Transaction Fees Explained: What They Are and Why They Matter in Crypto

When you send crypto, you pay a transaction fee, a small payment made to miners or validators to process and confirm your transaction on a blockchain. Also known as gas fees, it’s not a tax—it’s the cost of using the network. Without it, your transaction sits idle. Think of it like a toll on a highway: no payment, no passage. These fees aren’t fixed. They change based on demand, network congestion, and the complexity of what you’re doing—sending ETH is cheaper than deploying a smart contract.

Why do some networks charge more than others? It comes down to how they handle workload. Bitcoin’s network is slow and simple, so fees rise when lots of people are sending at once. Ethereum used to be the same until it switched to Proof of Stake in 2022, which cut energy use by 99.95% and made fees more predictable. Now, networks like Solana and Polygon keep fees low by processing thousands of transactions per second. But if you’re using a newer chain with low fees, ask: is it secure? Or just cheap because no one’s watching?

Transaction fees also tie into staking, the process where users lock up crypto to help secure a blockchain and earn rewards. When you stake, you’re not just earning interest—you’re helping keep fees low by supporting the network’s efficiency. On the flip side, if you’re trading on a decentralized exchange, each swap adds a fee. That’s why some users batch trades or wait for off-peak hours. And if you’re chasing airdrops, like the NBOX NFT giveaway or the CHIHUA scam, remember: claiming often requires a small fee. If someone asks you to send crypto to "unlock" your airdrop, that’s not a fee—it’s a trap. Even blockchain fees, the broader term covering all costs to interact with a distributed ledger. These fees are what keep networks running without central control. They’re the invisible engine behind every swap, every NFT mint, every wallet transfer.

High fees don’t mean better security. They just mean more people are trying to use the network at once. That’s why some traders avoid Ethereum during NFT drops, or switch to alternative chains like Arbitrum or Base. And if you’re new to crypto, start small. Test with $1 transfers before sending large amounts. Watch how fees change over time. Use tools that show real-time fee estimates. Don’t assume the default is the best.

What you’ll find in the posts below isn’t just theory. It’s real examples: how Chinese banks block crypto withdrawals, why Qatar bans institutional trading, how the SEC’s $4.68 billion in fines changed enforcement, and why some exchanges like DueDEX or Nimera offer zero fees—but come with their own risks. You’ll see how transaction fees play out in real markets, not just whitepapers. No fluff. No hype. Just what happens when money moves on a blockchain.

Block rewards are fading as Bitcoin nears its supply cap. The future belongs to transaction fees, liquid staking, modular chains, and AI-driven incentives. Here's how blockchain payouts will change by 2030.

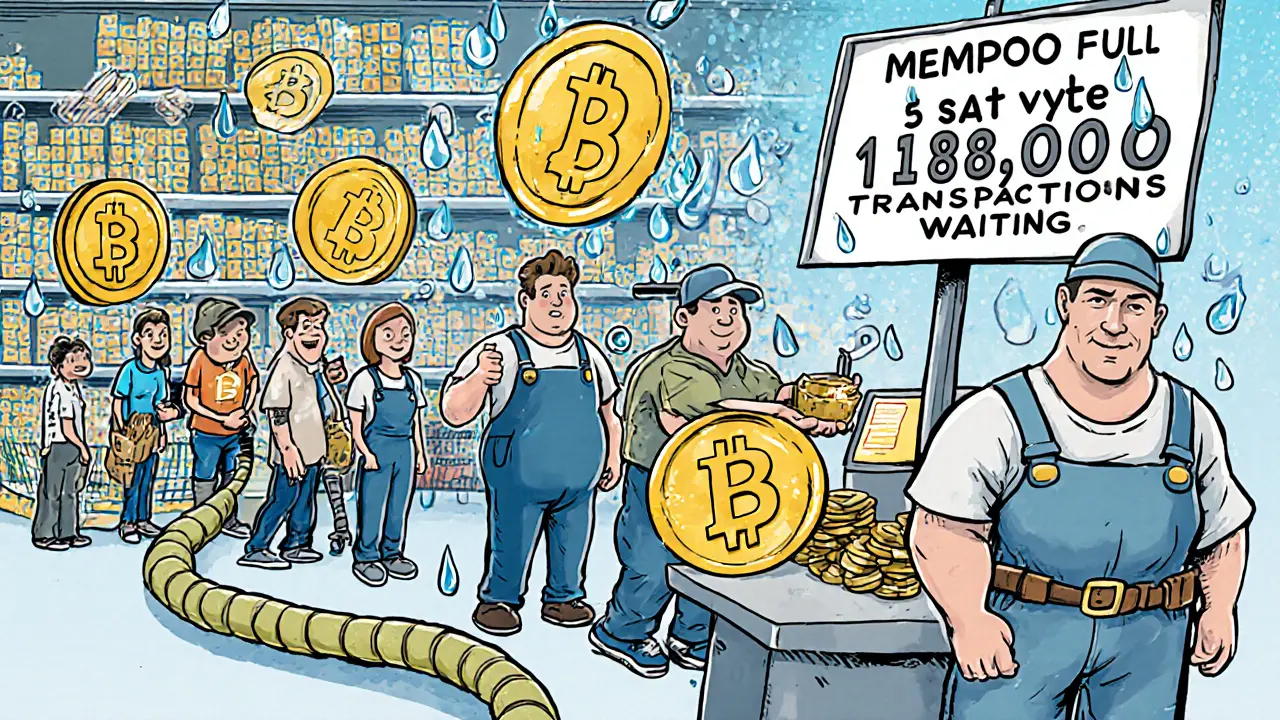

Learn how mempool size affects Bitcoin transaction speeds and fees. Understand congestion triggers, real-time monitoring tools, and how to avoid delays with proper fee settings and address types.

Block reward economics drive blockchain security by rewarding miners and validators with new coins and transaction fees. Bitcoin's halving creates scarcity; Ethereum's staking adjusts rewards dynamically. Understanding this is key to knowing how crypto networks survive long-term.