Mempool Congestion: Why Your Crypto Transactions Get Stuck and How to Fix It

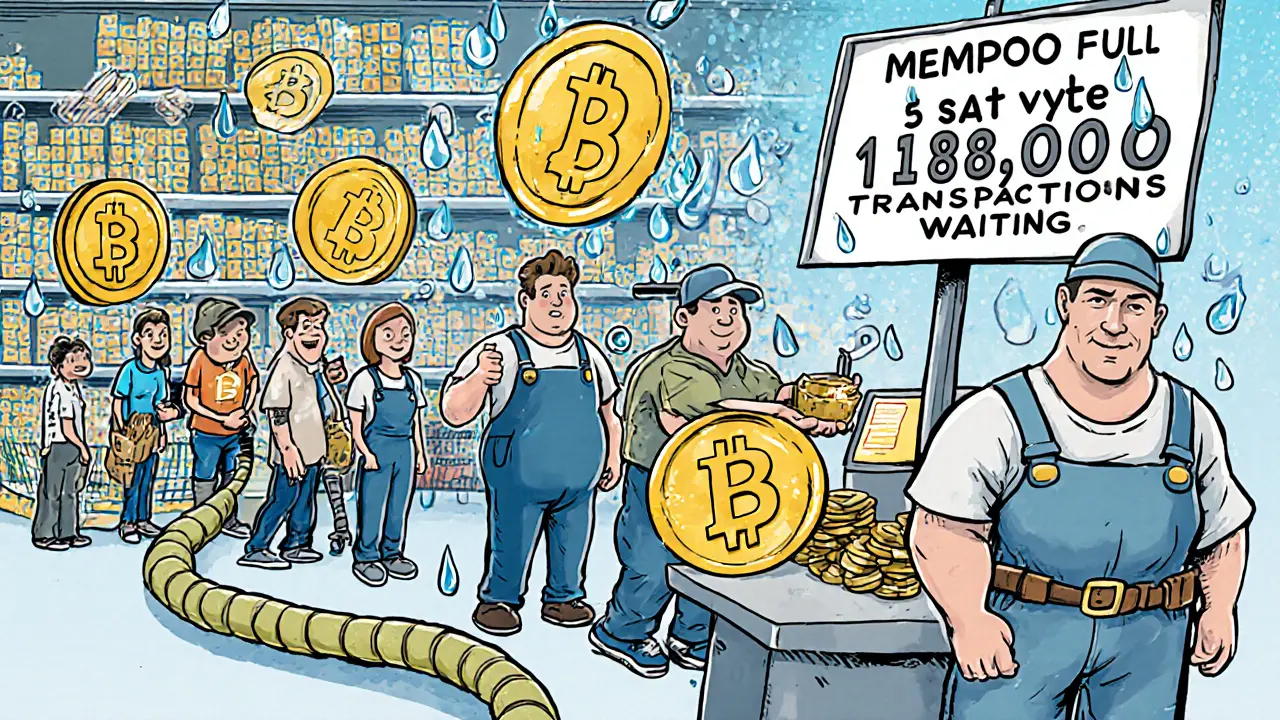

When you send crypto, it doesn’t jump straight into a block—it waits in a holding area called the mempool, a temporary storage space where unconfirmed transactions wait to be picked up by miners or validators. Also known as the transaction pool, it’s the bottleneck that decides whether your payment goes through in seconds or days. When too many people send transactions at once, the mempool fills up like a traffic jam on a highway. Bitcoin’s mempool, for example, can hold over 200,000 transactions during peak times. If you don’t pay enough in fees, your transaction gets buried under others—and stays there.

Mempool congestion isn’t just an inconvenience; it’s a direct result of how blockchains balance security, speed, and cost. Bitcoin limits each block to 1 MB (or 4 MB with SegWit), so only so many transactions fit. Ethereum handles more per block but still gets overwhelmed during NFT drops or DeFi surges. When the mempool backs up, miners prioritize transactions with the highest fees. That’s why you see fees jump from $0.50 to $20 overnight. It’s not a glitch—it’s the market at work. This is why tools like transaction fee estimators, systems that analyze current mempool data to suggest optimal fees exist. They help you avoid overpaying or getting stuck.

There’s also a hidden side effect: mempool congestion pushes users toward Layer 2 solutions like the Lightning Network or Optimism. If your transaction takes hours to confirm on Ethereum, you’ll start asking why you’re not using a faster chain. That’s why projects like Solana and Polygon gained traction—not just because they’re cheap, but because they avoid the mempool chaos altogether. Even Bitcoiners now rely on sidechains and payment channels to bypass the bottleneck. The mempool doesn’t just affect your wallet—it shapes the whole crypto ecosystem.

What you’ll find in the posts below aren’t just theory or charts. They’re real-world examples of how mempool congestion plays out: from Bitcoin’s fee spikes during halving cycles to Ethereum’s gas wars during NFT launches. You’ll see how traders time their moves, how wallets auto-adjust fees, and why some transactions never confirm. No fluff. Just what happens when the network gets crowded—and how to move through it without losing money.

Learn how mempool size affects Bitcoin transaction speeds and fees. Understand congestion triggers, real-time monitoring tools, and how to avoid delays with proper fee settings and address types.