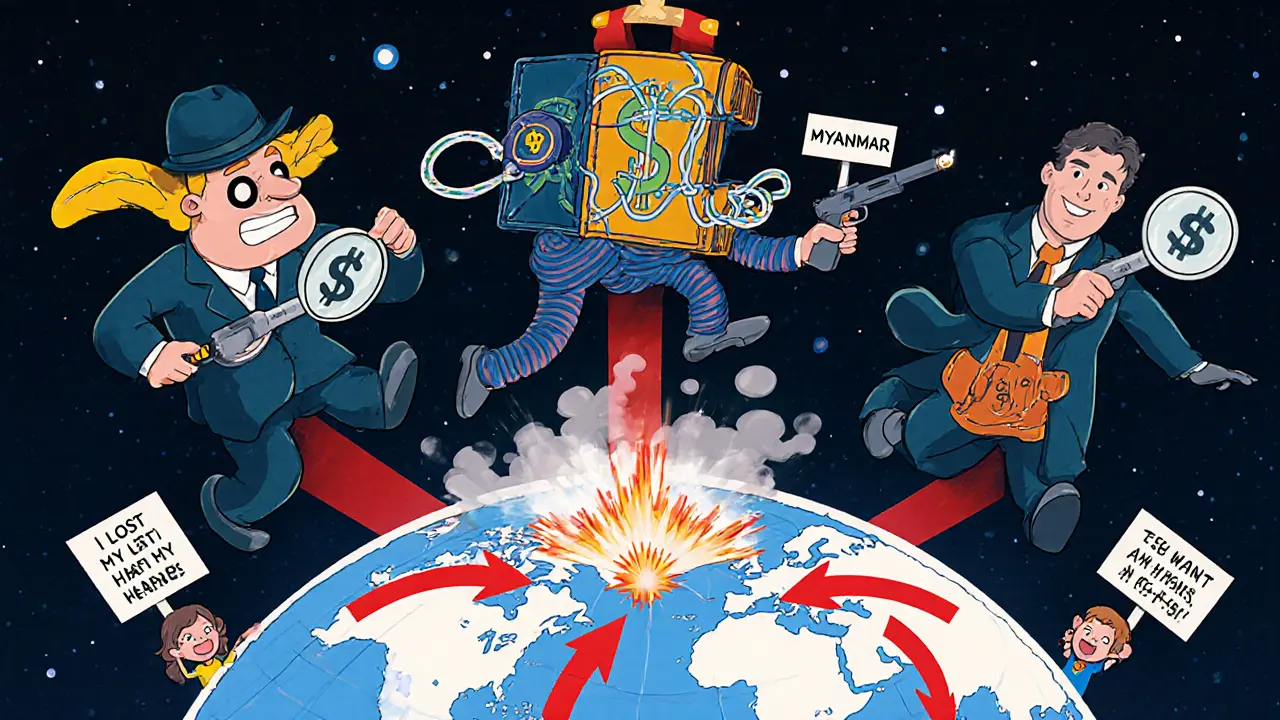

On September 8, 2025, the U.S. Treasury slapped sanctions on nine crypto-related entities operating out of Shwe Kokko, Myanmar-part of a sweeping crackdown on a network that stole over $10 billion from Americans in just one year. This wasn’t just another regulatory move. It was a direct strike against what the government called a modern slavery operation disguised as a cryptocurrency investment business.

How These Scams Work

These aren’t your typical phishing emails or fake ICOs. The scam centers in Shwe Kokko are large, walled compounds where people-often lured with fake job offers from Thailand or China-are trapped, forced to work 18-hour days, and beaten if they don’t meet daily targets. Their job? To scam Americans out of their money using crypto. Victims get contacted through dating apps, social media, or LinkedIn messages. The scammers build trust over weeks, sometimes months. They talk about crypto gains, show fake charts, and eventually convince people to send Bitcoin, Ethereum, or stablecoins to wallets controlled by these criminal networks. Once the money moves, it’s layered through mixers, swapped across chains, and funneled into offshore accounts. No one ever sees it again. The Treasury says these operations aren’t random. They’re organized, militarized, and protected by the Karen National Army (KNA), a rebel group that controls the Shwe Kokko region. In exchange for a cut of the profits, the KNA provides armed guards, immunity from local police, and even electricity and internet infrastructure. The U.S. government now officially calls the KNA a transnational criminal organization.Who Got Sanctioned

The sanctions targeted nine specific entities tied to scam compounds in Shwe Kokko and ten more based in Cambodia. But the real targets were the people behind them: Saw Chit Thu, the KNA leader, and his two sons, Saw Htoo Eh Moo and Saw Chit Chit. All three were named as key operators of the scam network. OFAC froze any U.S. assets these individuals or their companies might have held-even bank accounts under shell names. U.S. citizens and businesses are now legally banned from any transaction with them, directly or indirectly. That includes sending crypto to a wallet linked to one of these entities, even if you didn’t know it was connected. The sanctions also hit the digital infrastructure: websites, domain names, and crypto wallet addresses tied to the scam operations. Some of these wallets had held over $200 million in Bitcoin alone, according to blockchain analysis firms working with the Treasury.Why Crypto? Why Myanmar?

Crypto is perfect for this kind of crime. Transactions are fast, irreversible, and hard to trace once they leave the initial exchange. Unlike traditional banking, there’s no central authority to freeze funds or reverse transfers. Scammers exploit that. Myanmar, especially the border areas like Shwe Kokko, is ideal because it’s lawless. The military junta has lost control of large parts of the country. The KNA runs the area like a private fiefdom. Local authorities don’t investigate. International police can’t enter without permission. And since the region isn’t recognized as a sovereign state, there’s no clear jurisdiction for global law enforcement. The result? A perfect storm. Criminals get protection. Victims get nothing. And the money flows out through crypto, often ending up in exchanges in Southeast Asia or Europe that don’t ask too many questions.

The Human Cost

Behind every $10 billion loss is a human story. The Treasury doesn’t just call these scams financial fraud-they call them human rights abuses. The people running the scams? Many are victims themselves. They were trafficked, sold into debt bondage, or kidnapped. They’re forced to scam strangers while living in cages, under constant surveillance. One former employee, who escaped in early 2025 and spoke to the FBI under witness protection, described being locked in a room with 15 others, given a phone and a script, and told to make 20 successful scams a day-or face punishment. He said he saw people beaten with metal rods for failing to convince victims to send more money. And the American victims? They’re not just out money. Many lost life savings, retirement funds, or money meant for medical bills. Some took out loans to invest. Others were emotionally manipulated into believing they were helping a partner they met online. The psychological damage runs deep.How the U.S. Is Fighting Back

This isn’t the first time the U.S. has acted. But it’s the most comprehensive. The Treasury used four different executive orders at once:- E.O. 13851-targets transnational criminal organizations

- E.O. 13694-hits cyber-enabled financial fraud

- E.O. 13818-addresses serious human rights violations

- E.O. 14014-targets threats to Myanmar’s stability

What This Means for Crypto Users

If you’re a regular crypto user, you’re not at risk just for holding Bitcoin or Ethereum. But you need to be careful about where you send your funds. OFAC has published a list of all sanctioned wallet addresses. If you accidentally send crypto to one of them-even if you thought it was a legitimate exchange-you could be violating U.S. law. The Treasury says ignorance isn’t a defense. That’s why major exchanges like Coinbase and Kraken have started blocking transfers to these addresses automatically. If you’ve ever received crypto from an unknown source-especially from a wallet linked to Southeast Asia-check it against OFAC’s sanctions list. It’s free. It’s public. And it could save you from legal trouble.What’s Next?

The U.S. says this is just the beginning. Treasury officials have hinted that more sanctions are coming-possibly targeting banks in Thailand and Cambodia that processed these funds, or even officials in Myanmar’s military who benefit from the scam profits. There’s also growing pressure to force crypto exchanges outside the U.S. to comply with OFAC rules. If an exchange serves U.S. customers-even indirectly-it could be cut off from the global financial system. Meanwhile, the KNA is reportedly shifting operations to other border towns. But with U.S. intelligence now focused on the patterns-how money moves, who protects whom, where the scams are clustered-it’s harder to hide. The message is clear: crypto isn’t a free-for-all. If you use it to enable slavery and theft, the U.S. will find you.How to Protect Yourself

- Never send crypto to someone you met online, no matter how real they seem.

- Use only regulated exchanges that screen for sanctioned addresses.

- Check wallet addresses on OFAC’s SDN list before sending large amounts.

- If you suspect you’ve been scammed, report it to the FBI’s IC3 immediately-even if you think it’s too late.

- Be wary of "guaranteed returns" on crypto investments. If it sounds too good to be true, it is.

Comments (19)

Savan Prajapati

November 29, 2025 AT 01:48

This is insane, people are being beaten to scam others.

Mark Adelmann

November 30, 2025 AT 04:59

I’ve been in crypto since 2017 and this is the first time I’ve seen the government go this hard. It’s not just about money-it’s about human lives. Kudos to the Treasury for treating it like the atrocity it is.

Michael Labelle

December 1, 2025 AT 20:12

It’s wild how the same tech that’s supposed to empower people is being used to enslave them. Feels like we’re living in a dystopian thriller.

Eddy Lust

December 2, 2025 AT 14:01

My buddy got scammed last year through a Tinder date who "taught him DeFi." He lost his dad’s funeral money. I still get mad thinking about it. This isn’t just fraud-it’s soul-crushing.

Evelyn Gu

December 4, 2025 AT 06:35

Let me just say-this whole situation is beyond messed up. I mean, think about it: people are literally chained to desks in Myanmar, forced to lie to strangers on dating apps, just to survive. And the worst part? The scammers themselves are victims too. It’s a cycle of exploitation that’s been engineered by warlords and enabled by decentralized tech that no one can regulate. The U.S. is finally hitting the right targets, but what about the people still trapped in those compounds? Who’s going to rescue them? And what happens when the KNA just moves the whole operation to Laos or Cambodia? The infrastructure is already there-internet, power, armed guards. It’s not like they’re starting from scratch. This feels like a game of whack-a-mole, and the mole keeps growing legs.

ola frank

December 4, 2025 AT 16:23

The application of E.O. 13851, 13694, 13818, and 14014 in tandem represents a novel convergence of transnational criminal, cyber-financial, human rights, and geopolitical sanctioning frameworks. This is not merely regulatory enforcement-it is the institutionalization of asymmetric counter-narcotics doctrine applied to crypto-enabled human trafficking. The systemic interlock between non-state armed actors and decentralized financial infrastructure necessitates a redefinition of jurisdictional sovereignty in the digital age.

imoleayo adebiyi

December 5, 2025 AT 04:42

It breaks my heart to think that someone could be forced to hurt others just to stay alive. I hope more people hear this story-not just as a crypto issue, but as a human one. We need to remember the faces behind the wallets.

jeff aza

December 6, 2025 AT 22:47

OFAC’s list is a mess-over 400 wallet addresses, half of them false positives from legit exchanges… and now Coinbase is blocking transfers to ANY wallet that even looks like it’s from Southeast Asia? That’s not security-that’s overreach. And don’t even get me started on the "ignorance isn’t a defense" line. So now I’m legally liable if I send ETH to a wallet that’s 0.0001% similar to a sanctioned one? This is dystopian.

Vijay Kumar

December 7, 2025 AT 05:09

Why are Americans so naive? You think someone on Instagram is your soulmate and you send them your life savings? That’s not crypto’s fault-that’s yours.

Vance Ashby

December 7, 2025 AT 18:34

so like… if i send btc to a wallet and later find out it’s on the list… am i a criminal?? 😳

Brian Bernfeld

December 9, 2025 AT 09:07

Let me tell you something-this is the most important thing the U.S. has done for global justice in years. These aren’t just scammers. They’re traffickers. And the fact that the Treasury tied the KNA to this as a transnational criminal org? That’s huge. It means we’re finally treating this like the war crime it is. I’ve talked to survivors in Thailand. They’re terrified to speak up. If this helps even one person get freed? Worth every byte of blockchain analysis.

Grace Zelda

December 9, 2025 AT 20:46

They’re forcing people to scam their own kind. That’s the real horror. Not the money-what they had to become to survive.

Sam Daily

December 10, 2025 AT 05:59

Y’all need to check your wallet addresses before sending anything! 🚨 I’ve got a free tool on my site that checks OFAC lists in real-time-link in bio! Stay safe out there 💪

Kristi Malicsi

December 11, 2025 AT 01:42

So crypto is evil now? Or are people just dumb? The tech didn’t make them do it

Michael Fitzgibbon

December 11, 2025 AT 11:35

It’s chilling how the same anonymity that protects whistleblowers and dissidents also shields slavers. We need better tools-not just sanctions. Think blockchain forensics trained on behavioral patterns, not just wallet addresses. Maybe AI that flags psychological manipulation tactics in messages. Tech can be the problem… and the solution.

priyanka subbaraj

December 11, 2025 AT 16:33

Imagine being the one who has to lie to a widow and say her husband’s crypto fund is "growing"-while you’re locked in a room with bruises from last night’s beatings. That’s not a scam. That’s hell.

George Kakosouris

December 13, 2025 AT 10:15

OFAC’s move is performative. They’re not going to stop this-they’re just making it harder for U.S. citizens to get scammed so they can say they "did something." Meanwhile, the money flows through Thai banks, Cambodian exchanges, and Chinese P2P networks. This is theater with a blockchain backdrop.

Tony spart

December 14, 2025 AT 19:52

Why are we spending billions to stop this when we got criminals on our own border? This is weak. America’s got bigger problems than some Myanmar scammers.

Joel Christian

December 16, 2025 AT 16:51

i just sent 5k to a guy on twitter last week… oh god oh god oh god… is it on the list?? i cant remember the wallet… plz help someone