High Leverage Crypto: What It Is, How It Works, and Why It’s Dangerous

When you trade high leverage crypto, a trading method that lets you borrow funds to amplify your position size. Also known as margin trading, it lets you control $10,000 worth of Bitcoin with just $500—but if the price moves against you, you lose more than your initial deposit. This isn’t investing. It’s betting with borrowed money, and most people don’t survive it.

Crypto leverage, the practice of using borrowed capital to increase exposure to cryptocurrency price movements. Also known as leveraged positions, it’s common on exchanges like Binance, Bybit, and OKX, where you can trade with up to 125x leverage on some coins. That means a 1% drop in Bitcoin can wipe out your entire stake if you’re fully leveraged. No other market offers this kind of risk. Stocks? Max 2x leverage. Forex? Usually 50x. Crypto? 100x or more—and exchanges don’t warn you enough.

Margin trading crypto, the act of borrowing funds from a platform to open a larger trade than your balance allows. Also known as leveraged trading, it’s not just about buying low and selling high—it’s about timing, liquidation levels, and avoiding the liquidation waterfall. A single flash crash, a big whale selling, or even a bad tweet can trigger a cascade of forced sells. You don’t need the market to crash 20% to lose everything. Sometimes 5% is enough.

People get drawn in because they see others making quick profits. But those posts are highlights, not the full story. Behind every 10x win, there are 100 people who lost their entire account. The math doesn’t lie: if you’re trading 50x leverage, you only need to be right 2% of the time to break even. The rest? You’re gambling with house odds stacked against you.

Real traders use leverage sparingly—maybe 5x or 10x at most. They set stop-losses, avoid trading during news events, and never risk more than 1-2% of their capital per trade. But most beginners go all in. They think leverage is a shortcut to wealth. It’s not. It’s a trap.

What you’ll find in these posts aren’t guides on how to use leverage. They’re warnings. Stories of people who lost everything. Exchanges that collapsed under margin calls. Coins that got wiped out by leveraged short squeezes. And the quiet truth: if you don’t understand how liquidation works, you shouldn’t be near high leverage crypto.

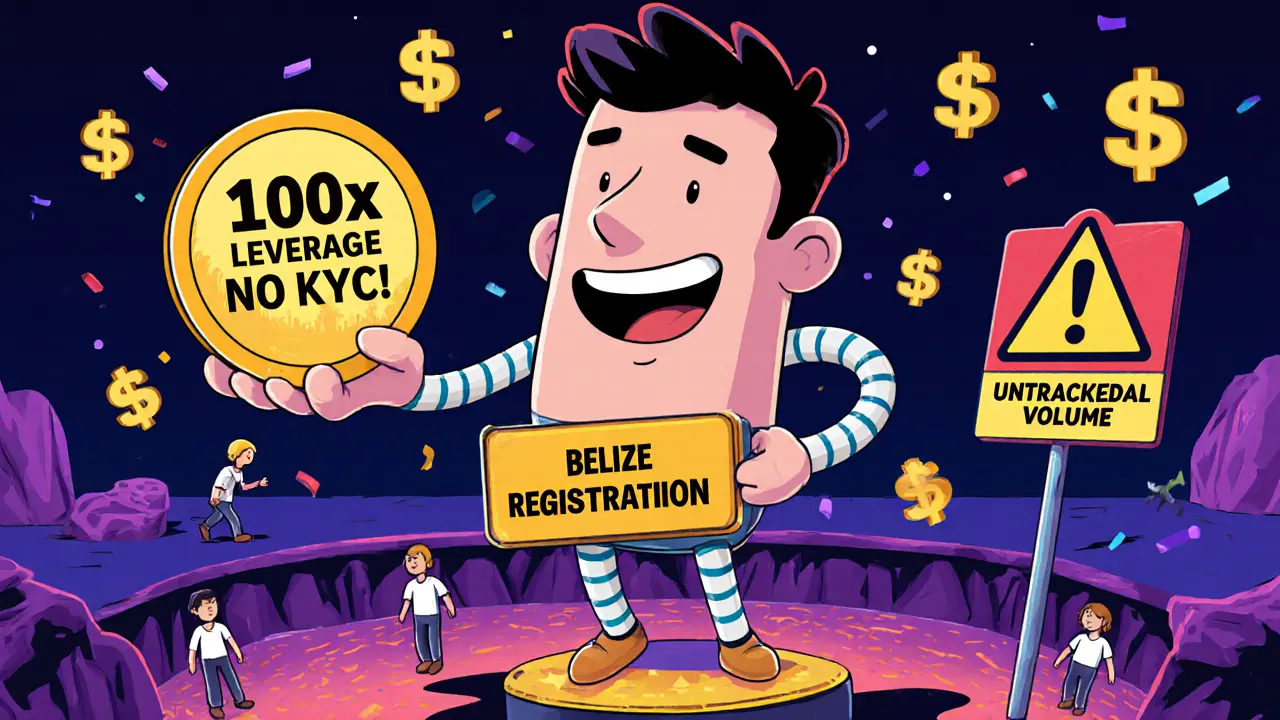

DueDEX offers zero fees and 100x leverage with no KYC, but lacks verified volume, supports only BTC/USD, and shows red flags of a scam. Is it worth the risk?