DueDEX Crypto Exchange: What It Is and Why Traders Use It

When you trade crypto without handing over your ID, you're using a DueDEX crypto exchange, a non-KYC decentralized exchange built on the MultiversX blockchain. Also known as DueDEX DEX, it lets users swap tokens directly from their wallets—no sign-up, no bank account, no waiting. Unlike centralized platforms like Binance or Coinbase, DueDEX doesn’t hold your funds. You control your keys. That means no frozen accounts, no surprise withdrawals, and no third parties deciding what you can trade.

It’s not just about privacy. DueDEX runs on MultiversX, a high-performance blockchain designed for speed and low fees. Also known as Elrond, this network processes thousands of transactions per second, making swaps near-instant. This matters because on slower chains like Ethereum, a simple trade can cost $20 and take 10 minutes. On DueDEX, it’s under $0.10 and under 3 seconds. That’s why serious DeFi users—especially in regions with strict banking rules—choose it. The exchange also supports non-KYC exchange, a category of platforms that avoid identity verification to protect user autonomy. This makes DueDEX a go-to for traders who want to avoid surveillance, avoid delays, or simply don’t trust centralized systems. You won’t find fiat on-ramps here. No credit cards, no bank transfers. But you’ll find over 200 tokens, deep liquidity pools, and tools for advanced users like limit orders and batch swaps.

DueDEX isn’t for beginners who need hand-holding. There’s no customer service chat, no educational videos, no mobile app. You need to know how to connect a wallet, set gas fees, and spot scams. But if you’ve used Uniswap or SushiSwap before, you’ll feel right at home. The interface is clean, the fees are transparent, and the platform doesn’t change without warning. What you see is what you get.

What you’ll find in the posts below are real reviews, comparisons, and breakdowns of DueDEX’s strengths and blind spots. You’ll see how it stacks up against xExchange and Nimera. You’ll learn why some traders avoid it entirely—and why others won’t use anything else. No fluff. No hype. Just what happens when you trade on a blockchain that actually works.

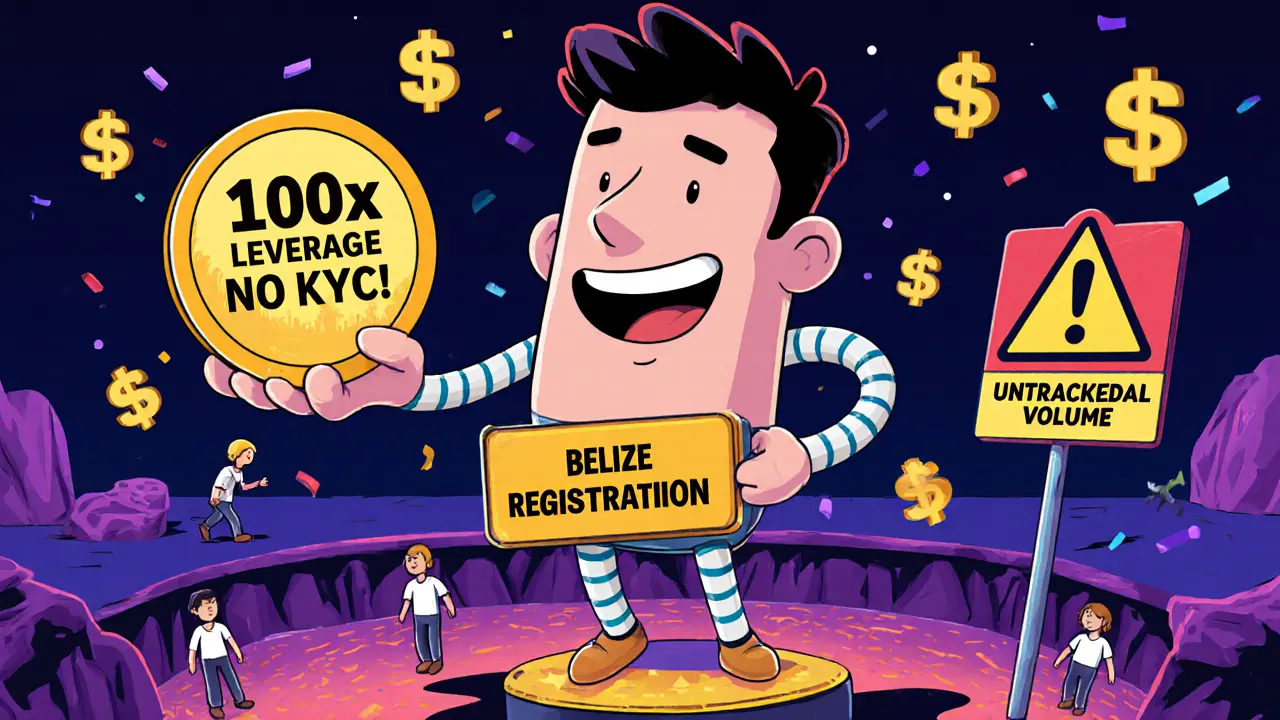

DueDEX offers zero fees and 100x leverage with no KYC, but lacks verified volume, supports only BTC/USD, and shows red flags of a scam. Is it worth the risk?