DueDEX Review: Is This Decentralized Exchange Worth Your Time?

When you're looking for a DueDEX, a decentralized exchange built for fast, low-fee crypto swaps with no account setup. It's not just another DEX—it's designed for traders who want full control over their funds and hate waiting for approvals. Unlike centralized platforms, DueDEX doesn’t ask for your ID, doesn’t hold your coins, and doesn’t shut down when regulators knock. But that freedom comes with trade-offs you need to know before you trade.

DueDEX runs on the MultiversX, a high-performance blockchain optimized for speed and low costs, often used in DeFi and gaming, which gives it an edge in transaction speed. Swaps happen in under a second, and fees stay below $0.10—even during market spikes. That’s a big deal if you’re swapping tokens like EGLD, USDT, or newer memecoins. But here’s the catch: it has no mobile app, no fiat on-ramps, and no customer support team. If you mess up a transaction, there’s no one to call. You’re on your own. That’s fine for experienced users, but beginners often get burned by wrong addresses or forgotten gas limits.

Compared to other decentralized exchanges, platforms like Uniswap or PancakeSwap that let users trade directly from their wallets without intermediaries, DueDEX feels more like a niche tool. It doesn’t have the liquidity of the big names, so slippage can be high on smaller tokens. But if you’re trading popular assets or want privacy-focused swaps without KYC, it’s one of the cleanest options out there. The interface is simple, the wallet integration works smoothly with Ledger and Trust Wallet, and there’s no hidden fee structure. No subscription. No tiered pricing. Just pay the network fee and go.

What’s missing? No staking. No yield farming. No NFT marketplace. DueDEX doesn’t try to be everything. It’s focused on one thing: fast, private, peer-to-peer swaps. That’s why it shows up in reviews from traders who’ve had accounts frozen on centralized platforms or got locked out by overzealous compliance systems. If you’ve ever lost access to your funds because a bank flagged your crypto activity, DueDEX feels like a breath of fresh air.

But don’t assume it’s safe just because it’s decentralized. Scammers target DEX users with fake token listings and cloned websites. Always check the official contract address. Never click links from Twitter or Telegram. And never send crypto to an address you didn’t generate yourself. DueDEX itself isn’t a scam—but the crypto space is full of people who want to pretend it is.

Below, you’ll find real user experiences, technical breakdowns, and comparisons with other platforms that help you decide if DueDEX fits your trading style—or if you’re better off elsewhere.

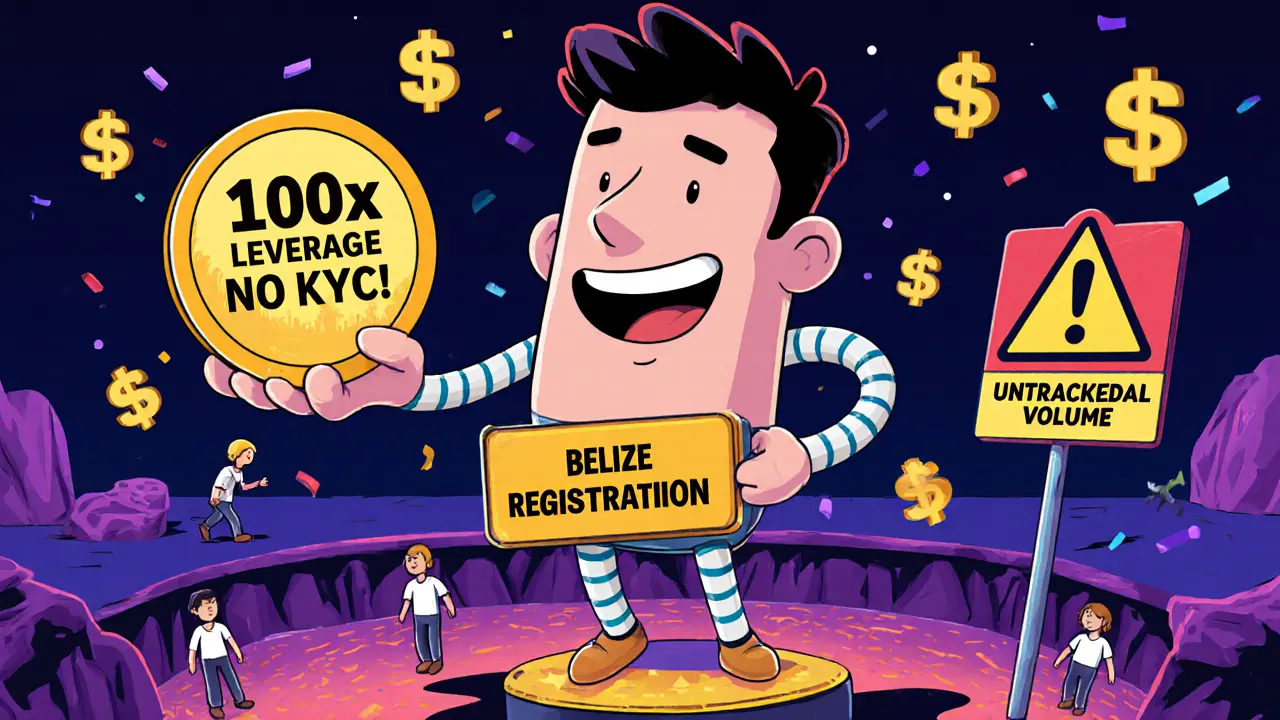

DueDEX offers zero fees and 100x leverage with no KYC, but lacks verified volume, supports only BTC/USD, and shows red flags of a scam. Is it worth the risk?