DueDEX scam: What happened and how to avoid fake crypto exchanges

When people talk about the DueDEX scam, a crypto exchange that vanished after collecting user funds without delivering trading services. Also known as DueDex fraud, it became a textbook case of how fake decentralized exchanges trick users into depositing crypto, then disappear. This wasn’t just a glitch or a slow withdrawal—it was a full exit scam, where the operators pulled the plug, wiped the liquidity, and vanished with millions in user funds.

What made the DueDEX scam, a crypto exchange that vanished after collecting user funds without delivering trading services. Also known as DueDex fraud, it became a textbook case of how fake decentralized exchanges trick users into depositing crypto, then disappear. so dangerous was how it mimicked real DeFi platforms. It had a clean interface, fake trading volume, and even posted fake customer support replies. Users thought they were using a legit DEX until they couldn’t withdraw. The same tactics show up in other fake crypto exchange, a platform that pretends to offer trading but is designed to steal deposits. Also known as crypto exchange fraud, it often uses cloned logos, fake audit reports, and influencer shills to look real.. Many of these platforms target new users who don’t know to check for verified contracts, live audits, or community history. The DeFi scam, a fraudulent project in decentralized finance that promises high returns but steals funds. Also known as rug pull, it often hides behind anonymous teams and unverifiable code. playbook is simple: create hype, attract deposits, then vanish. And the crypto fraud, any illegal scheme designed to steal cryptocurrency from users through deception. Also known as crypto scam, it thrives when people skip basic verification steps. doesn’t stop at exchanges—it shows up in airdrops, yield farms, and even fake wallet apps.

If you’ve ever wondered why some platforms vanish overnight while others stick around, the difference is usually transparency. Real exchanges publish team members, undergo third-party audits, and have active community channels. Fake ones hide behind anonymous GitHub accounts, use stock images for logos, and delete their Twitter accounts when questions get too loud. The DueDEX scam didn’t fail because of market conditions—it failed because it was never real to begin with. You’ll find more cases like this in the posts below: exchanges that looked safe but weren’t, tokens that promised the moon but delivered nothing, and how to spot the red flags before you send your crypto anywhere.

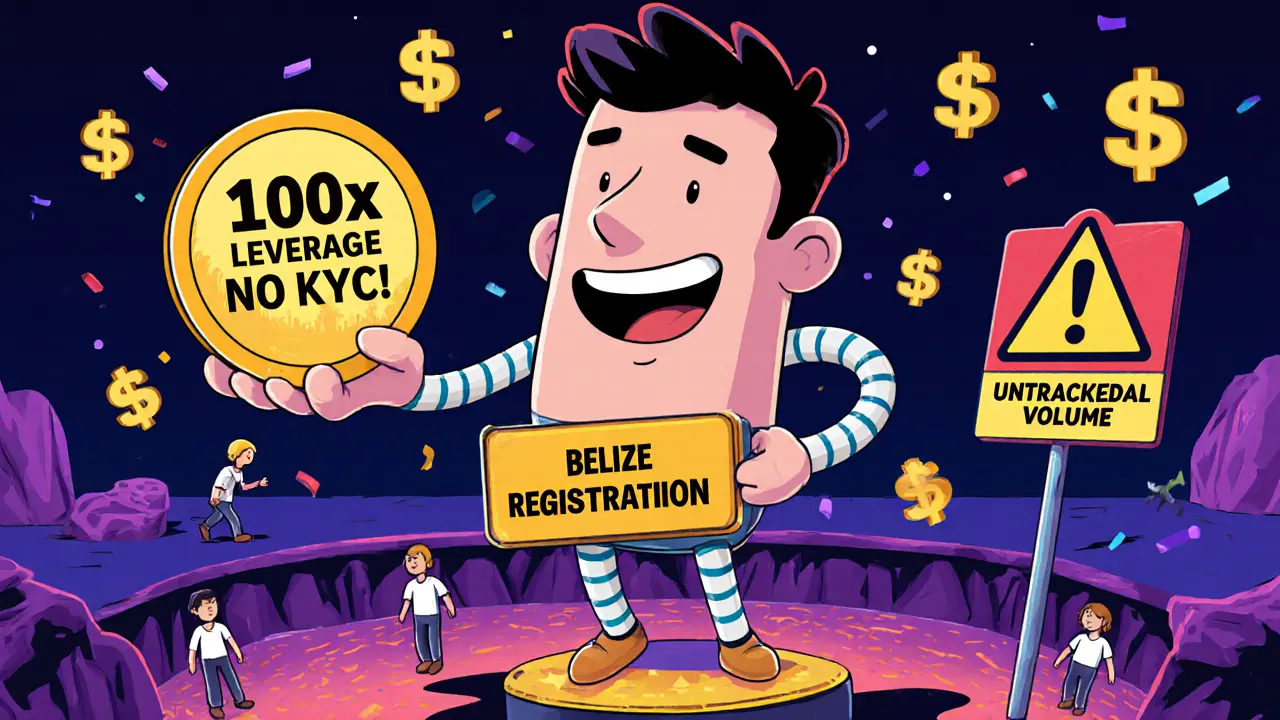

DueDEX offers zero fees and 100x leverage with no KYC, but lacks verified volume, supports only BTC/USD, and shows red flags of a scam. Is it worth the risk?