Mempool Size: What It Means for Crypto Transactions and Network Speed

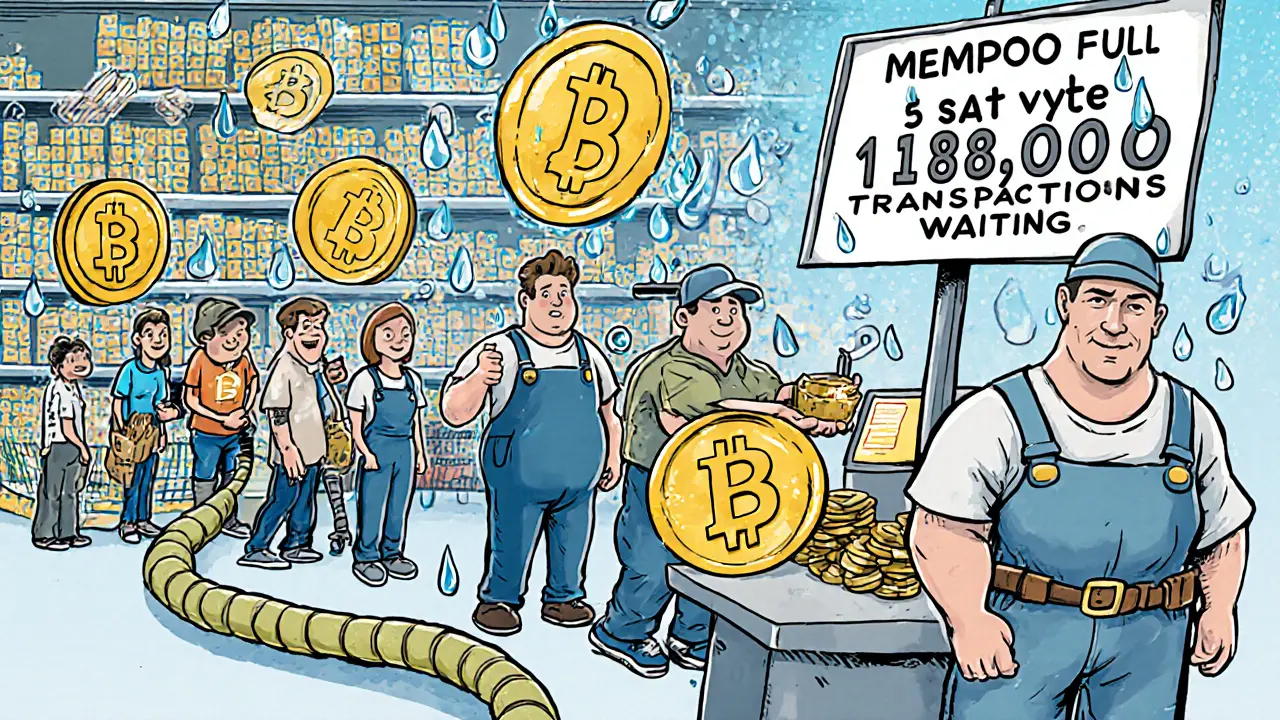

When you send a crypto transaction, it doesn’t jump straight into a block. First, it waits in a holding area called the mempool, a temporary storage space where unconfirmed transactions wait to be picked up by miners or validators. Also known as the transaction pool, it’s the frontline of blockchain congestion—where speed, cost, and timing all collide. Think of it like a line at the grocery store: if the line is long, you either wait longer or pay extra to jump ahead.

The size of the mempool directly affects how fast your transaction gets confirmed. When the mempool fills up—say, during a big NFT drop or a sudden market spike—miners prioritize transactions with the highest fees. That’s why your $50 transfer might take hours while someone else’s $500 trade goes through in minutes. Ethereum and Bitcoin both use mempools, but Bitcoin’s is more sensitive to fee spikes because its block size is fixed. Ethereum’s dynamic block sizes help a bit, but during high demand, even its mempool backs up. This isn’t theoretical—it’s daily reality. On June 12, 2024, Bitcoin’s mempool hit over 400,000 unconfirmed transactions, pushing average fees above $15. That’s not a glitch. That’s the system working as designed.

Understanding mempool size helps you make smarter moves. If you’re buying a token on a DEX and the mempool is packed, you might wait 20 minutes and pay $8 in fees—or you could adjust your gas price and save $6 while waiting 5 extra minutes. Tools like Mempool.space and Etherscan show real-time mempool data so you can see the backlog before you hit send. It’s not about being tech-savvy. It’s about not wasting money. And if you’re staking or running a validator, you need to know how mempool pressure affects your rewards. High congestion means more transaction fees get distributed to validators, which can boost your income—but only if your node stays online and responsive. Slashing penalties don’t care if the network is busy. They care if you’re offline.

Behind every delayed transaction, every surprise fee, every failed swap, there’s a mempool. It’s the quiet engine of blockchain efficiency—and the first place you should look when things slow down. Below, you’ll find real-world examples of how mempool behavior shaped crypto outcomes: from NFT sales that failed because of congestion, to traders who saved thousands by timing their moves around mempool spikes. These aren’t guesses. They’re lessons from people who watched the mempool—and used it to their advantage.

Learn how mempool size affects Bitcoin transaction speeds and fees. Understand congestion triggers, real-time monitoring tools, and how to avoid delays with proper fee settings and address types.