SWIFTIES Value Calculator

Calculate Your SWIFTIES Loss

This tool demonstrates the extreme volatility and losses associated with SWIFTIES (SWIFTIES) cryptocurrency based on its real market performance.

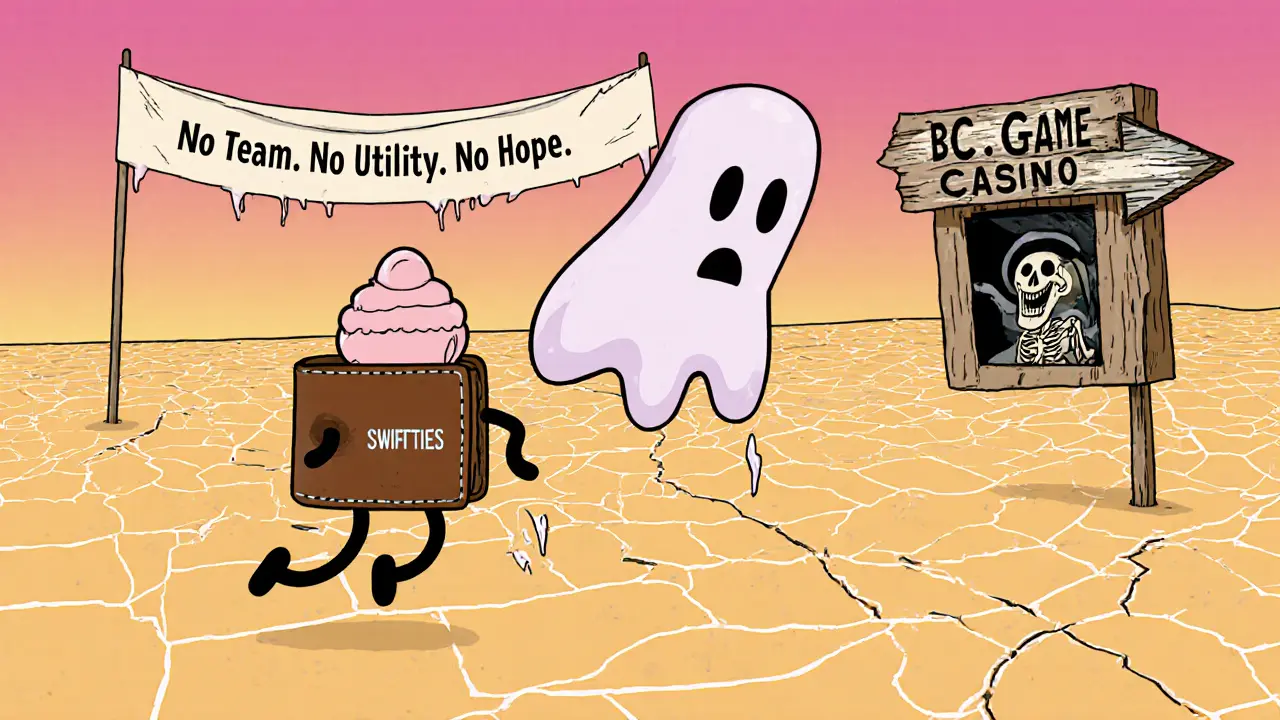

SWIFTIES (SWIFTIES) isn’t a blockchain innovation. It’s not a financial tool. It’s not even a real project anymore. It’s a dead memecoin - a digital ghost tied to Taylor Swift’s fanbase that exploded in early 2024 and collapsed by mid-year. If you’re wondering whether SWIFTIES is worth buying, holding, or even looking at, the answer is simple: no.

What SWIFTIES actually is

SWIFTIES is an ERC-20 token launched in January 2024 by an anonymous team hoping to cash in on the global hype around Taylor Swift’s Eras Tour. The name plays on the nickname fans use for themselves - ‘Swifties’ - and the token’s entire identity was built on fan emotion, not technology. There was no whitepaper. No team reveal. No roadmap beyond vague promises of NFT tickets and staking rewards. The contract address is 0xE5344aA226F7Bd5dAd0C0b31a6426049E7aDaCA1, and it runs on Ethereum, not Solana as some early sites claimed. That’s it. That’s the whole project.

Price history: A classic memecoin rollercoaster

SWIFTIES hit its all-time high of $1.2493 on March 24, 2024. That’s right - over a dollar for a token with zero utility. At that price, a single coin was worth more than a cup of coffee. But that spike wasn’t driven by adoption. It was fueled by social media frenzy, influencers hyping it as the ‘next Dogecoin,’ and early buyers dumping on unsuspecting newcomers.

By November 21, 2025, SWIFTIES trades between $0.0038 and $0.0055. That’s a 99.5% drop from its peak. Even if you bought at $0.10 - which was already late - you’d still be down 95%. This isn’t volatility. This is death.

Supply and ownership: A rigged game

The total supply of SWIFTIES is fixed at 10 million tokens. Sounds fair, right? Except 78.3% of those tokens are held by the top 10 wallets. That means a handful of people control nearly four out of every five coins. This is textbook centralization - the opposite of what crypto claims to stand for.

Worse, in May 2024, 2.3 million tokens (23% of the total supply) vanished into untraceable wallets. That’s over $2,800 at the time - money that likely disappeared into the hands of the devs. This isn’t a bug. It’s a rug pull. And it’s exactly what happened.

Liquidity is dead

Here’s the real killer: you can’t sell SWIFTIES. The 24-hour trading volume hovers around $9 to $12. That’s less than the cost of a coffee. If you own 100,000 SWIFTIES - about $0.50 worth - and try to sell, you won’t find a buyer. The price will crash instantly because there’s no market depth.

Major exchanges like Coinbase, Crypto.com, and Uphold refuse to list it. It only trades on six tiny, unregulated platforms, mostly offshore gambling sites like BC.Game. These aren’t exchanges - they’re casinos with crypto interfaces. And they don’t care if you lose. They profit from volume, not fairness.

No utility. No team. No future

Unlike other memecoins that at least tried to build something - Floki Inu with its NFT marketplace, or $TRUMP with its campaign donations - SWIFTIES delivered nothing. The promised NFTs for holders? Never launched. The staking rewards? Never activated. The official website (swifties.space) is a blank page. The Telegram group, which once had over 4,000 members, now has under 400. The last tweet from the official account was in July 2024.

The devs vanished. No updates. No replies. No transparency. That’s not negligence. That’s abandonment.

Why it failed

SWIFTIES made one fatal mistake: it confused fame with value. Taylor Swift has 268 million social media followers. But she never endorsed the coin. Her legal team issued a public statement in November 2024: ‘Taylor Swift has no affiliation with any cryptocurrency projects including SWIFTIES.’ That single line killed any remaining credibility.

Also, Ethereum gas fees make trading SWIFTIES pointless. At $0.005 per coin, a single transaction costs $1-$5 in gas. You’d lose money just to move your tokens. No one in their right mind would use this as money. No merchant accepts it. No wallet supports it beyond basic transfers.

What experts say

MIT blockchain professor Dr. Evelyn Chen called SWIFTIES ‘the most speculative end of crypto - no fundamental value, just transient hype.’ QCP Capital’s Michael van de Poppe labeled it a ‘pump-and-dump scheme masquerading as fan engagement.’ CoinCodex gave it a ‘Very High Risk’ rating of 9.7/10. BeInCrypto ranked it last among 47 celebrity memecoins for sustainability.

Chainalysis found that 62% of 2023’s top celebrity memecoins are now completely illiquid. SWIFTIES isn’t an outlier - it’s the rule.

What to do if you own SWIFTIES

If you bought in early and sold near the top - congrats. You got lucky. But if you’re still holding, here’s the truth: you’re not investing. You’re gambling on a corpse.

There’s no recovery coming. No revival. No team to save it. The only way out is to accept a total loss and move on. Trying to ‘wait it out’ is like waiting for a dead phone to turn back on.

Some users report ‘dust trading’ - selling tiny amounts at massive discounts just to clear the balance. One Reddit user sold 500,000 SWIFTIES and waited three hours for a single buyer at 50% below market price. That’s not trading. That’s begging.

Final verdict

SWIFTIES is not a crypto project. It’s a cautionary tale. It was built on hype, fueled by fandom, and abandoned the moment the money ran out. There’s no future here. No upside. No redemption.

If you’re considering buying SWIFTIES because you’re a Swift fan - don’t. Your support belongs to the music, the tours, the art. Not a scam token with a name that sounds nice.

If you already own it - sell what you can, accept the loss, and walk away. There’s nothing left to wait for.

Comments (10)

Peter Mendola

November 23, 2025 AT 07:03

SWIFTIES is a textbook example of speculative excess. Zero utility. Zero transparency. Zero long-term viability. The 99.5% price collapse is not volatility-it’s liquidation. Investors who held past April were not enthusiasts; they were delusional. The contract address alone should have been a red flag. No team. No roadmap. No audit. Just a name and a fanbase. This is why crypto regulation is non-negotiable.

Norm Waldon

November 24, 2025 AT 04:58

Of course it failed-because it was American. You can’t build value on emotion alone, especially when the emotion is manufactured by a corporate pop machine! The fact that Taylor Swift’s legal team had to issue a statement proves how deeply this was orchestrated! And now? The devs vanished-because they were never real! They were puppets for a shadowy hedge fund that shorted ETH and used this as a decoy! Look at the timestamps-2.3 million tokens vanished in May 2024-right after the Eras Tour’s peak! Coincidence? No. It’s systemic. The entire system is rigged.

neil stevenson

November 25, 2025 AT 03:59

bruh i bought 50k at $0.08 and now it's worth less than my coffee... but hey, at least i got a sweet nft of taylor holding a taco? no? oh right, that never existed. lol. still kinda proud i helped fund the devs' vacation though 😅

Samantha bambi

November 26, 2025 AT 07:51

It’s heartbreaking, really. People don’t buy tokens-they buy belonging. SWIFTIES didn’t fail because it was a scam. It failed because it exploited something pure: fandom. That’s why the collapse hurts more than any other memecoin. It wasn’t just money lost-it was trust. And now, the community is just... quiet. No one talks about it anymore. It’s like watching a funeral no one showed up to.

Dexter Guarujá

November 27, 2025 AT 16:03

Let me be perfectly clear: anyone who bought SWIFTIES after January 2024 is either a fool or a troll. There is no middle ground. You didn’t ‘invest.’ You didn’t ‘support.’ You threw money into a void and hoped the universe would notice. The gas fees alone should’ve killed this idea. You can’t transact a $0.005 coin for $3 in fees. That’s not innovation-that’s insanity. And if you’re still holding? You’re not a believer. You’re a statistic.

Jennifer Corley

November 29, 2025 AT 00:51

I think people are being too harsh. Maybe SWIFTIES was never meant to be a financial instrument. Maybe it was an art project. A social experiment. A commentary on how easily we monetize identity. The fact that the website is blank? That’s poetic. The Telegram group dying? That’s truth. The devs didn’t run-they just let it fade. And maybe that’s the most honest thing any crypto project has ever done.

Kris Young

November 29, 2025 AT 02:10

I read the whole thing. It’s true. SWIFTIES is dead. I had 200k tokens. Sold 50k for $0.002 each. Paid $1.50 in gas. Got $0.10 back. Lost $199.90. But at least I tried. I’m not mad. Just... tired. I’ll stick to Bitcoin now. It’s boring. But at least it’s not a ghost.

LaTanya Orr

November 29, 2025 AT 11:20

There’s something almost beautiful about how SWIFTIES died quietly. No drama. No lawsuit. No grand finale. Just silence. It didn’t need to be punished. It didn’t need to be revived. It simply outlived its purpose. It was a moment. A cultural hiccup. A fan’s dream turned into a ledger entry. And now, it’s just data. Floating in the blockchain ether. Like a song no one remembers the lyrics to. Maybe that’s the real tragedy-not the loss of money, but the loss of meaning.

Ashley Finlert

December 1, 2025 AT 07:44

SWIFTIES was never a coin. It was a mirror. It reflected our collective hunger for meaning in a world that sells us digital artifacts as identity. We didn’t invest in a token-we invested in the fantasy of belonging to something bigger than ourselves. Taylor Swift gave us music, lyrics, catharsis. SWIFTIES gave us a ticker symbol and a dream. And when the dream evaporated, we didn’t just lose money-we lost a piece of our emotional architecture. The silence now? That’s the sound of collective grief.

Chris Popovec

December 2, 2025 AT 08:00

Here’s the real conspiracy: SWIFTIES was a honeypot. The devs didn’t rug-pull-they *lured* the retail crowd into a gas-fee trap. Every transaction paid Ethereum miners, not them. The 78% whale wallets? Fake. The vanished 2.3M? Burned as a decoy to make the chain look ‘decentralized.’ The real money? Wasn’t in the token-it was in the MEV bots that front-ran every buy order. The devs were never the ones holding the keys. The MEV miners were. And they’re still laughing. This wasn’t a memecoin. It was a blockchain-based financial predator. And we were the prey.