No KYC Crypto Exchange: Trade Privately Without Identity Verification

When you use a no KYC crypto exchange, a platform that lets you trade cryptocurrency without submitting personal documents or identity verification. Also known as non-KYC exchange, it gives you full control over your funds and keeps your financial activity private. Unlike big platforms that demand your driver’s license or passport, these exchanges let you connect your wallet and start trading in minutes—no forms, no waiting, no questions.

This isn’t just about convenience. A decentralized exchange, a peer-to-peer trading platform that runs on blockchain and doesn’t hold your assets. Also known as DEX, it’s the backbone of no-KYC trading. Platforms like xExchange and Nimera operate this way because they don’t act as custodians. Your crypto stays in your wallet. That’s why they don’t need your ID—they can’t freeze your funds even if they wanted to. This model also avoids the legal risks that centralized exchanges face in places like the U.S. or EU, where strict rules force them to collect personal data. A privacy crypto, a trading approach focused on keeping your transaction history and identity hidden from third parties. Also known as anonymous crypto trading, it’s not just a feature—it’s the core design of these platforms.

Some users think no-KYC means unregulated or unsafe. But that’s not true. Many of these exchanges use open-source code, have public audits, and rely on smart contract security instead of corporate trust. You still need to be careful—phishing sites and fake DEXs are everywhere—but the right tools make it manageable. Use wallet connectors like WalletConnect, check contract addresses manually, and avoid platforms that ask for seed phrases. The real danger isn’t the lack of KYC—it’s trusting a platform that promises safety while holding your keys.

What you’ll find below are real reviews of exchanges that actually work without ID checks in 2025. Some are built for advanced users who want full control. Others offer simple swaps with low fees. You’ll also see what’s missing: no fiat on-ramps, no mobile apps, no customer support teams. That’s the trade-off. If you want privacy, you give up convenience. But if you value ownership over paperwork, these are the tools that let you trade on your terms.

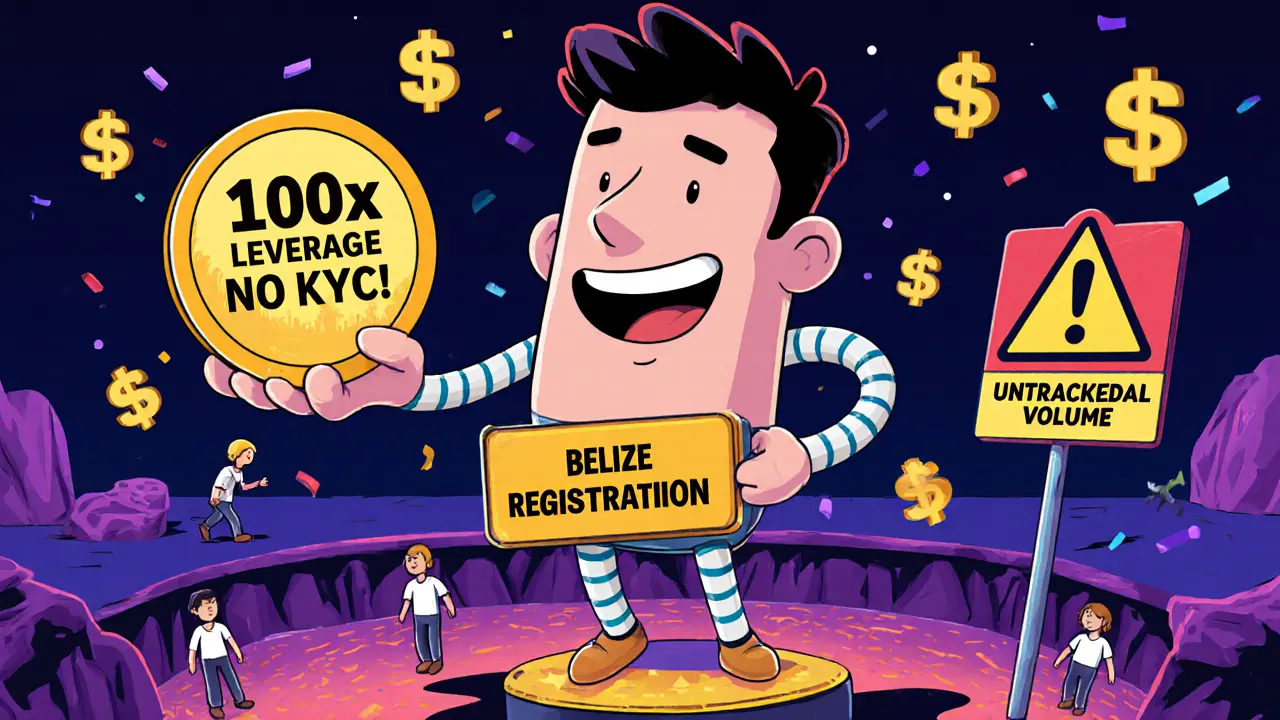

DueDEX offers zero fees and 100x leverage with no KYC, but lacks verified volume, supports only BTC/USD, and shows red flags of a scam. Is it worth the risk?