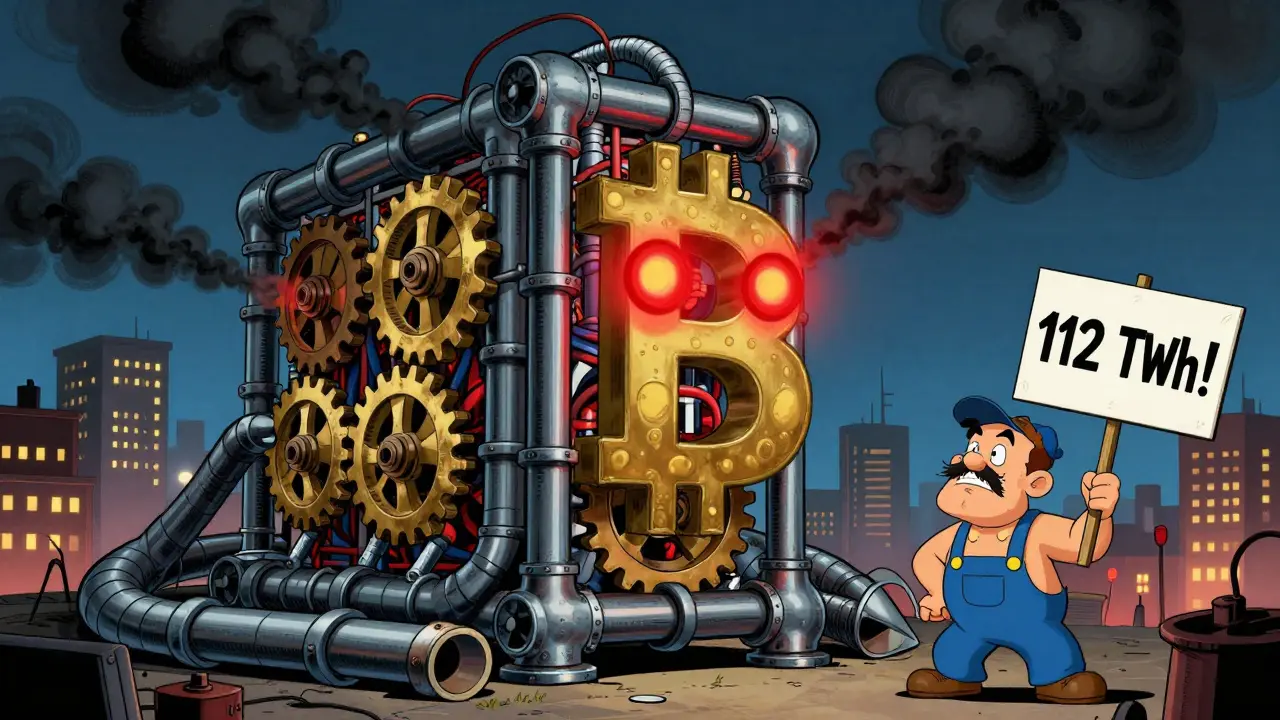

Before 2022, if you talked about blockchain energy use, people immediately thought of Bitcoin. Mining rigs humming 24/7, data centers lit up like industrial factories, electricity bills rivaling small countries. It wasn’t just a technical detail-it was a moral question. Why should digital money burn more power than a city just to confirm transactions?

How Proof of Work Drained the Grid

Proof of Work (PoW) is like a digital arms race. Miners compete to solve math puzzles using powerful computers. The first one to solve it gets rewarded with new coins. But here’s the catch: thousands of machines are solving the same puzzle at the same time. Only one wins. The other 9,999 are wasting electricity. Every single second.Bitcoin’s network alone used about 112.06 terawatt-hours (TWh) of electricity per year before the Ethereum Merge. That’s more than the entire annual consumption of countries like Belgium or Norway. Each Bitcoin transaction used roughly 707 kWh-enough to power an average American home for over three weeks. And for what? To secure a network that’s never been hacked, yes-but also to maintain a system where energy waste is baked into its design.

It wasn’t just Bitcoin. Other PoW chains like Litecoin and Dogecoin added to the pile. The carbon footprint of Bitcoin in 2022 hit 62.51 million metric tons of CO2. That’s equal to the annual emissions of 13 million cars. Environmental groups called it unsustainable. Regulators started taking notice. And then, everything changed.

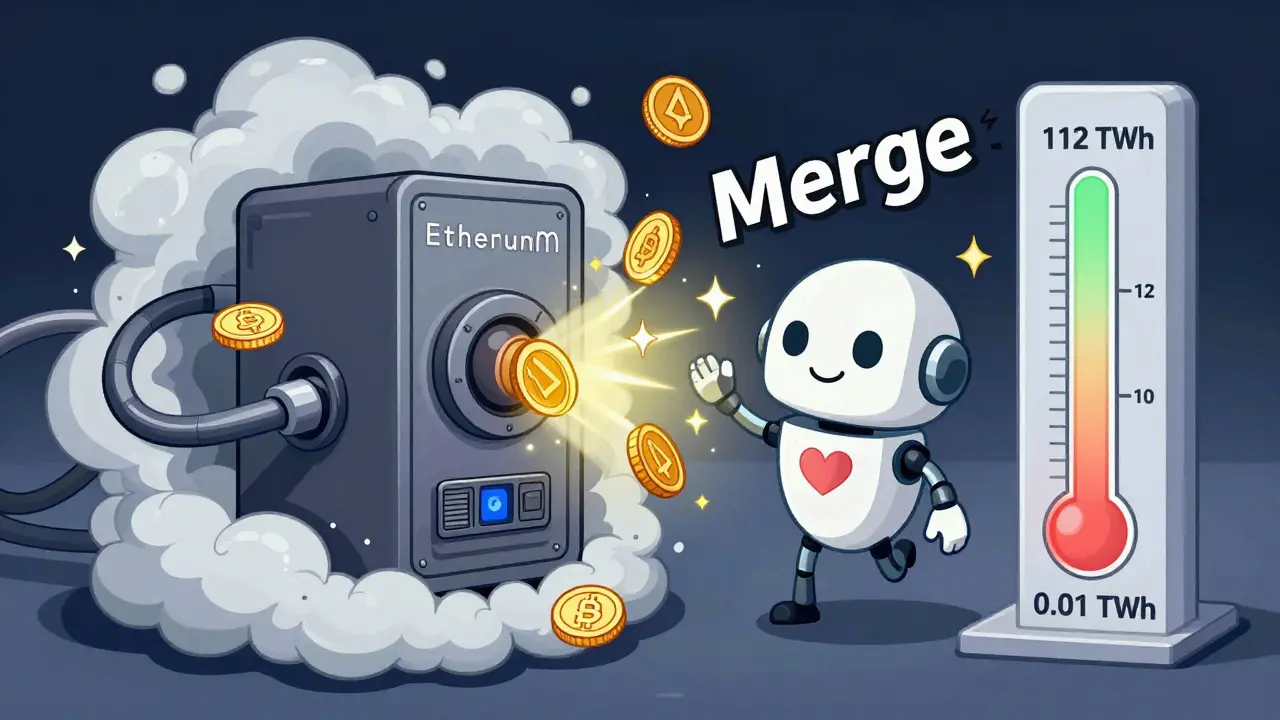

The Ethereum Merge: A Turning Point

On September 15, 2022, Ethereum-then the second-largest blockchain by market cap-pulled the plug on Proof of Work. In one move, called The Merge, it switched to Proof of Stake (PoS). The result? Energy use dropped by 99.95%.Before the Merge, Ethereum used about the same amount of energy as Bitcoin: 112.06 TWh annually. After? Just 0.01 TWh. That’s not a small improvement. It’s a complete overhaul. Ethereum went from using as much power as a medium-sized country to the same amount as 2,100 average American homes. One transaction on Ethereum now uses 0.0026 kWh. That’s less energy than it takes to boil a kettle.

This wasn’t theoretical. The Ethereum Foundation tracked it. Independent analysts confirmed it. Even skeptics had to admit: the numbers didn’t lie. The switch didn’t hurt security. It didn’t slow down the network. It didn’t break anything. It just made it infinitely cleaner.

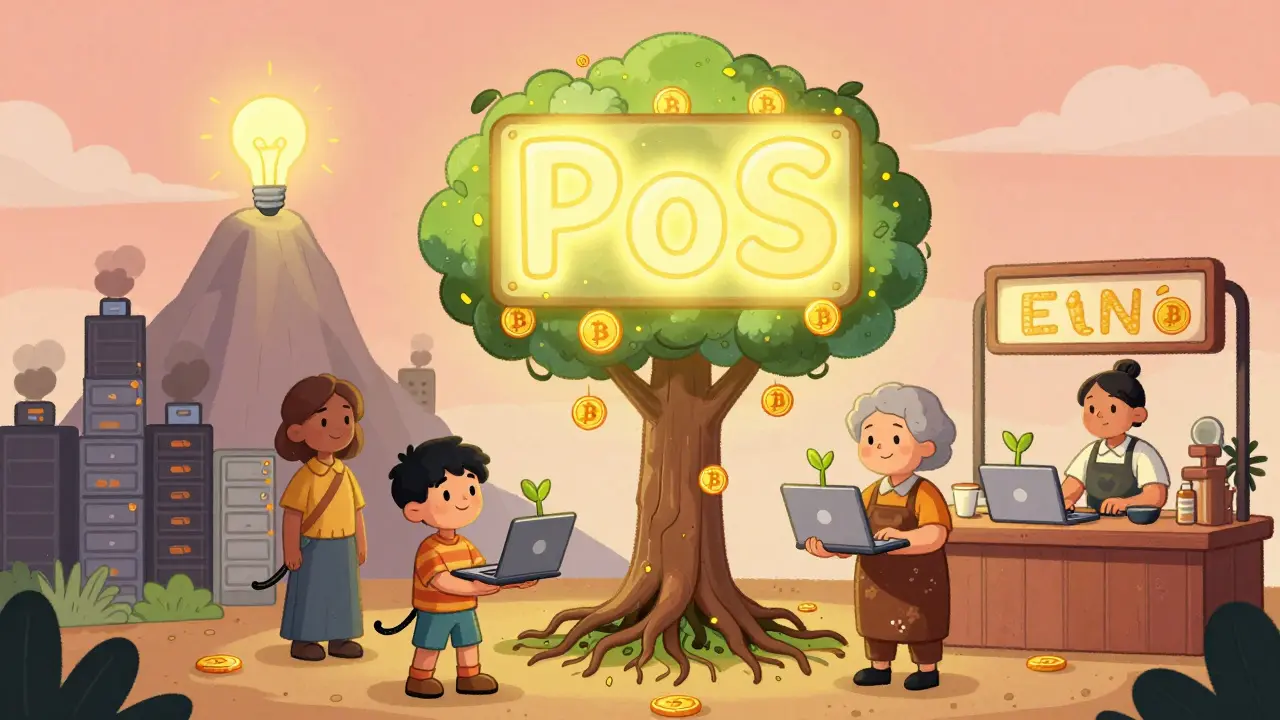

How Proof of Stake Works-Without the Waste

Proof of Stake doesn’t need miners. It needs validators. Instead of racing to solve puzzles, validators are chosen based on how much cryptocurrency they’re willing to lock up-called “staking.” The more you stake, the higher your chance of being selected to verify the next block. If you do your job right, you earn rewards. If you try to cheat or go offline too often, you lose part of your stake. It’s called slashing.No mining rigs. No ASIC chips. No cooling systems. No massive power draws. You can run a validator node on a $500 laptop with 8 GB of RAM and a 500 GB SSD. That’s it. No special hardware. No noise. No heat. No electricity bills that make you flinch.

Compare that to Bitcoin mining, which requires machines that draw 1,500 to 3,000 watts each-running nonstop, often in warehouses filled with hundreds of them. PoS doesn’t need that. It doesn’t even need to be competitive. It just needs enough people to lock up their coins to keep the network secure.

Real Numbers: PoS vs PoW Energy Use

| Network | Consensus | Annual Energy Use | CO2 Emissions | Per Transaction Energy |

|---|---|---|---|---|

| Bitcoin | Proof of Work | 112.06 TWh | 62.51 Mt CO2 | 707 kWh |

| Ethereum (pre-Merge) | Proof of Work | 112.06 TWh | 52.36 Mt CO2 | ~700 kWh |

| Ethereum (post-Merge) | Proof of Stake | 0.01 TWh | 0.01 Mt CO2 | 0.0026 kWh |

| Cardano | Proof of Stake | 0.0000000001 TWh | Negligible | ~0.0005 kWh |

| Visa | Centralized | ~0.0001 TWh | ~0.001 Mt CO2 | ~0.0003 kWh |

Look at that table. Ethereum post-Merge uses less energy than a single Visa transaction. Cardano? It’s so efficient, you’d need to run millions of transactions before it uses the same power as a single Bitcoin transaction. PoS networks aren’t just better-they’re in a different league.

Why This Matters Beyond Energy Bills

This isn’t just about saving electricity. It’s about legitimacy. Before the Merge, crypto was seen as an environmental liability. Now, it’s becoming part of the solution.Companies that care about ESG (Environmental, Social, and Governance) standards used to avoid blockchain. Now, they’re asking for it. Gartner found that 68% of Fortune 500 companies experimenting with blockchain now prefer PoS platforms. Why? Because they can prove they’re not contributing to climate change. The European Union’s MiCA regulations, which took effect in 2024, now require all blockchain networks operating in the EU to report their carbon footprints. PoW chains can’t compete. PoS chains? They’re already compliant.

Startups building supply chain tools, carbon credit platforms, or digital identity systems now choose PoS by default. The Casper Network reported a 210% year-over-year increase in enterprise adoption in 2023-mostly because clients asked for it. No one wants to build a green tech product on a network that uses more energy than a small country.

Who Can Run a Validator? Almost Anyone

One of the biggest myths about blockchain is that you need to be rich or tech-savvy to participate. With PoW, that was true. To mine Bitcoin profitably, you needed thousands of dollars in hardware, cheap electricity, and cooling systems. It was a game for industrial players.PoS changed that. You don’t need to buy a $10,000 mining rig. You can stake as little as 0.01 ETH through platforms like Lido or Coinbase. That’s about $25 at current prices. You get rewarded with 3-5% annual interest, and you’re helping secure the network. No setup. No noise. No heat. Just click and go.

Since the Merge, Ethereum node operators have increased by 63%. Why? Because anyone with a decent laptop can now run a node. You don’t need to be a crypto millionaire. You don’t need to live where electricity is cheap. You just need a stable internet connection.

What About Centralization? The Other Side of the Coin

No system is perfect. Critics of PoS point to one big concern: centralization. If only people with large amounts of ETH can become validators, won’t power concentrate in the hands of a few?It’s a real risk. As of 2024, the top 10 staking pools control about 40% of Ethereum’s total stake. That’s more than most people would like. But Ethereum’s team is working on it. Sharding-splitting the network into smaller pieces-is coming. It will allow more validators to join without increasing hardware demands. It also limits how much any single validator can earn, reducing the incentive to hoard coins.

Compare that to Bitcoin, where mining is dominated by a handful of giant pools in China and the U.S. PoW is centralized too-just in a different way. PoS centralization is easier to fix with software. PoW centralization requires replacing entire machines.

The Future Is Already Here

By 2025, Delphi Digital predicts 80% of new blockchain projects will use Proof of Stake. That’s up from 55% in 2023. Why? Because the math is undeniable. The technology works. The market demands it. The regulators require it.Bitcoin might stick with PoW. It’s the original. It’s secure. It’s entrenched. But it’s also the exception now. Every new chain-Solana, Polygon, Avalanche, Tezos, Polkadot-uses PoS. Even Ripple’s XRP Ledger moved away from its original consensus model to something closer to PoS.

The energy efficiency of PoS isn’t just a feature. It’s the default expectation. If you’re building something on blockchain today, you don’t ask, “Can we use PoS?” You ask, “Why wouldn’t we?”

What’s Next for Ethereum?

Ethereum’s work isn’t done. The Merge was just the first step. Next came Proto-Danksharding in March 2024, which improved scalability without increasing energy use. By 2026, full sharding will roll out. That means Ethereum will handle thousands of transactions per second-while still using less power than a single lightbulb.And it’s not just Ethereum. Casper Network partnered with renewable energy providers to make its validation operations net-zero. Other chains are following. The goal isn’t just efficiency-it’s sustainability. Clean energy, clean code, clean reputation.

Proof of Stake didn’t just fix blockchain’s energy problem. It redefined what blockchain could be. No longer a wasteful experiment. No longer a villain in the climate debate. Now, it’s a tool for building a better digital economy-one that doesn’t burn the planet to keep running.

Is Proof of Stake really 99.95% more energy efficient than Proof of Work?

Yes. Ethereum’s switch from Proof of Work to Proof of Stake in September 2022 cut its energy use from 112.06 TWh per year to just 0.01 TWh. That’s a 99.95% reduction, confirmed by the Ethereum Foundation, independent researchers, and energy tracking groups like the Cambridge Centre for Alternative Finance. Other PoS chains like Cardano and Solana show similar efficiency gains.

Can I stake Ethereum without buying 32 ETH?

Yes. You can stake as little as 0.01 ETH through liquid staking providers like Lido, Coinbase, or Kraken. These platforms pool your ETH with others to meet the 32 ETH validator requirement. You still earn rewards proportional to your stake, and you can withdraw your funds (with some delays) if needed. It’s the easiest way for regular users to participate.

Does Proof of Stake make blockchains less secure?

No. PoS is designed to be just as secure as PoW, but through different mechanisms. Instead of relying on computational power, it uses economic incentives: validators risk losing their staked coins if they act dishonestly. Ethereum’s PoS system has operated securely for over two years. The network has never been hacked, and slashing penalties make attacks financially unviable.

Why hasn’t Bitcoin switched to Proof of Stake?

Bitcoin’s community values decentralization and security above all else-and many believe PoW provides the strongest security guarantee. Changing Bitcoin’s consensus mechanism would require near-universal agreement from miners, developers, and users. That’s politically and technically difficult. So while Bitcoin remains PoW, nearly every new blockchain project since 2022 has chosen PoS instead.

Are there any downsides to Proof of Stake?

The main concern is centralization risk: wealthier participants can stake more and earn more rewards, potentially concentrating power. There’s also the risk of “nothing at stake” attacks, though modern PoS protocols like Ethereum’s Casper FFG have solved this with penalties. Another issue is liquidity-staked ETH can’t be moved freely until withdrawals are enabled (which happened in 2023). But these are manageable trade-offs compared to PoW’s massive energy waste.

What’s the environmental impact of running a PoS validator node?

Running a PoS validator uses about as much power as a home router or a smart fridge-around 10-30 watts continuously. That’s less than 1% of the energy used by a single Bitcoin mining rig. Even if your electricity comes from coal, the carbon footprint of a PoS node is negligible compared to PoW. Most validators use renewable energy anyway, making the overall impact near-zero.

Comments (16)

Daniel Verreault

December 28, 2025 AT 08:42

bro the merge was a goddamn miracle. 112 TWh to 0.01? that’s not optimization, that’s a magic trick. i used to think crypto was just a climate crime scene, now i can run a node on my toaster and feel like a green hero. also staking 0.01 eth? yes please. my wallet thanks me, the planet thanks me, my neighbors don’t hear my rig buzzing anymore. this is what innovation looks like.

Jacky Baltes

December 29, 2025 AT 23:09

The shift from PoW to PoS represents a profound reconfiguration of value validation. Energy expenditure as a proxy for security was a heuristic born of necessity, not principle. PoS replaces physical cost with economic commitment - a more elegant, if not yet perfectly decentralized, solution. The philosophical implications extend beyond blockchain into how we measure trust in digital systems.

Emily L

December 29, 2025 AT 23:15

okay but let’s be real - if you’re still defending bitcoin’s energy waste you’re either mining it or being paid to defend it. 700kwh per transaction? that’s like burning a whole damn gas station to send a cat pic. the rest of crypto moved on. why are you still clinging to the dinosaur?

Gavin Hill

December 30, 2025 AT 14:59

poS is way better but dont act like its perfect. the top 10 pools controlling 40% is still a problem. also why do we keep pretending centralized exchanges like coinbase are the answer to decentralization? they’re just new middlemen with staking buttons

SUMIT RAI

January 1, 2026 AT 09:25

ok but what if the entire world goes poS and then the grid goes down? 😏 then what? also i staked 0.01 eth and got 0.0003 eth back. so basically i paid for the wifi and got a sticker. 🤷♂️

Andrea Stewart

January 2, 2026 AT 03:22

Just to clarify a common misunderstanding - PoS doesn’t eliminate centralization risk, it just changes its form. PoW centralizes mining hardware and electricity access; PoS centralizes capital. But unlike PoW, PoS centralization can be mitigated through protocol-level incentives like slashing penalties and validator rotation. The key is design, not just the consensus model.

Josh Seeto

January 4, 2026 AT 00:06

so let me get this straight - you’re telling me we replaced a system that wasted energy with one that just makes rich people richer? brilliant. next up: voting with your wallet. democracy, but with compound interest. 🙃

Khaitlynn Ashworth

January 4, 2026 AT 06:19

oh wow the green crypto fairy tale. you guys are hilarious. you think running a node on a laptop is ‘clean’? what about the carbon cost of manufacturing that laptop? the rare earth metals? the e-waste? you’re just outsourcing pollution to the supply chain and calling it ‘sustainable.’ classic crypto logic.

NIKHIL CHHOKAR

January 6, 2026 AT 04:52

you all sound like you just drank the kool-aid. sure poS uses less power - but what about the moral hazard? if you can stake 32 eth and get rich, why not just buy more and keep hoarding? you’re not securing the network - you’re just gambling with someone else’s money. and don’t even get me started on liquid staking - that’s just leverage with extra steps.

Mike Pontillo

January 7, 2026 AT 23:38

bitcoin will never switch. it’s not about tech. it’s about religion. people worship the hash rate like it’s holy water. you can’t convince a cult member their god is wasteful. they’ll just say ‘god wants it that way.’

Joydeep Malati Das

January 9, 2026 AT 10:06

The transition to Proof of Stake is a commendable engineering achievement. The energy efficiency gains are quantifiable and substantial. However, the sociopolitical implications of validator concentration require ongoing academic scrutiny. The community must remain vigilant to ensure equitable participation.

rachael deal

January 10, 2026 AT 07:25

YESSSS this is the energy future we’ve been waiting for!! 🌱✨ I staked my first 0.05 ETH last month and felt like i was saving the planet one transaction at a time. no more guilt when i check my wallet. also my laptop doesn’t sound like a jet engine anymore. thank you ethereum. you’re the real MVP.

nayan keshari

January 10, 2026 AT 19:48

poS is just proof of wealth. the rich get richer, the poor get staking rewards that barely cover their electricity bill. meanwhile bitcoin miners at least create real hardware demand. this is capitalism with a green filter. still capitalism.

Johnny Delirious

January 12, 2026 AT 14:22

It is with the utmost respect for the principles of sustainable technological advancement that I acknowledge the monumental strides achieved by the Ethereum Merge. The reduction in energy consumption represents not merely a technical optimization, but a paradigmatic evolution in the architecture of decentralized consensus mechanisms. This constitutes a watershed moment in the history of distributed ledger technology.

Prateek Chitransh

January 12, 2026 AT 22:16

Look, I get the excitement - PoS is awesome. But let’s not pretend it’s a utopia. If you’re staking through Lido or Coinbase, you’re trusting them with your ETH. That’s not decentralization, that’s delegation. And if they get hacked or go rogue? Your stake is gone. Real validators run their own nodes. If you’re not doing that, you’re just a spectator with a passive income stream.

Michelle Slayden

January 14, 2026 AT 19:05

The elegance of Proof of Stake lies not merely in its energy efficiency, but in its alignment with economic theory: security is derived from aligned incentives, not brute computational force. Yet, the transition raises epistemological questions - if trust is now anchored in capital rather than computation, what does it mean for the ontological foundation of decentralized networks? The philosophical implications are profound.