Crypto Compliance Cost Calculator

Calculate Your Compliance Costs

Estimate the annual compliance costs for your crypto business based on your transaction volume across key states. Based on data from the 2025 US Crypto Regulations Guide.

Estimated Compliance Costs

Note: These are approximate annual costs based on 2025 regulations. Costs may vary based on business model, transaction complexity, and specific state requirements.

Wyoming requires $25 million capital for SPDI banks. New York requires $2 million minimum capital and $350,000/year in compliance. California only requires $1,000 registration.

There’s no single rulebook for cryptocurrency in the United States. If you’re running a crypto business, trading digital assets, or even just holding Bitcoin, where you live matters more than you think. As of 2025, 47 states have their own crypto rules - and they don’t agree on much. Some treat crypto like a bank product. Others treat it like a commodity. A few barely regulate it at all. This isn’t confusion - it’s chaos. And it’s costing businesses millions while leaving everyday users vulnerable.

New York’s BitLicense: The Hardest Regime in the Country

New York’s BitLicense, launched in 2015, was the first major state crypto regulation. It’s also the most restrictive. To operate in New York, a crypto company must get a license from the Department of Financial Services (NYDFS). The application costs $5,000. The minimum capital requirement? $2 million. You need detailed business plans, cybersecurity systems that meet NYDFS 500.00 standards, and ongoing reporting. Cold storage for 80% of assets? Mandatory. Biometric access controls? Required.Only 37 companies have ever gotten a BitLicense as of September 2025. Over 100 applications were rejected. Coinbase moved its main office out of New York in 2021. Circle, the issuer of USDC, followed. Why? Because compliance costs an average of $350,000 per year per company. For a small startup, that’s impossible.

Users feel it too. Crypto-related complaints in New York take an average of 217 days to resolve. Compare that to California’s 38-day average. Many New York residents report being blocked from using popular exchanges or facing delays when withdrawing funds. One Reddit user, u/CryptoTraderNYC, closed his exchange in 2023 after spending $187,000 on compliance with zero revenue. He moved to Wyoming. His volume tripled in 18 months.

Wyoming: The Crypto-Friendly State

Wyoming doesn’t just allow crypto - it built a whole banking system around it. In 2018, it created Special Purpose Depository Institutions (SPDIs), state-chartered banks that can hold crypto assets and offer traditional banking services like deposits and loans. These banks are FDIC-insured and regulated by the Wyoming Division of Banking.Kraken Bank, Avanti Financial Group, and several other crypto-native banks operate under this model. In 2024, they processed $12.7 billion in crypto transactions. The state doesn’t tax crypto. It doesn’t impose capital requirements on small operators. Businesses with under $35,000 in annual crypto activity don’t need a license at all.

Wyoming’s approach has paid off. Since 2020, it’s captured 63% of all new crypto banking jobs in the U.S. State revenue from crypto operations hit $427 million in 2024 - 7.3% of total state revenue. That’s more than New York’s $189 million, despite New York’s economy being 15 times larger.

It’s not perfect. SPDI charters require $25 million in capital and FDIC insurance - so only big players can use them. But for startups and innovators, Wyoming is the only state that feels like home.

California: The Middle Ground

California doesn’t license crypto companies. It registers them. Under the California Financing Law, any business that transacts over $500,000 in virtual currency annually must register with the Department of Financial Protection and Innovation (DFPI). The fee? $1,000. No minimum capital. No mandatory cold storage. No biometric access.As of Q3 2025, 142 crypto businesses were registered in California. That’s more than any other state except Texas. The process takes 45 to 60 days. Enforcement is active - the DFPI has opened 17 cases against unregistered firms - but it’s not designed to stop innovation. It’s designed to catch bad actors.

Users benefit too. Dispute resolution is 38% faster than in New York. Exchanges operating primarily in California report higher customer satisfaction. The state’s approach is simple: if you’re big enough to move half a million dollars in crypto, you owe the state paperwork. Everything else is left open.

Texas and Other Light-Touch States

Texas takes a hands-off approach. It doesn’t require licenses or registrations for crypto businesses. Instead, it applies existing money transmission laws. If you’re transmitting money - whether it’s dollars or Bitcoin - you need a money transmitter license. But there’s no separate crypto rule. No cold storage mandates. No capital requirements.Other states like Tennessee, South Dakota, and Oklahoma follow similar models. They don’t create new crypto laws. They stretch old ones. That means less red tape, but also less clarity. A business in Tennessee might think it’s fine to operate without a license - until the state attorney general says Bitcoin counts as money transmission. Then it’s a surprise audit.

These states attract smaller operators and developers. But they also create risk. Without clear rules, users have fewer protections. If a Texas-based exchange collapses, there’s no state fund to reimburse customers. No insurance. No guaranteed resolution process.

The States That Don’t Know What to Do

Twenty-eight states require bonding - a financial guarantee that a company will cover losses if it fails. Bond amounts range from $25,000 in Texas to $500,000 in New York. Nineteen states exempt small operators who handle under $1 million in crypto annually.But 11 states, including Massachusetts, Connecticut, and New Jersey, are tightening rules. Massachusetts Secretary of the Commonwealth William Galvin called the state-by-state system “a recipe for disaster.” He pointed to $2.1 billion recovered from crypto scams in Massachusetts between 2020 and 2025. His office now requires all crypto firms operating in the state to register and submit quarterly audits.

Arizona, Nevada, and Florida have created “regulatory sandboxes” - safe zones where startups can test new products without full compliance. Arizona’s sandbox has led to a 34% faster growth rate for crypto startups compared to non-sandbox states. But sandboxes aren’t permanent. They’re testing grounds. And once the test ends, companies either get regulated - or get shut down.

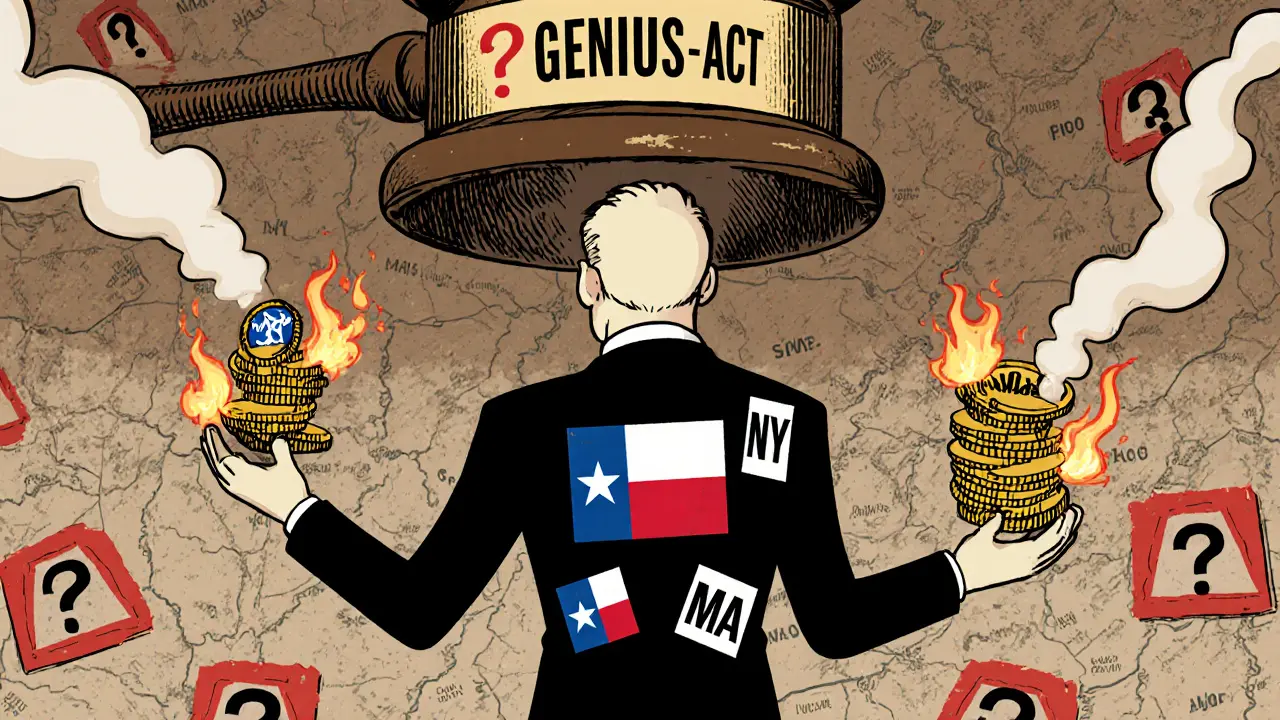

The Federal Crackdown Is Coming - But It’s Not Clear Yet

In September 2025, President Trump signed the GENIUS Act into law. It’s the first major federal crypto framework. It requires stablecoins to be backed 100% by liquid assets. It gives the CFTC authority over most crypto trading. It tells states they can keep their rules - as long as they don’t conflict with federal law.That’s a problem. Because what’s a conflict? New York’s BitLicense requires cold storage. The GENIUS Act doesn’t mention it. Is that a conflict? Wyoming’s SPDI banks are allowed to hold crypto as deposits. The federal law doesn’t say they can’t. Is that allowed?

Twenty-two states are already suing the federal government, claiming the GENIUS Act violates the 10th Amendment by overreaching. The courts will decide. But until then, businesses are stuck in limbo. They have to comply with 47 different sets of rules - and now, one federal one too.

What This Means for You

If you’re a crypto user: your access to exchanges, withdrawal speeds, and dispute resolution depend on your state. If you’re in New York, you’re likely dealing with slower service and higher fees. If you’re in Wyoming, you’re probably getting better service - but fewer consumer protections.If you’re a business: your choice of where to incorporate affects your costs, growth, and survival. New York? You’ll need $2 million and a team of lawyers. California? You’ll pay $1,000 and move fast. Wyoming? You can build a bank. Texas? You can fly under the radar - until you can’t.

Most crypto companies now operate from multiple states. That means paying $287,000 a year on average just to comply with state regulations - money that could go to security, product development, or customer support. A Blockchain Association survey found 68% of crypto firms say state regulation uncertainty is their top challenge. 41% avoid operating in certain states entirely.

What’s Next?

The Wharton Stevens Center predicts federal harmonization by 2028. But Massachusetts’ Galvin says the patchwork will become unworkable by 2026. The truth? Nobody knows. What we do know is this: the rules are changing fast. What’s legal today might be illegal tomorrow. What’s cheap today might cost ten times more next year.Right now, the safest move is to know your state’s rules - and know them well. Don’t assume your crypto exchange will protect you. Don’t assume your state has your back. The system isn’t designed for that. It’s designed for control. And the only way to survive it is to understand it.

Is crypto legal in all 50 states?

Yes, owning and trading cryptocurrency is legal in all 50 states. But how you can use it - whether you can run a business, exchange it for fiat, or custody it - depends on your state’s rules. Some states make it easy. Others make it nearly impossible.

Which state has the best crypto regulations?

Wyoming is widely considered the best for crypto businesses. It offers Special Purpose Depository Institutions (SPDIs), no state income tax on crypto, low barriers for small operators, and clear legal definitions. For users, California offers the best balance of access, speed, and consumer protection. New York has the most protection but the worst experience.

Do I need a license to buy Bitcoin in my state?

No. Buying Bitcoin for personal use doesn’t require a license in any state. Licenses and registrations apply only to businesses that transmit, store, exchange, or custody crypto for others. If you’re just buying and holding, you’re not regulated - unless you’re doing it at scale for others.

Why do crypto companies move from New York to Wyoming?

Because New York’s BitLicense is expensive, slow, and restrictive. The average compliance cost is $350,000 per year. The licensing process takes over a year. Wyoming offers a faster, cheaper, and more predictable environment. Companies can operate as state-chartered banks, avoid state income tax, and scale without bureaucratic delays. Over 100 crypto firms have relocated since 2020.

Is the federal government going to override state crypto laws?

The GENIUS Act of 2025 gives the federal government authority over stablecoins and trading, but it doesn’t eliminate state rules. States can still enforce their own regulations as long as they don’t directly conflict. That’s why 22 states are suing - they believe the federal law overreaches. The outcome will likely be decided in court, not Congress. For now, both sets of rules apply.

What should I do if I run a crypto business across multiple states?

Start by identifying which states you operate in. Then map each state’s requirements: licensing, registration, capital, reporting, and bonding. Use a compliance platform like Chainalysis or Coinfirm to automate tracking. Most multi-state operators spend $287,000 annually just on state compliance. Budget for it. Hire a regulatory lawyer familiar with state crypto laws. Don’t try to wing it - one violation can shut you down.

Are crypto taxes different by state?

Yes. Nine states have no state income tax, so crypto gains aren’t taxed at the state level: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming, and New Hampshire (though New Hampshire taxes interest and dividends). In states like California and New York, crypto gains are taxed as ordinary income - sometimes up to 13.3%. Always track your transactions and consult a tax professional familiar with your state’s rules.

Comments (18)

diljit singh

November 22, 2025 AT 04:50

Wyoming? More like Wyoming Inc. where the rich get tax breaks and everyone else gets scammed

Phil Taylor

November 23, 2025 AT 12:05

Of course the UK doesn't get this. You lot still think Bitcoin is a fad and New York's rules are 'sensible'. Pathetic. This isn't regulation, it's corporate protectionism disguised as consumer safety. The BitLicense is a monopoly tool. Stop pretending you care about users when your entire system is designed to kill innovation.

Lara Ross

November 25, 2025 AT 06:33

For anyone considering starting a crypto business, please don't underestimate the importance of legal counsel. State-by-state compliance is not optional-it's existential. I've seen too many brilliant teams collapse because they assumed 'everyone does it this way.' The truth? No one does it the same way. Document everything. Track every transaction. And never, ever assume a state's silence means permission. That's how you end up in federal court.

Abhishek Anand

November 25, 2025 AT 12:08

The real tragedy isn't the patchwork of laws-it's that we've allowed the state to become the arbiter of financial freedom. The Constitution didn't grant governments the right to decide who can hold digital money. It guaranteed the right to property. Yet here we are, with bureaucrats in Albany and Sacramento playing god with private wallets. Wyoming isn't the hero-it's the symptom. We're not building a free market, we're building a feudal system where only those with capital can buy access to liberty.

vinay kumar

November 26, 2025 AT 09:44

California's 1000 dollar fee is a joke. You think that's regulation? That's a parking ticket for billionaires. Meanwhile real people get locked out of exchanges because some NY bureaucrat decided cold storage is the only way to keep coins safe. Who decided that? Not me. Not you. Some guy with a title and a desk in a building that doesn't even understand what blockchain is

Leisa Mason

November 26, 2025 AT 17:44

Let me guess-Wyoming’s 'success' is just because they have 600k people and zero oversight. Of course they look good. It's not regulation, it's abandonment. You think a $25 million bank charter is for startups? That's a luxury for VCs. Meanwhile, the guy in Texas trying to run a small exchange gets audited because some state attorney decided Bitcoin = money transmission. This isn't freedom. It's regulatory roulette.

Rob Sutherland

November 27, 2025 AT 10:16

It's funny how we call this chaos when it's really just evolution. Every new technology faces this. The internet had the same fights. The telephone had zoning laws. The automobile had speed limits in every county. We're not broken-we're becoming. The question isn't which state is best. It's whether we're willing to let the system adapt-or if we'll keep screaming for someone to fix it for us.

Tim Lynch

November 28, 2025 AT 23:12

Think about it: the federal government just gave itself authority over stablecoins and trading… and now 22 states are suing because they think that's overreach. But when New York creates a $2 million barrier to entry, that’s 'consumer protection.' When Wyoming lets you build a crypto bank? That's 'regulatory arbitrage.' The hypocrisy is the only consistent thing here. We don’t hate regulation-we hate when it doesn’t serve us.

Lani Manalansan

November 30, 2025 AT 11:59

As someone who moved from New York to Texas, I can say this: the difference isn't just laws-it's culture. In NY, crypto is a threat to be contained. In Texas, it's just another business. No one cares if you hold Bitcoin. They care if you pay your bills on time. That’s it. You don’t need a license to be honest. You just need to show up. And that’s more than most states will give you.

Frank Verhelst

December 1, 2025 AT 04:53

Wyoming = 🚀

Texas = 🛠️

California = 📋

New York = 🚫💸

Massachusetts = 🕵️♂️📜

Just save this image and bookmark it. Your future self will thank you.

Roshan Varghese

December 1, 2025 AT 21:26

the geniuss act is a trap. theyre gonna use it to track every wallet. dont you see? they want to know who owns what. the '100% backing' is just to make it look legit. soon theyll say you cant hold btc unless you register with the fed. theyre setting up a digital serfdom. and wyoming? its a front. the feds control the banks anyway. they just let you think you have choice

Dexter Guarujá

December 2, 2025 AT 00:08

Let’s be clear: if you’re complaining about state-by-state regulation, you’re complaining about American federalism. That’s not a bug-it’s the whole point. The Founders didn’t want a monolith. They wanted competition. New York wants to control. Wyoming wants to attract. California wants to tax. That’s democracy. The problem isn’t the system-it’s people who think they deserve a single rulebook because they’re too lazy to read 47 different ones.

Jennifer Corley

December 2, 2025 AT 15:48

Did anyone else notice that the article mentions 47 states have rules… but then says 28 require bonding and 19 exempt small operators? That adds up to 47. So where are the other 3? And why does the article never say? This isn’t a guide-it’s a selective narrative. If you’re going to claim authority, at least be honest about the gaps.

Chris Popovec

December 3, 2025 AT 12:18

BitLicense isn’t about security-it’s about control. NYDFS doesn’t care if you’re safe. They care if you’re dependent. The $350k/year cost? That’s not compliance. That’s a tax on innovation. And the cold storage mandate? It’s not about theft-it’s about surveillance. If your keys are in cold storage, they’re in a vault they can audit. If you’re holding your own? That’s the real threat. The system isn’t broken. It’s designed to make you hand over control.

Charan Kumar

December 3, 2025 AT 16:28

India has no crypto laws but we still trade. People here just use p2p. No licenses. No forms. No waiting. You think the US needs all this paperwork? We’ve been doing it for years without any state telling us how to hold our money. Maybe the problem isn’t regulation-it’s the belief that you need permission to own something

Sunita Garasiya

December 4, 2025 AT 17:23

Wyoming’s 'success' is just because they have 580,000 people and zero lawyers. Meanwhile California has 40 million and 17 enforcement cases? That’s not balance-that’s a warning sign. You think 142 registered companies means 'open'? That’s less than 0.0003% of the population. This isn’t freedom. It’s a VIP club with a $1000 entry fee.

Mike Stadelmayer

December 4, 2025 AT 21:45

Just moved my LLC to Nevada last month. No state income tax, no crypto registration, and the DMV clerk didn’t even blink when I said I was in crypto. I didn’t need a lawyer. I didn’t need a compliance team. I just filed a form and paid $75. If you’re not doing this, you’re leaving money on the table. And honestly? You’re letting fear make your decisions.

Anthony Demarco

December 5, 2025 AT 13:11

They say federal law will override state rules but here’s the truth: the feds don’t have the manpower to enforce this. So they’ll pick the big fish-Coinbase, Kraken, Circle-and leave the rest to the states. That means Wyoming and Texas will keep thriving while New York and Massachusetts will keep suffocating small players. This isn’t harmonization. It’s a two-tier system where the rich get federal protection and the rest get state chaos.