Crypto Exchange Risk Checker

This tool helps you identify potential red flags of crypto exchange scams by checking against key indicators of legitimacy. The following criteria are based on verified scam patterns and the VyFinance case study.

Risk Assessment

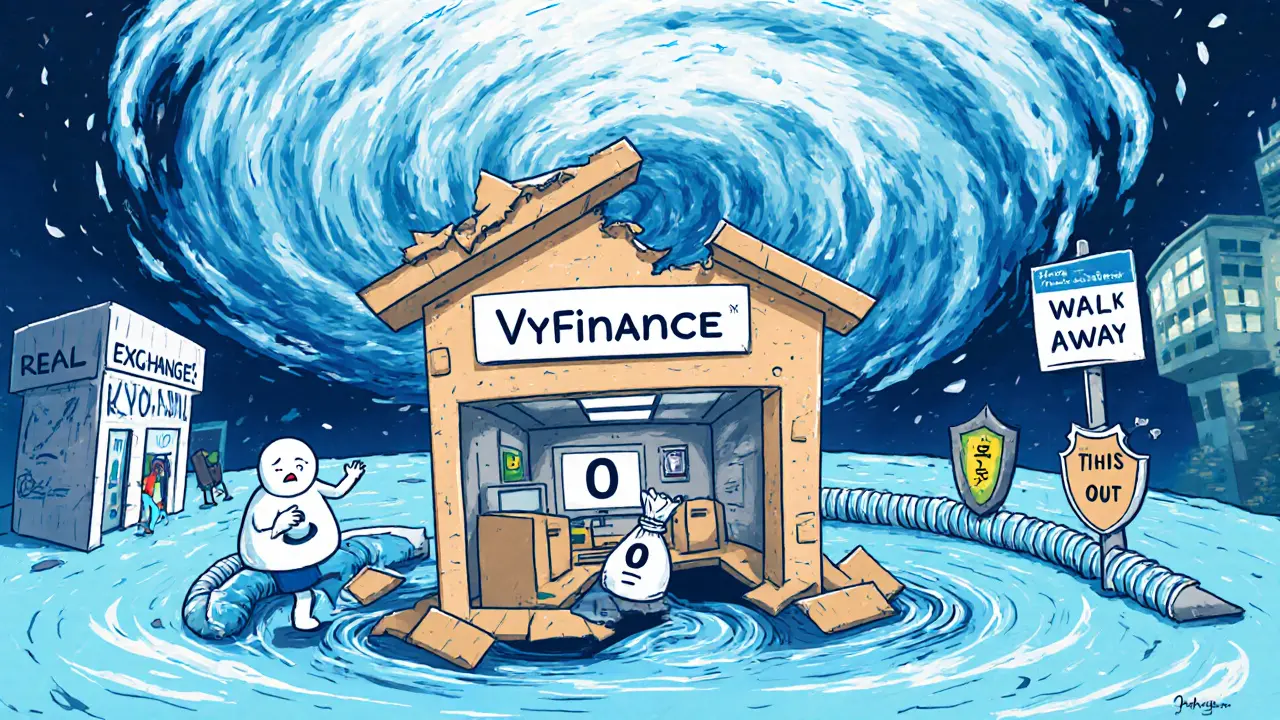

When you're looking for a new crypto exchange, you want one that’s active, trustworthy, and backed by real users. VyFinance doesn’t meet any of those standards. In fact, the platform shows almost no signs of being a legitimate, functioning exchange - and plenty of signs it might be dangerous.

Zero Reviews, Zero Trust

On FxVerify, a platform that collects and verifies user reviews for financial services, VyFinance has a 0 out of 5 star rating. And not just one or two bad reviews - zero reviews. That’s not normal. Even brand-new exchanges get feedback within weeks. People talk about their experiences, good or bad. They complain about slow withdrawals. They praise low fees. They warn others about scams. VyFinance has none of that. Not a single verified user has left a comment. That’s not silence - it’s absence.

The VYFI Token Isn’t Proof of Legitimacy

VyFinance is tied to a token called VYFI, which you can find on CoinGecko. But here’s the catch: CoinGecko doesn’t verify exchanges. It just tracks prices. Just because VYFI has a price chart doesn’t mean VyFinance is real. It could be a pump-and-dump scheme with a token attached to nothing. Many fake exchanges create tokens to look legit, then vanish after collecting deposits. CoinGecko listings don’t equal safety. They equal visibility - and visibility is the only thing VyFinance has.

No Team, No History, No Transparency

Every reputable exchange tells you who runs it. Binance has a public leadership team. Coinbase lists its regulatory licenses. Kraken publishes security audits every year. VyFinance? Nothing. No about page. No founder names. No office address. No regulatory status. No press releases. No social media activity worth mentioning. If you can’t find out who’s behind a platform that handles your money, you shouldn’t trust it. Period.

How Real Exchanges Compare

Compare VyFinance to exchanges like Binance, Kraken, or Coinbase. They have:

- Thousands of verified user reviews

- Publicly listed compliance licenses (FinCEN, FCA, etc.)

- Regular third-party security audits

- 24/7 customer support with real response times

- Active communities on Reddit, Twitter, and Discord

VyFinance has none of these. Instead, it has a website that looks like a template bought off the shelf - generic design, broken links, no blog, no educational content, no help center. Real exchanges invest in user education. Fake ones just want your crypto.

Why This Matters in 2025

Crypto regulation is tighter than ever. In 2025, the U.S., EU, and UK are cracking down on unlicensed platforms. Exchanges that don’t follow rules get shut down fast - and users lose everything. VyFinance shows no signs of being licensed anywhere. No mention of KYC, no AML policies, no legal disclaimers. That’s not negligence. It’s a red flag waving in a hurricane.

Exit Scams Are Common - And VyFinance Fits the Pattern

Every year, dozens of crypto exchanges disappear overnight. They call themselves “next-gen,” promise high yields, and vanish after collecting deposits. Their websites go dark. Their social accounts vanish. Their tokens crash to zero. That’s an exit scam. And VyFinance matches every early warning sign:

- No user reviews

- No team info

- No regulatory presence

- Only a token with no real utility

- No community engagement

These aren’t coincidences. They’re patterns. And if you deposit money into VyFinance, you’re not investing - you’re gambling with your crypto.

What to Do Instead

If you want to trade crypto safely, stick with exchanges that have proven track records:

- Coinbase - Best for beginners, fully regulated in the U.S.

- Kraken - Strong security, low fees, good for active traders

- Binance - Largest volume, wide coin selection (check availability in your country)

- Bybit - Popular for derivatives and futures trading

All of these have hundreds of thousands of users, public audits, and customer support you can actually reach. VyFinance has none of that.

Final Warning

There’s no such thing as a “hidden gem” exchange with zero reviews. If it were good, people would be talking about it. If it were safe, it would have licenses. If it were real, you’d find at least one honest review. VyFinance has none of that. The complete lack of information isn’t mysterious - it’s intentional. Don’t be the first person to lose money on this platform. Walk away. Save your crypto for places that actually care about their users.