tale. if you want to run a global ledger, you need real hardware, real electricity, real competition. ethereum sold out for woke points. bitcoin is the only real blockchain left. the rest is corporate greenwashing dressed up as tech innovation.

Natalie Reichstein

November 23, 2025 AT 15:16

you think this is about energy? no. its about control. the elite want to make staking so easy that grandma can do it, so they can track every single transaction, every single movement of value. no more anonymity. no more decentralization. just a beautifully lit, energy-efficient surveillance system with a blockchain label on it. they call it progress. i call it surrender.

Chris Popovec

November 24, 2025 AT 16:58

did you know that the 32 eth requirement is a lie? the real minimum is 16 eth if you use a pooled validator with a 10% fee. and those pooled validators? theyre all controlled by a handful of venture capital firms that also own the exchanges. its not decentralization. its oligarchy with a ui. and the carbon math? they ignore the embedded emissions from all the new servers and data centers built to support poS. the numbers are cooked.

Kris Young

November 25, 2025 AT 11:40

the data is clear. ethereum uses 99.95% less energy. that’s a fact. bitcoin uses more than norway. that’s also a fact. you can argue about motives, but you can’t argue with numbers. if you care about the planet, you support poS. if you don’t, that’s your choice.

James Edwin

November 26, 2025 AT 07:55

if you’ve ever thought crypto was just for tech nerds, think again. my neighbor, a school bus driver, staked $50 on coinbase last month and got her first reward. she didn’t need a rig. didn’t need to understand hash rates. just clicked a button. that’s power. real, human, accessible power. stop acting like tech has to be complicated to be legitimate.

LaTanya Orr

November 28, 2025 AT 05:40

isn’t it interesting how we equate energy use with value? we built civilizations on fire, on coal, on oil. now we’re terrified of electricity? maybe the real question isn’t how little energy poS uses, but why we think any digital system should be guilt-free. maybe the answer is that we’re not ready to accept that progress always has a cost. even a tiny one.

Jennifer Corley

November 29, 2025 AT 21:52

you say ethereum uses less than 200 homes. but how many homes are running full nodes? how many are running validators? how many are just passive stakers? the infrastructure behind those 2.62 megawatts isn’t just a laptop. there’s cloud hosting, dns services, monitoring tools, redundant backups-all powered by the same grid. the real energy footprint is hidden in the backend. and you’re not accounting for it.

Ashley Finlert

November 30, 2025 AT 14:09

in the grand tapestry of human innovation, we have always traded one form of excess for another. the steam engine replaced the horse. the internal combustion engine replaced the steam. now, we replace brute computational force with economic alignment. this is not surrender. it is evolution. and to those who mourn the loss of the mining rig as a symbol of digital ruggedness-perhaps you are mourning not the technology, but the myth of rugged individualism in an interconnected world.

Marilyn Manriquez

December 1, 2025 AT 17:10

the transition to proof of stake represents a fundamental shift in how humanity engages with digital trust. it is not merely an upgrade. it is a moral imperative. we can no longer justify systems that consume the resources of entire nations for the sake of speculative assets. the future belongs to those who align technology with planetary responsibility. this is not a trend. it is the only viable path forward.

taliyah trice

December 1, 2025 AT 21:41

i staked 10 bucks and got 2 cents back. cool. i still use my phone the same.