Innterim Crypto Bridge: Web3 Guides and Crypto Insights from July 2025

When you're trying to make sense of Web3, the next generation of the internet built on decentralized blockchain networks that give users control over data and digital assets. Also known as decentralized web, it's not just a tech buzzword—it's where your money, identity, and online interactions are shifting away from big corporations and into your own hands. In July 2025, the shift became harder to ignore. More people were using wallets like MetaMask and Coinbase Wallet not just to hold crypto, but to interact with real apps—games, social platforms, lending tools—all running on blockchains without middlemen.

That’s why crypto airdrops, free token distributions given to users who meet simple eligibility rules, often as a way for new projects to build early communities exploded in popularity. People weren’t just waiting for free coins—they were learning how to qualify, avoid scams, and track deadlines using simple checklists. Meanwhile, DeFi, a system of financial services like lending, borrowing, and trading that runs without banks, powered entirely by smart contracts on blockchains kept getting easier to use. You didn’t need to be a coder anymore. Just a few clicks in a trusted app could let you earn interest on your stablecoins or swap tokens with low fees. And behind it all, blockchain, a public, tamper-proof digital ledger that records every transaction across a network of computers, forming the foundation of all crypto systems became less mysterious. People stopped asking "How does it work?" and started asking "How do I use it?"

What you’ll find in this archive isn’t theory. It’s the real stuff people actually did in July 2025: how to claim airdrops from new Layer 2 chains, which exchanges had the lowest fees for swapping SOL to ETH, why one wallet setup saved someone $200 in gas fees, and how a simple DeFi strategy earned steady returns without risky leverage. No fluff. No hype. Just clear steps, verified tools, and honest warnings about what to avoid. If you’re trying to move past just buying Bitcoin and start actually using crypto in your daily life, this collection is your roadmap.

Qatar bans all institutional cryptocurrency activity for banks and financial firms, but allows tokenized securities under strict oversight. Learn how this unique regulatory model compares to the rest of the GCC in 2025.

Saudi Arabia bans banks from handling crypto transactions, but crypto adoption is booming anyway. Learn how users bypass the restrictions, why the government resists, and what this means for traders and businesses.

Blockchain technology is transforming cross-border payments by slashing fees, cutting settlement time to minutes, and offering full transparency. Discover how businesses and individuals are already using it to send money globally faster and cheaper than ever before.

DeFi is no longer experimental-it's cutting payment costs for small businesses, enabling global lending without banks, and integrating with government digital currencies. Here's how it works in 2025 and how you can use it safely.

Blockchain social media lets you own your profile and earn from your content - unlike Facebook or Twitter. But it’s not for everyone. Here’s how they really compare in 2025.

Crypto mining in Iran is legal in 2025 but tightly controlled by the government. Miners face high electricity costs, sudden bans, and a two-tier system favoring state-linked operations. The future points toward a state-controlled digital currency.

Zeddex Exchange claims zero trading fees but has almost no users, no security, and no regulatory oversight. In 2025, it's not a viable option for any serious crypto trader.

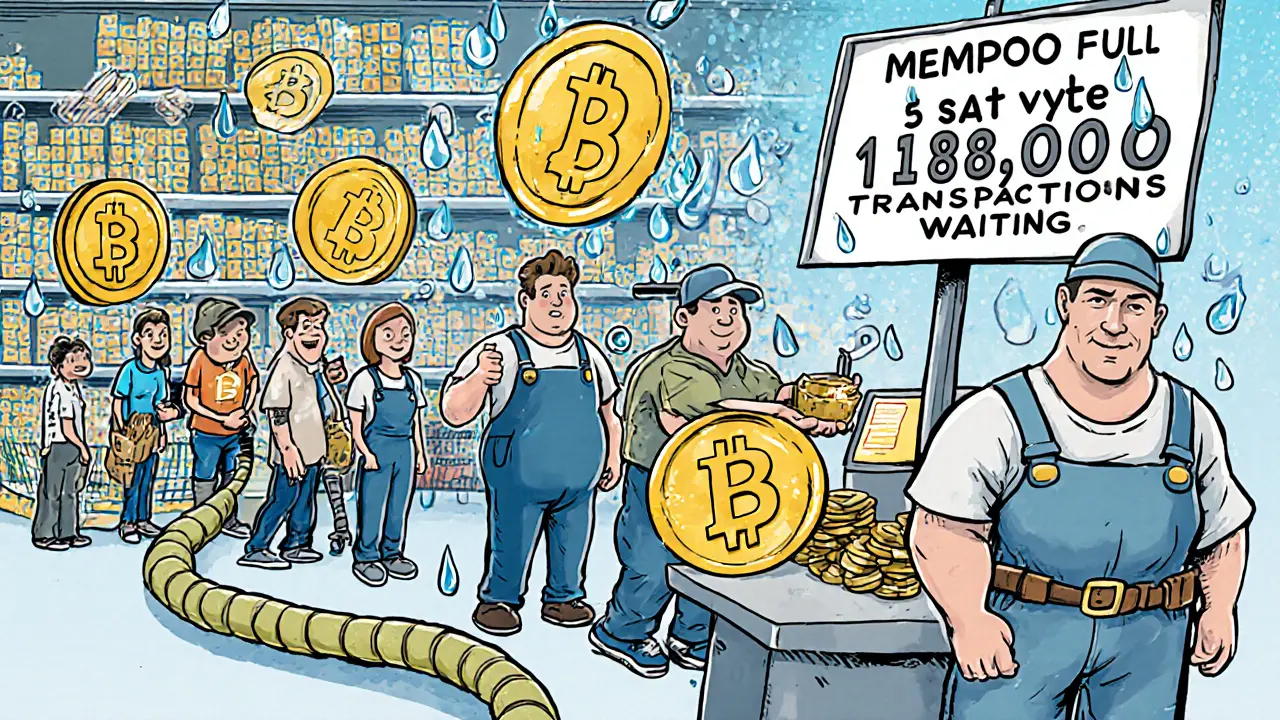

Learn how mempool size affects Bitcoin transaction speeds and fees. Understand congestion triggers, real-time monitoring tools, and how to avoid delays with proper fee settings and address types.

12-word vs 24-word seed phrases: which one actually keeps your crypto safe? The answer isn't about more words - it's about how you store them. Here's what experts and data really say.

EAGLE INU (EAGLE) is a near-worthless meme crypto with $0 trading volume, no development, and a market cap under $5,000. Learn why experts say avoid it and what really happens if you buy it.

LUXO is a niche cryptocurrency designed to authenticate luxury goods using blockchain. But without partnerships from major brands, it remains unused and under-traded, making it a high-risk, low-reward asset.

The SEC fined crypto firms $4.68 billion in 2024 - mostly from one case. But after a leadership change, enforcement shifted from registration rules to fraud. Here's what changed, why it matters, and what's next.