Bitcoin Mempool: What It Is and Why It Matters for Transactions

When you send Bitcoin, it doesn’t jump straight into a block. First, it enters the Bitcoin mempool, a temporary holding area for unconfirmed transactions waiting to be picked up by miners. Also known as the transaction pool, it’s the last stop before your Bitcoin gets confirmed on the blockchain. Think of it like a line at the airport security checkpoint—everyone waits their turn, but not everyone gets through at the same speed.

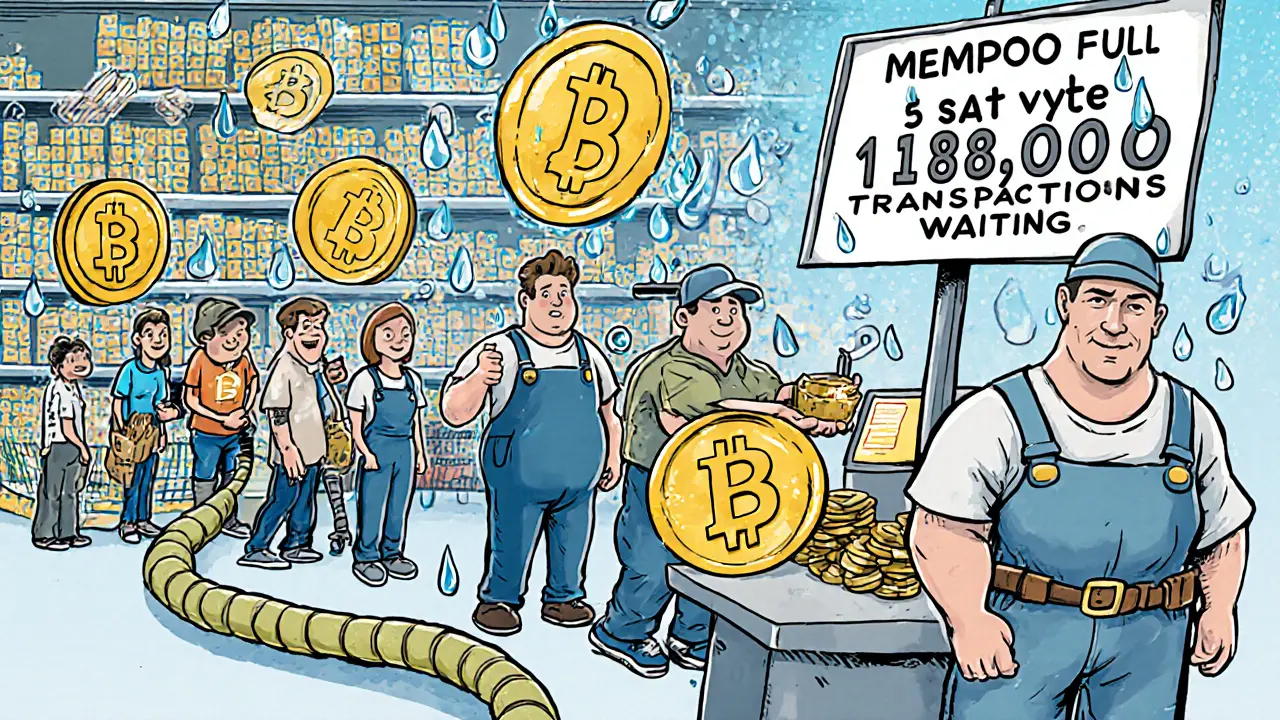

The mempool backlog, the number of unconfirmed transactions waiting to be processed changes by the minute. When the network gets busy—like during a price spike or a big NFT drop—the mempool fills up fast. Miners prioritize transactions with the highest fees, so if you send Bitcoin with a low fee, you might wait hours, even days. That’s why knowing how the mempool works isn’t just technical—it’s financial. A $1 fee might get you confirmed in 10 minutes during quiet times, but during peak congestion, you might need $10 or more to avoid getting stuck.

Bitcoin fees, the cost you pay to have your transaction included in a block are directly tied to mempool size. When the mempool is full, fee estimation tools show higher numbers. When it’s empty, fees drop. This isn’t random—it’s a market. You’re bidding for space. And if you’re using a wallet that auto-sets fees, you might be overpaying without realizing it. Tools like mempool.space let you see real-time congestion, so you’re not guessing.

Miners don’t just pick transactions randomly. They sort them by fee per byte, meaning smaller transactions with high fees often jump ahead of larger ones. This is why sending 0.1 BTC with a high fee can clear faster than sending 1 BTC with a low fee. It’s not about how much you send—it’s about how much you’re willing to pay per unit of data.

The transaction confirmation, the process of a transaction being included in a block and added to the blockchain isn’t guaranteed until it’s buried under six blocks. But your transaction can sit in the mempool for hours before it even gets picked up. That’s why some people use Replace-by-Fee (RBF) or Child-Pays-for-Parent (CPFP) to speed things up after the fact. These aren’t magic fixes—they’re workarounds for a system that’s designed to be predictable, not instant.

What you’ll find in the posts below isn’t theory—it’s real-world insight. You’ll see how mempool congestion affected Bitcoin transactions during the 2024 halving cycle, how users lost money by ignoring fee estimates, and why some wallets fail to explain what’s really happening behind the scenes. You’ll also learn how to read mempool data like a miner, how to avoid getting stuck in a backlog, and what happens when a transaction gets dropped because the mempool cleared out. This isn’t about understanding blockchain jargon—it’s about making sure your Bitcoin moves when you need it to.

Learn how mempool size affects Bitcoin transaction speeds and fees. Understand congestion triggers, real-time monitoring tools, and how to avoid delays with proper fee settings and address types.