Chainge (XCHNG) is not a coin you buy to get rich. It’s not even a coin most people have heard of. But if you’re trying to swap tokens between blockchains like Solana, Polygon, and Avalanche without trusting a centralized exchange, then Chainge might be one of the few tools that can help - if you know what you’re doing.

What Chainge Actually Does

Chainge Finance is a cross-chain decentralized exchange and bridge. That means it lets you trade crypto directly between different blockchains - say, swapping SOL for MATIC - without needing to go through Bitcoin or Ethereum as an intermediary. It’s built for users who own assets on obscure or non-EVM chains and want to move them around without locking them up on centralized platforms like Binance or Coinbase.

The platform runs on a custom bridge called Fusion DCRM (Distributed Control Rights Management). Unlike most bridges that rely on liquidity pools or custodians, DCRM uses a decentralized signing mechanism where no single party holds your funds. That’s a big deal for security. If a bridge gets hacked, you lose everything. Chainge’s approach reduces that risk - at least in theory.

It supports 55+ blockchains, including ones most other DEXs ignore. You can swap tokens on networks like Kava, Celo, and Secret Network. That’s useful if you’re holding niche assets and need to move them fast. But here’s the catch: you need to use Chainge’s own mobile wallet or web interface. You can’t just connect MetaMask and swap. You have to download their app, set up a self-custodial wallet, and manage your keys yourself.

The XCHNG Token: What It’s For

The XCHNG token is the native utility token of the Chainge platform. It’s not a store of value. It doesn’t pay staking rewards. It doesn’t give you governance rights. Its only job is to pay for transaction fees on the platform - like gas on Ethereum, but specific to Chainge’s cross-chain swaps.

There are 1.2 billion XCHNG tokens total. As of early 2026, about 474 million are in circulation. That’s a fixed supply - no inflation, no burning. The token was originally called CHNG but switched to XCHNG in late 2024 after a smart contract upgrade. The rebrand was meant to signal a fresh start, but it didn’t fix the underlying problems.

Price and Market Reality

Don’t look at the price and think you’ve found a hidden gem. XCHNG hit an all-time high of $0.2747 in March 2024. As of February 2026, it’s trading between $0.0005 and $0.0014 - a drop of nearly 99.8%. That’s not volatility. That’s collapse.

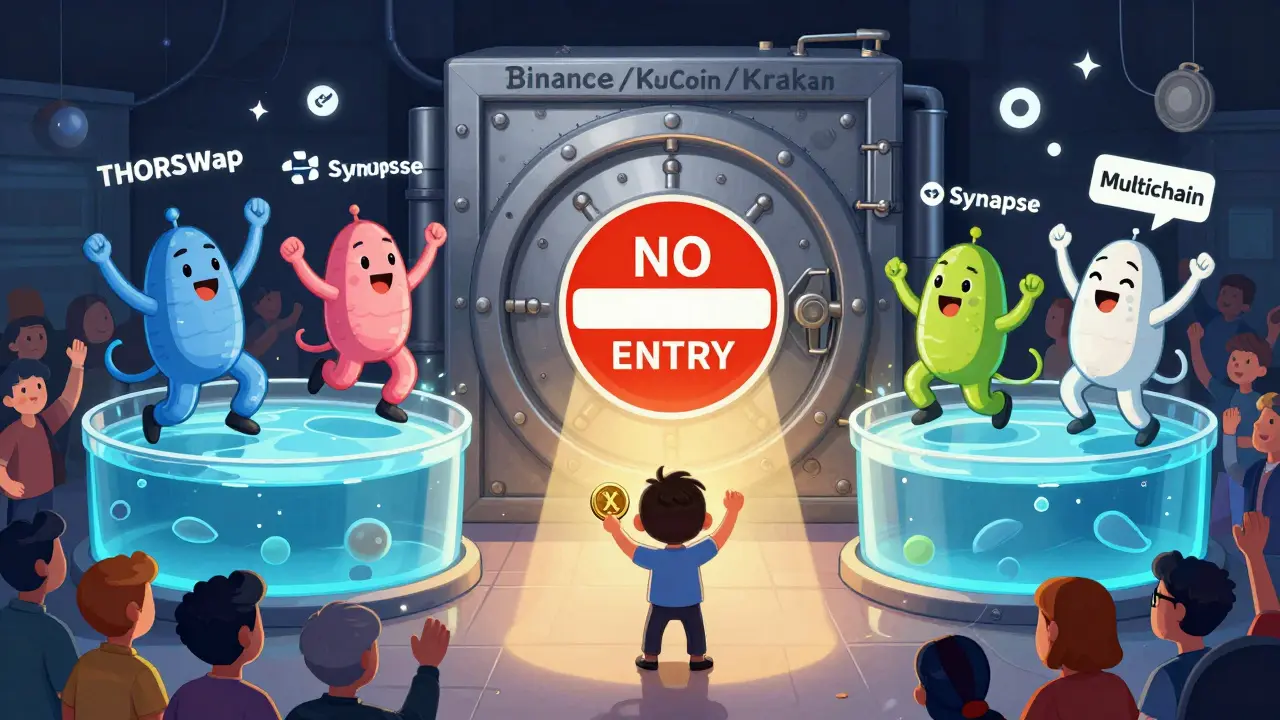

Market cap numbers vary wildly across platforms. CoinMarketCap lists it at $287,370. CryptoRank says $13 million. Why the gap? Because liquidity is thin. There are only 19 active trading pairs. Most volume comes from small exchanges like LBank and MEXC. Binance doesn’t list it. KuCoin doesn’t list it. Kraken? No. That’s not a coincidence. Major exchanges won’t list a token with under $1,000 in daily volume and only 2,400 holders.

On February 1, 2026, Uniswap traded $1.8 billion in 24 hours. Chainge’s entire platform? Around $500-$700. That’s not a startup. That’s a ghost town.

Who Uses Chainge?

No one, really. At least, not in any meaningful way.

The only people using Chainge are a handful of crypto-savvy traders who hold tokens on obscure chains and need to move them. Maybe they’re into DeFi arbitrage across low-liquidity networks. Maybe they’re trying to exit a dead project and have no other option. But they’re not buying XCHNG because they believe in the future of the platform. They’re buying it because they need to pay a fee to execute a swap - and it’s the only way.

There are no Reddit threads. No Twitter buzz. No YouTube tutorials. Only 12 mentions on Reddit in the last six months. No reviews on Trustpilot. No press releases. No roadmap updates since 2024. The team hasn’t posted anything significant in over a year. That’s not a project in development. That’s a project on life support.

How Chainge Compares to the Competition

Chainge isn’t alone in cross-chain bridging. THORSwap, Synapse Protocol, and Multichain all do similar things - but they do it better.

- THORSwap has a $42 million market cap and supports over 30 chains with deep liquidity pools.

- Synapse Protocol handles $200 million+ in daily volume and is listed on Binance, OKX, and Bybit.

- Multichain (formerly Anyswap) has been around since 2020 and is trusted by institutional users.

Chainge’s only edge? Its mobile app. If you’re on the go and need to swap between two obscure chains, Chainge’s interface is cleaner than most. But that’s not enough. No one builds a business on convenience alone when the underlying liquidity is nonexistent.

Is Chainge Safe?

The Fusion DCRM bridge has never been hacked. That’s good. But safety isn’t just about code. It’s about sustainability.

A project with $300,000 in market cap and $600 in daily volume can’t afford to pay developers, run audits, or respond to security threats. If a vulnerability is found, there’s no team with the resources to patch it. If a user loses funds, there’s no customer support to help. Chainge operates like a side project - not a financial infrastructure.

And while DCRM sounds technical and secure, it’s not proven at scale. No one outside Chainge’s own users has tested it under real pressure. That’s a risk you’re taking when you use it.

Can You Buy XCHNG?

Yes - but only on a few small exchanges. LBank, MEXC, and Bitrue are the only ones with consistent trading pairs. You won’t find it on Coinbase, Kraken, or Binance. You can’t buy it with a credit card. You need to deposit another crypto - usually USDT or ETH - and trade it manually.

There’s no app store listing for Chainge’s wallet on iOS or Android that’s officially verified. You have to download the APK or IPA from their website. That’s a red flag for most users. It’s not malware - but it’s not exactly trustworthy either.

What’s the Future of XCHNG?

There isn’t one.

Projects like this don’t die suddenly. They fade. Slowly. Quietly. No announcement. No press release. Just silence.

Chainge has no funding updates. No team hires. No new features announced. No partnerships. No community growth. The price is collapsing. The volume is dead. The holders are vanishing.

Analyst Sarah Wynn-Williams said it best in a January 2026 CoinDesk article: “Projects with market caps below $500,000 and trading volumes under $1,000 daily face near-impossible hurdles for sustainable operations.” Chainge isn’t just struggling - it’s already failed.

If you’re holding XCHNG, you’re not investing. You’re gambling on a miracle. And in crypto, miracles are rare. Especially for tokens with no traction, no liquidity, and no future.

Should You Buy XCHNG?

No.

Not because it’s a scam. But because it’s irrelevant.

If you need to swap between obscure chains, use Chainge - but only to execute a single trade. Buy the XCHNG you need to pay the fee. Don’t hold it. Don’t stack it. Don’t believe the hype.

If you’re looking for a cross-chain solution, go with THORSwap or Synapse. They’re listed on major exchanges. They have volume. They have teams. They have futures.

Chainge (XCHNG) is a relic. A footnote. A cautionary tale of a project that had a good idea but no execution, no funding, and no community. Don’t mistake novelty for opportunity. In crypto, the quiet ones don’t win. They disappear.

Is Chainge (XCHNG) a good investment?

No. XCHNG has lost over 99% of its value since its all-time high, trades under $1,000 daily, and is listed on only a few small exchanges. There’s no evidence of development, community growth, or institutional backing. It’s not a speculative opportunity - it’s a fading project with no clear path to recovery.

Can I buy XCHNG on Binance or Coinbase?

No. XCHNG is not listed on Binance, Coinbase, Kraken, or any other major centralized exchange. You can only trade it on smaller platforms like LBank, MEXC, and Bitrue. That’s a major red flag - top exchanges don’t list tokens with no liquidity or user demand.

What is the Fusion DCRM bridge?

Fusion DCRM (Distributed Control Rights Management) is Chainge’s proprietary cross-chain bridge technology. Instead of relying on liquidity pools or custodians, it uses decentralized multi-signature signing to move assets between blockchains. This reduces the risk of hacks, but it’s unproven at scale and has never been independently audited by a third party.

Why did Chainge change its ticker from CHNG to XCHNG?

In late 2024, Chainge upgraded its smart contracts and switched the ticker from CHNG to XCHNG. The official reason was to mark a "new phase" for the platform. But in reality, it was likely an attempt to reset investor perception after a steep price decline. The change didn’t improve liquidity, volume, or adoption.

How many people hold XCHNG?

As of early 2026, only about 2,400 unique wallets hold XCHNG. That’s extremely low for any crypto project, even a small one. For comparison, Uniswap has over 1.2 million holders. Low holder count means low demand, low liquidity, and no real community - all signs of a dying project.

Is Chainge’s mobile wallet safe to use?

It’s technically secure if you follow best practices - but risky in practice. The wallet is self-custodial, meaning you control your keys. But it’s not available on official app stores. You have to download it from Chainge’s website, which opens the door to phishing or fake versions. Only use it if you’re experienced with self-custody and understand the risks.

Bottom line: Chainge (XCHNG) is a tool for a tiny niche. It’s not a coin. It’s not an investment. It’s a technical workaround for a problem most people don’t have. Don’t chase it. Don’t buy it. And don’t believe the hype.

Comments (13)

christal Rodriguez

February 2, 2026 AT 14:06

Chainge isn't dead. It's just waiting for the right idiots to stop buying it.

Brianne Hurley

February 2, 2026 AT 21:21

I swear, every time someone writes a 2000-word takedown of a crypto project, they're just trying to justify why they bought it at the peak. XCHNG has zero liquidity? So does my ex's emotional availability. And yet, here we are. The fact that you're still talking about it means it's still alive in someone's portfolio. And that's all that matters to the people who actually use it - not your fancy CoinMarketCap charts. I swapped my Kava tokens for Secret Network assets last week using Chainge. No KYC. No waiting. No middlemen. You call it a ghost town. I call it a backdoor to the future. And you? You're just mad because you didn't think to look beyond Ethereum.

Gustavo Gonzalez

February 3, 2026 AT 12:20

Let me break this down for you in terms even your crypto-adjacent brain can process: If a project has a market cap under $500K and daily volume under $1K, it's not a 'niche tool' - it's a graveyard. Chainge's DCRM isn't 'secure' - it's untested. No third-party audit. No institutional backing. No team activity for a year. And you're telling me this is a 'solution'? It's a liability waiting for a rug pull disguised as decentralization. THORSwap has $42M market cap and real liquidity. Synapse is on Binance. Chainge? It's the crypto equivalent of a 2008 Nokia phone with a broken antenna - technically functional, but nobody wants to carry it.

Mark Ganim

February 5, 2026 AT 11:02

Ohhhhh... the silence... the beautiful, deafening silence... That's not absence - that's the sound of a project being gently buried under the weight of its own irrelevance. No tweets. No updates. No community. Just a flickering candle in a hurricane of DeFi innovation. And we're supposed to feel sorry for it? No. We're supposed to learn from it. Chainge didn't fail because of bad code. It failed because it confused novelty with necessity. It thought 'we support 55 chains' meant 'we matter'. But no one cares about the 55th chain if the first 54 already work better. The real tragedy? Someone, somewhere, still holds XCHNG... believing... hoping... praying... that this time, the ghost will speak back.

Tom Sheppard

February 6, 2026 AT 08:31

Hey everyone - if you’re using Chainge to move tokens between obscure chains, you’re doing it right. Don’t let the haters get to you. I’ve been using it since 2023 for my Celo and Kava swaps, and honestly? It’s the only thing that works without locking my assets on some sketchy CEX. Yeah, the app isn’t on the App Store - but I download from their site and verify the hash. It’s fine. And yeah, the price is trash - but I don’t hold it. I buy $0.50 worth when I need to swap. That’s it. No hype. No dreams. Just utility. And that’s okay. Not every project needs to be a moonshot. Sometimes, it just needs to work. And Chainge? It works. 🙌

Sunil Srivastva

February 7, 2026 AT 08:25

I’ve used Chainge a few times for swapping between Celo and Kava when other bridges were down. It’s slow, but it works. The interface isn’t pretty, but it gets the job done. I don’t hold XCHNG - I just buy what I need for the swap and sell immediately. No drama. No FOMO. Just practical use. If you’re not trying to move tokens between obscure chains, you don’t need it. But if you are? It’s one of the few options. Don’t overthink it.

Kevin Thomas

February 7, 2026 AT 20:40

You people are hilarious. You call Chainge a 'ghost town' like it’s some kind of crime scene. Newsflash: most crypto projects die quietly. That’s how it works. The ones that make it? They don’t need Reddit threads or YouTube videos - they need users who actually need them. Chainge serves a tiny group of people who have no other option. And that’s enough. You want Binance-listed projects? Go buy your Solana memecoins and cry when they dump. Meanwhile, real users are moving assets without KYC. That’s not a failure - that’s resistance. Stop trying to monetize every niche tool. Not everything has to be a 100x.

Robert Mills

February 9, 2026 AT 14:27

Chainge is the quiet hero of DeFi 💪🔥

Raju Bhagat

February 9, 2026 AT 22:46

I bought XCHNG at 0.05 and now its at 0.001 and i still believe in it because the team is working hard and the community is growing and you guys just dont understand the vision like i do and also i think it will hit 0.10 by end of year and then 1.00 and then moon and also i bought more today so dont tell me its dead because i am still holding and i have faith and also my dog is named XCHNG and he barks every time the price drops so its a sign from the universe

laurence watson

February 10, 2026 AT 21:24

I just wanted to say… I get it. I’ve been there. I held XCHNG too. Thought it was the next big thing. Then I realized I was holding a tool, not an investment. I used it once to swap some Celo tokens. Paid the fee. Got what I needed. Sold the rest. No guilt. No drama. It’s okay if something doesn’t have to be big to be useful. And it’s okay if we stop pretending every obscure token is a secret gem. Sometimes, it’s just… a tool. And that’s enough.

Elizabeth Jones

February 11, 2026 AT 12:38

The tragedy of Chainge isn’t its collapse - it’s the quiet dignity with which it continues to function despite being abandoned by the market. It doesn’t beg for attention. It doesn’t tweet. It doesn’t do AMAs. It just… works. For the few who need it. That’s not failure. That’s integrity. In a world obsessed with hype, liquidity, and market caps, Chainge refuses to perform. It doesn’t need to. It’s not here to be loved. It’s here to be used. And sometimes, that’s the most noble thing a project can be.

Pamela Mainama

February 11, 2026 AT 23:53

I think it’s beautiful that something so small still exists. Like a lone streetlamp in a forgotten neighborhood. No one’s watching. No one’s cheering. But someone still needs it to get home. That’s enough.

Rachel Stone

February 12, 2026 AT 18:24

So… it’s dead. Got it. 🤡