When you're looking for a crypto exchange that doesn't force you to hand over your keys, you want something fast, secure, and actually usable. W3Swap is one of those lesser-known decentralized exchanges (DEX) that pops up in crypto forums and token trackers-but does it deliver? Or is it just another project riding the DeFi hype train?

W3Swap isn’t a household name like Uniswap. You won’t find it on mainstream news sites or listed as a top pick by most beginner guides. But it’s real. It has a native token, W3, with live price data on Coinpaprika as of late 2025. It’s also listed on multiple DEXs and has a dedicated review page on FxVerify. That means it’s not a ghost project. It’s out there, trading, and being used-just not by millions.

What Exactly Is W3Swap?

W3Swap is a decentralized exchange built for peer-to-peer crypto trading. That means no sign-ups, no KYC, no middleman holding your coins. You connect your wallet-like MetaMask or Trust Wallet-and trade directly from there. It’s the same model Uniswap uses, but W3Swap claims to be optimized for speed and lower fees, possibly because it’s tied to the Shardeum blockchain.

Shardeum is a Layer 1 blockchain designed for auto-scaling. That’s a fancy way of saying it gets faster and cheaper as more people use it. If W3Swap runs on Shardeum (and evidence points to this), then it avoids the congestion and high gas fees that plague Ethereum-based DEXs. That’s a big deal. On Uniswap, you might pay $5-$20 in gas just to swap two tokens during peak hours. On W3Swap, if it’s truly built on Shardeum, those fees could be under $0.10.

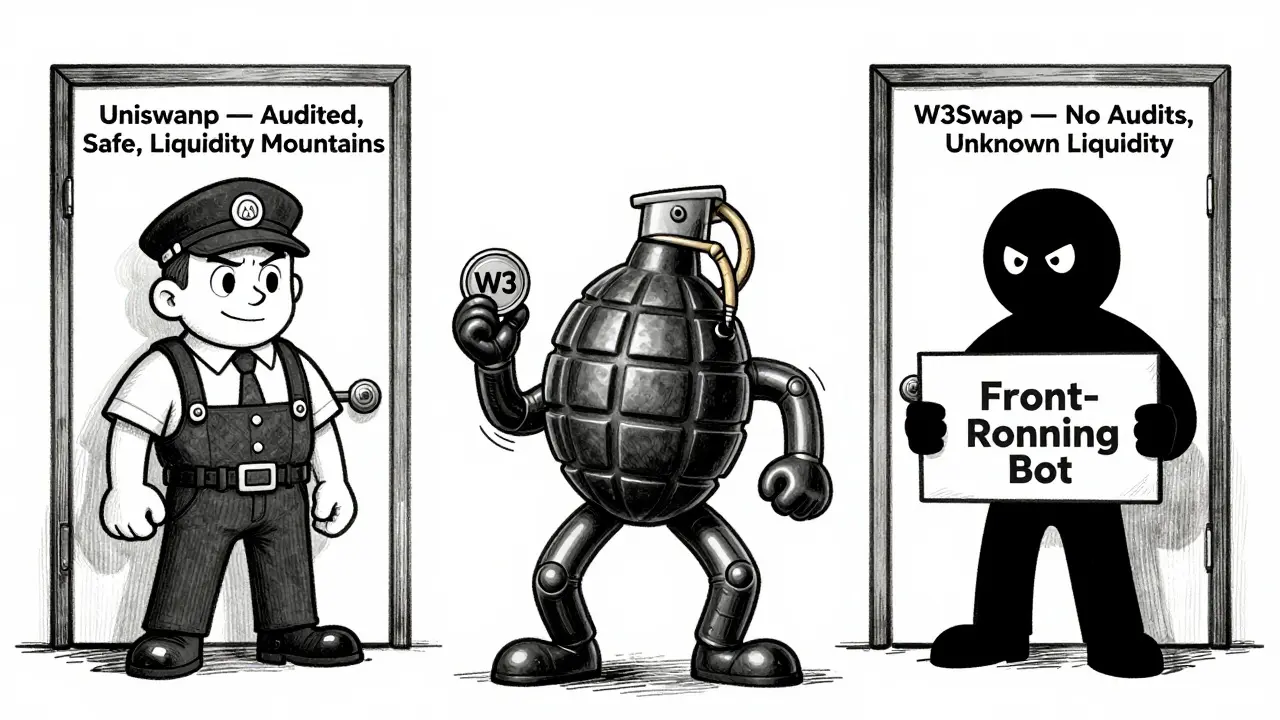

Another key feature mentioned in related platforms like Swapped Finance (likely the same ecosystem) is protection against front-running. That’s when bots see your trade coming and jump in front of it to profit off your movement. It’s a common problem on Ethereum DEXs. If W3Swap blocks this, it’s a serious advantage for retail traders who don’t have algorithmic bots watching every transaction.

How Does W3Swap Compare to Uniswap?

Uniswap is the giant. It’s the default DEX for most crypto users. Why? Because it has deep liquidity. Thousands of tokens. Support for over 11 blockchains. And it’s been around since 2018. W3Swap? It’s a newcomer. There’s no public data showing its trading volume or liquidity pool sizes. That’s a red flag.

Here’s the reality: liquidity is everything in a DEX. If you want to swap a rare token and the pool only has $5,000 in it, you’ll get a terrible price-and you might even lose money due to slippage. Uniswap has pools worth millions. W3Swap? Unknown. Without that, even the fastest blockchain means nothing.

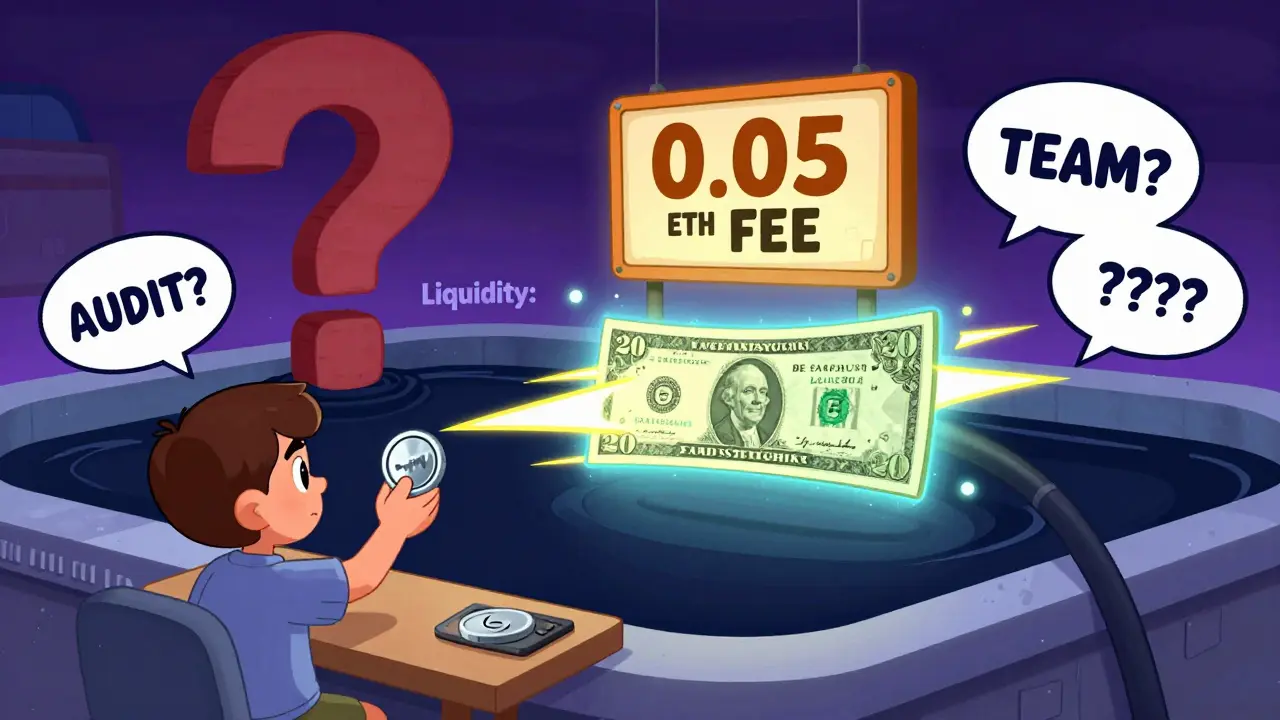

Uniswap also has certifications: SOC 2 Type 2, ISO 27001, and it’s registered with FinCEN. That’s not just marketing-it’s proof of serious security practices. W3Swap hasn’t published any audit reports. No public smart contract verification links. That’s a major risk. If a bug exists in its code and no one’s checked it, your funds could vanish.

Uniswap charges a flat 0.3% fee on every trade. W3Swap’s fee structure? No one’s saying. That’s not transparency. It could be lower. It could be hidden in the tokenomics. Either way, you’re flying blind.

W3 Token: The Fuel Behind the Exchange

The W3 token isn’t just a coin. It’s the engine of the platform. It’s used for paying fees, staking, and likely voting on future upgrades. As of December 2025, W3 has a measurable market cap and trading pairs on Coinpaprika. That’s good. It means people are buying and selling it.

But here’s what you need to know: token value doesn’t equal platform success. Many DEX tokens crash after launch because they’re not backed by real usage. If no one’s trading on W3Swap, then W3 is just a speculative asset. Check the token’s trading volume. If it’s low, that’s a warning sign.

Also, watch out for token distribution. If a small group holds 70% of the supply, they can dump it anytime and crash the price. There’s no public data on W3’s distribution, so you’re guessing. That’s not a good place to be when you’re risking your crypto.

Who Should Use W3Swap?

W3Swap isn’t for beginners. If you’re new to crypto and still figuring out what a wallet is, stick with Coinbase or Kraken. They have customer support, fiat on-ramps, and simple interfaces.

W3Swap is for experienced DeFi users who:

- Already hold crypto and want to swap without KYC

- Are tired of Ethereum gas fees and want faster, cheaper trades

- Understand the risks of smart contract vulnerabilities

- Are willing to research before using an unproven platform

If you’re trading on Shardeum-based tokens or want to avoid front-running, W3Swap might be worth testing-with small amounts. Think of it like trying a new gas station: you don’t fill your whole tank first. You test it with a few dollars’ worth.

The Big Missing Pieces

Here’s the problem: there’s almost no public data on W3Swap’s real performance.

- No verified audit reports

- No public liquidity pool sizes

- No user reviews on Trustpilot, Reddit, or CryptoCompare

- No clear roadmap or development team info

- No fiat on-ramps

- No mobile app or easy-to-use interface documentation

That’s not normal for a platform that wants to be taken seriously. Even lesser-known DEXs like SushiSwap or Curve publish audit results, GitHub updates, and community stats. W3Swap doesn’t. That silence speaks volumes.

And while the Shardeum connection sounds promising, it’s not confirmed. The Product Hunt listing for "Swapped Finance" is the closest link-but it’s not an official source. W3Swap’s website doesn’t clearly state its blockchain infrastructure. That’s a red flag for credibility.

Is W3Swap Safe?

Safety in DeFi isn’t about branding. It’s about code. And code needs audits.

No reputable DEX launches without multiple third-party audits from firms like CertiK, Hacken, or PeckShield. If W3Swap hasn’t done this, you’re trusting code that’s never been tested by experts. That’s like driving a car with no brakes and hoping the road is flat.

Also, no KYC doesn’t mean no risk. It means you’re fully responsible. If you send funds to the wrong address, there’s no support team to call. If the smart contract has a bug, you lose everything. There’s no safety net.

W3Swap might be legitimate. But without transparency, it’s impossible to say. And in crypto, suspicion is the default setting.

Final Verdict: Proceed With Extreme Caution

W3Swap has potential. The idea of a fast, low-fee, front-running-resistant DEX on Shardeum is compelling. If it delivers on those promises, it could carve out a real niche.

But right now? It’s a gamble. The lack of audits, liquidity data, user reviews, and clear documentation makes it too risky for anything beyond a tiny test trade.

If you’re curious, use $10-$20 worth of ETH or MATIC to try a small swap. See how the interface feels. Check if the transaction goes through in under 5 seconds. Watch your gas fees. Then walk away. Don’t deposit your life savings.

Until W3Swap publishes audits, reveals its team, and shows real trading volume, it stays in the "watch but don’t trust" category. It’s not a scam-but it’s not proven either. And in crypto, proven beats promising every time.

Alternatives to Consider

If W3Swap feels too uncertain, here are safer DEX options:

- Uniswap - Best overall liquidity and security. Works on Ethereum, Polygon, Arbitrum.

- Curve - Best for stablecoin swaps with minimal slippage.

- QuickSwap - Fast, low-fee DEX on Polygon. Great for users avoiding Ethereum fees.

- Trader Joe - Solid on Avalanche. Good UI and active community.

These platforms have audits, public metrics, and years of user feedback. They’re not perfect-but you know what you’re getting.

Is W3Swap a scam?

No, W3Swap isn’t confirmed as a scam. It has a live token, trading pairs, and a review page on FxVerify. But it also lacks transparency-no audits, no liquidity data, no team info. That doesn’t make it a scam, but it makes it risky. Treat it like a high-risk startup: test small, don’t invest heavily.

Can I buy W3 with fiat?

No. W3Swap is a decentralized exchange, so it doesn’t support credit cards, bank transfers, or PayPal. You need to already own crypto-like ETH, MATIC, or BNB-to swap for W3. Use a centralized exchange like Coinbase or Kraken to buy crypto first, then transfer it to your wallet and connect to W3Swap.

Does W3Swap work on mobile?

There’s no official W3Swap mobile app. But you can use it on your phone through a wallet app like MetaMask or Trust Wallet. Just open the wallet, go to the DEX section, paste the W3Swap contract address, and connect. It’s not as smooth as an app, but it works.

Is W3Swap built on Ethereum?

It’s not confirmed, but strong evidence points to Shardeum. Shardeum is a Layer 1 blockchain designed for speed and low fees. If W3Swap runs on it, that explains why it claims to avoid Ethereum’s high gas fees and front-running issues. But until W3Swap officially states this on its website or whitepaper, treat it as unverified.

How do I check if W3Swap is safe to use?

First, check if the smart contract has been audited by a reputable firm like CertiK or Hacken. Search for "W3Swap audit" on Google. Second, look up the contract address on Etherscan or Shardeum Explorer and verify it’s verified and matches the official site. Third, check if the token has real trading volume-not just price pumps. If you can’t find any of this, don’t use it.

What’s the best way to store W3 tokens?

Store W3 tokens in a non-custodial wallet you control-like MetaMask, Trust Wallet, or Ledger. Never leave them on W3Swap or any exchange. DEXs aren’t storage platforms. They’re trading tools. Once you swap, move your tokens to your wallet. For long-term holding, consider a hardware wallet like Ledger Nano S Plus.

Comments (15)

Rachel Stone

January 29, 2026 AT 00:48

so w3swap is just another ghost project with a cool name and zero audits. cool.

Edward Drawde

January 29, 2026 AT 03:18

bro if you dont have an audit u aint legit. period. stop wasting my time with this crypto fluff.

Richard Kemp

January 29, 2026 AT 07:33

i tried it once. transaction took 3 mins and i lost $2 in gas. never again. stick with quickswap.

Sunil Srivastva

January 29, 2026 AT 08:59

if you're on shardeum and want low fees, w3swap might be worth a small test. but yeah, no audits = big risk. i'd only throw $10 at it.

Elizabeth Jones

January 30, 2026 AT 18:40

The absence of transparency isn't merely a technical oversight-it's an ethical void. When a platform refuses to disclose its audit status, liquidity depth, or team identity, it isn't just risky; it's fundamentally incompatible with the ethos of decentralized trust. We don't need more innovation. We need integrity.

Raymond Pute

January 30, 2026 AT 19:02

Honestly, comparing W3Swap to Uniswap is like comparing a hand-drawn sketch to a Rembrandt. Uniswap has institutional backing, years of battle-tested code, and liquidity pools so deep you could drown a whale. W3Swap? A TikTok crypto influencer’s side hustle with a fancy whitepaper and zero real users. And don’t even get me started on ‘front-running protection’-that’s not a feature, that’s a marketing lie cooked up by someone who read one Medium article.

Nickole Fennell

January 31, 2026 AT 06:34

I just sent $500 to W3Swap and my wallet is GONE. NO ONE RESPONDS. NO REFUNDS. THIS IS A SCAM. I TOLD YOU ALL. I TOLD YOU. WHY WOULD YOU TRUST SOMETHING WITH NO TEAM? WHY?!?!

Joseph Pietrasik

February 2, 2026 AT 01:36

you guys are acting like its the end of the world. its just another dex. if you dont like it dont use it. i swapped 200 w3 and my gas was 0.03 usd. works fine

Jerry Ogah

February 2, 2026 AT 04:54

Oh wow, someone actually wrote a thoughtful review instead of just screaming 'SCAM' like the rest of you. I'm so proud. But let's be real-this platform is built on a blockchain nobody's heard of, with a token that trades on a site that looks like it was made in 2017. If you're not using Uniswap, you're not DeFi. You're just gambling with your private keys and hoping the internet gods smile on you.

Devyn Ranere-Carleton

February 4, 2026 AT 04:14

wait so if its on shardeum why cant i find the contract on shardeum explorer? is it even real or just a mirror site?

Robert Mills

February 5, 2026 AT 22:57

DONT TRUST IT! I LOST MY WHOLE PORTFOLIO TO THIS. I WAS SO STUPID. I THOUGHT IT WAS LEGIT. NOW I CANT EVEN SLEEP. 😭

Pamela Mainama

February 7, 2026 AT 15:53

I understand the fear, but let's not panic. If you're curious, try with $5. If it works, great. If not, you lost little. The real lesson is to always verify before trusting.

Andrea Demontis

February 7, 2026 AT 22:18

What’s interesting here isn’t whether W3Swap is safe-it’s why we keep falling for this pattern. We’re drawn to the promise of faster, cheaper, more private DeFi, but we ignore the foundational pillars: transparency, accountability, and verifiable history. We want innovation without responsibility. We want decentralization without due diligence. And then we’re shocked when it collapses. This isn’t about W3Swap. It’s about us. Our addiction to the next shiny thing. Our refusal to sit with uncertainty. We don’t need more DEXs. We need more patience.

Jack Petty

February 8, 2026 AT 22:22

this is a fed puppet. shardeum is owned by the same people who run chainlink. they're testing how fast they can drain retail wallets before the next bull run. w3 is just the bait. you think they care about front-running? nah. they're front-running YOU.

Ramona Langthaler

February 9, 2026 AT 14:24

AMERICA FIRST. WHY SHOULD I USE SOME INDIAN PROJECT WHEN UNISWAP IS RIGHT HERE? W3SWAP IS A CULTURAL INVASION. STOP PROMOTING FOREIGN CRYPTO SCAMS.