Bitcoin Transaction Confirmation Time Estimator

How Your Transaction Will Be Confirmed

Enter your fee rate and current mempool size to estimate confirmation time. Based on data from Bitcoin's network congestion patterns.

Estimated Confirmation Time

What Is a Mempool, and Why Does It Matter?

The mempool is the holding area where unconfirmed Bitcoin transactions wait to be picked up by miners and added to a block. Think of it like a line at a busy grocery store - everyone’s got their items ready, but only so many checkouts are open. Each node on the Bitcoin network keeps its own mempool, so there isn’t one global pool, but thousands of slightly different ones. Transactions stay here until they’re confirmed, or until they’re kicked out after two weeks if they’re too low-fee.

When the mempool fills up, things slow down. If you send a transaction with a low fee during high congestion, it might sit there for hours - or even days. That’s not a bug. It’s how the network balances demand with limited block space. Miners prioritize transactions with the highest fees per byte (satoshis per vbyte), so the mempool becomes a real-time auction. The bigger the mempool, the more people are competing for space.

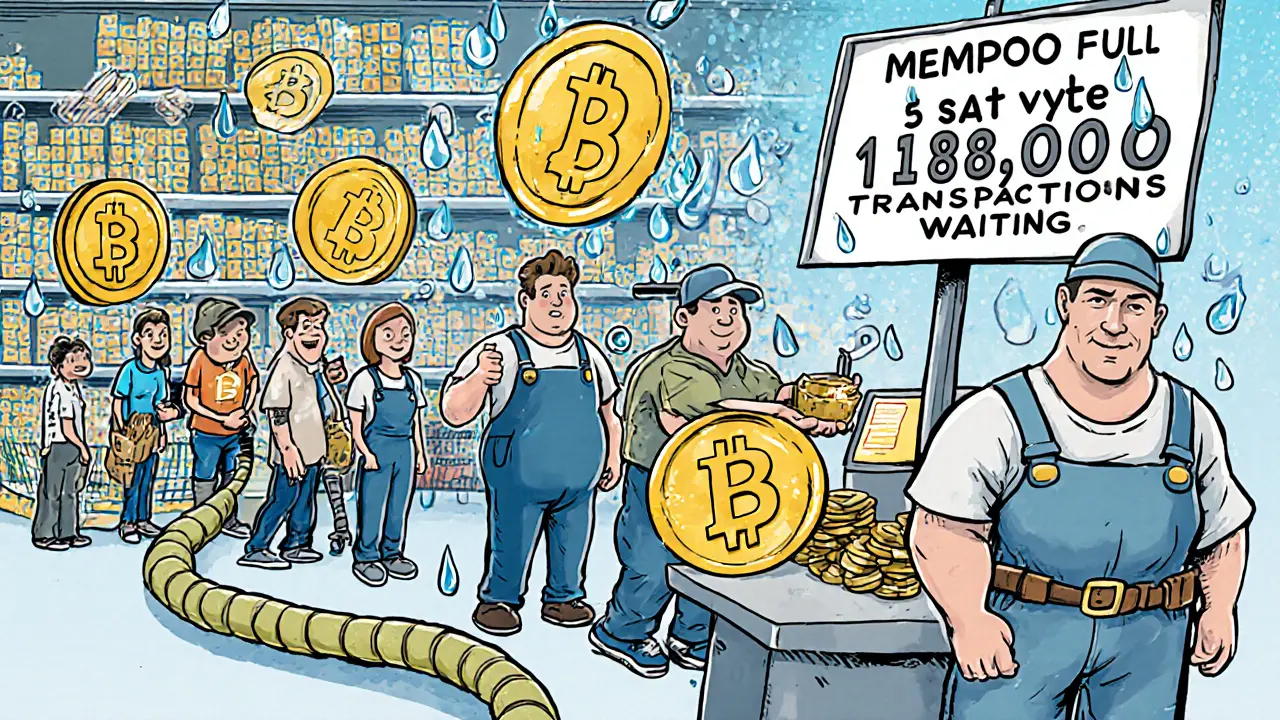

How Big Is the Mempool, and What Happens When It Overflows?

Bitcoin Core, the most common software running on Bitcoin nodes, sets a default mempool size limit of 300 MB. That might sound huge, but it’s not just raw transaction data. It includes metadata, indexes, and pointers needed to track and validate each transaction. In reality, that 300 MB holds roughly 150,000 to 200,000 transactions at peak efficiency. Once that limit is hit, the node starts removing the lowest-fee transactions first to stay responsive.

Here’s what real-world mempool sizes look like:

- Normal conditions: 15,000-40,000 transactions

- Medium congestion: 50,000-100,000 transactions

- High congestion: 100,000-200,000+ transactions

- Extreme events (like Nov 2021): Over 300,000 transactions

When mempool size crosses 50,000 transactions, you can expect confirmation delays to start creeping up. At 100,000+, it’s common to see waits of 30 minutes to several hours. During the 2021 peak, some transactions took over 72 hours to confirm - even with fees of 50 sat/vbyte.

How Transaction Fees Drive Mempool Behavior

Miners make money from transaction fees. So they pick the transactions that pay the most. The fee rate is measured in satoshis per virtual byte (sat/vbyte). Bitcoin’s minimum relay fee is 1 sat/vbyte - but that’s just the floor. During normal times, 5-10 sat/vbyte gets you a confirmation within a few blocks. During congestion, you need 50-200 sat/vbyte to be competitive.

Here’s what users actually paid during recent congestion events:

- 1 sat/vbyte: Confirmed in 72+ hours (if at all)

- 10 sat/vbyte: Confirmed in 4-8 hours during medium congestion

- 100 sat/vbyte: Confirmed in under 10 minutes during high congestion

- 200+ sat/vbyte: Confirmed in under 5 minutes, even at peak

Many users don’t realize that setting a fee too low isn’t just slow - it’s often useless. If your transaction gets evicted from the mempool after 336 hours, it’s gone. You have to resend it with a higher fee.

Why Mempool Congestion Happens - And When It Gets Worse

Congestion isn’t random. It usually spikes during:

- Major crypto events (ETF approvals, halvings, price surges)

- Large-scale NFT drops or token launches

- Exchange withdrawals after market rallies

- Wallets sending bulk transactions (like airdrop claims)

In 2023, Bitcoin’s average mempool size grew from 25,000 transactions in 2020 to over 50,000. That’s a 100% increase in demand - but block size hasn’t changed. Each block still holds about 2,000-2,500 transactions. So when more people send transactions than can fit in 10 minutes of mining time, the queue builds.

One big reason congestion sticks around? Many users still use legacy (non-SegWit) addresses. These are 30-40% larger than SegWit or Taproot addresses, meaning they take up more space in the mempool and blocks. Switching to a Bech32 (bc1) address reduces your transaction size and helps you pay less.

How to Check Mempool Status Before Sending

You don’t have to guess whether the network is congested. Real-time tools show you exactly what’s happening:

- mempool.space - Shows live mempool size, fee rates, and historical trends

- Blockchain.com mempool - Tracks transaction count and fee estimates

- BitInfoCharts - Visualizes fee trends and confirmation times

Here’s a simple rule: If the mempool count is over 100,000 transactions, increase your fee by 2-3x your normal rate. If it’s over 150,000, use 5x. Most wallets (like BlueWallet, Electrum, or Wallet of Satoshi) now show real-time fee suggestions - use them.

Pro tip: Don’t wait until the last minute. If you know a big event is coming (like a Bitcoin ETF decision), send your transactions early - before the rush.

What to Do When Your Transaction Is Stuck

Stuck transactions are frustrating, but they’re fixable. Here are your options:

- Wait it out - If the mempool clears, your transaction may still confirm. But this could take days.

- Replace-by-Fee (RBF) - If your original transaction was marked as RBF-enabled, you can resend it with a higher fee. Most modern wallets support this.

- Child-Pays-for-Parent (CPFP) - Send a new transaction that spends the output of your stuck one, and give it a high fee. Miners will pick up both together to maximize their reward.

- Use a fee accelerator - Some services (like BitPay or ViaBTC) let you pay extra to bump your transaction. But these aren’t guaranteed and cost money.

Never try to double-spend manually - that can cause chain splits or rejection. Stick to RBF or CPFP if you need speed.

How Developers and Nodes Handle Mempool Limits

If you run a Bitcoin node, you can tweak mempool settings in your bitcoin.conf file:

maxmempool=500- Increases mempool size to 500 MB (requires more RAM)minrelaytxfee=0.000005- Lowers the minimum fee to 0.5 sat/vbyte (not recommended for most)mempoolexpiry=336- Keeps unconfirmed transactions for 14 days

Increasing maxmempool helps you see more transactions during congestion, but it uses more memory. Users running 500 MB mempools report better visibility during spikes - but their nodes use 15-20% more RAM. For most home users, sticking with 300 MB is fine.

Developers building apps should always:

- Use SegWit or Taproot addresses to reduce transaction size

- Batch multiple payments into one transaction (saves 30-50% in fees)

- Implement dynamic fee estimation using APIs like mempool.space

- Warn users when network congestion is high

The Bigger Picture: Mempool Congestion and the Future of Bitcoin

Mempool congestion isn’t a flaw - it’s a feature. It ensures that Bitcoin remains secure and decentralized. If anyone could flood the network with free transactions, miners would have no incentive to keep the network running. Fee competition keeps miners honest and prevents spam.

But congestion also pushes innovation. During the 2017 and 2021 congestion peaks, adoption of the Lightning Network surged. By 2025, over 40% of Bitcoin value transfers are expected to happen off-chain through layer-2 solutions, dramatically reducing pressure on the main chain. Taproot adoption is also helping - it makes transactions smaller and cheaper, cutting mempool usage by 15-25%.

Other blockchains handle this differently. Ethereum uses EIP-1559’s base fee burning system. Solana processes transactions in parallel and rarely sees mempool backups. But Bitcoin’s approach - limited space, fee-based prioritization - is intentional. It’s a market mechanism that scales with demand.

For users, the lesson is simple: Pay attention to the mempool. Don’t treat Bitcoin like a credit card. Plan ahead. Use the right address type. Monitor fees. And understand that delays aren’t failures - they’re part of how the system works.

How Layer-2 Solutions Are Changing the Game

As mempool congestion became routine, users and developers turned to layer-2 networks to bypass the bottleneck. The Lightning Network, for example, allows instant, near-zero-fee payments by routing transactions off-chain. Between 2022 and 2024, Lightning’s capacity grew by over 230%, directly in response to Bitcoin’s congestion.

Other solutions like sidechains (e.g., Rootstock) and state channels also help. But Lightning is the most adopted. When Bitcoin’s mempool hits 100,000+ transactions, you’ll often see a spike in Lightning channel openings - users are actively choosing to leave the main chain to avoid fees and delays.

For everyday users, this means you don’t always need to use Bitcoin’s main chain. If you’re sending small, frequent payments (like coffee or tips), use Lightning. Save Bitcoin for larger transfers where security and finality matter most.

Comments (13)

Kaitlyn Boone

November 21, 2025 AT 13:24

why do people still use legacy addys when bech32 is free and faster? this is like using a horse and buggy in 2025.

Chris Popovec

November 22, 2025 AT 15:20

mempool congestion? nah. this is all part of the central bank takeover. they want you to pay fees so you'll switch to their digital dollar. watch how fast the mempool clears when they shut down the nodes.

Charan Kumar

November 24, 2025 AT 08:56

in india we dont care about mempool size we just wait and send again later

Natalie Reichstein

November 25, 2025 AT 02:24

you people still don't get it. fee competition isn't a feature, it's a failure of design. if you're proud of this, you're proud of exclusion. the rich pay to move first, the poor wait or get erased. this isn't decentralization, it's feudalism with hashes.

James Edwin

November 25, 2025 AT 17:44

if you're not using mempool.space before every tx you're basically throwing money into a black hole. i've saved hundreds by checking the chart. seriously, do this.

Jennifer Corley

November 26, 2025 AT 04:46

interesting how you mention segwit but ignore that taproot is 20% more efficient and still under 40% adoption. you're not educating, you're just recycling old data.

Kris Young

November 28, 2025 AT 01:55

I agree with Jennifer. Taproot adoption is still too low. And we should be pushing for it harder. It's not just about fees-it's about privacy, efficiency, and future-proofing.

Ashley Finlert

November 28, 2025 AT 08:34

The mempool, in its chaotic grandeur, is a mirror of human nature: scarcity breeds competition, and competition reveals character. Some rage against the fee market. Others adapt, innovate, and thrive. Bitcoin does not bend to desire-it reveals who we are when the pressure mounts.

LaTanya Orr

November 28, 2025 AT 13:49

i think the real question is not how to pay more but why we accept that paying more should be the only way to get through. what if we designed a system where urgency didn't equal privilege

Dexter Guarujá

November 28, 2025 AT 16:47

This is why America needs to lead in Bitcoin development, not some third-world node operators with outdated configs. We built this network, and now we're paying for the incompetence of others who can't even set maxmempool right. Get your house in order.

Marilyn Manriquez

November 29, 2025 AT 00:38

The evolution of transaction fee dynamics reflects the maturation of a global financial system. One must approach it not as a technical inconvenience, but as a sociological phenomenon.

Peter Mendola

November 30, 2025 AT 17:09

CPFP is a band-aid. RBF should be mandatory. Period. If your wallet doesn't support it, delete it. 🚫

taliyah trice

December 1, 2025 AT 10:11

i just use lightning now. no stress. no fees. no waiting.