Most crypto coins try to be everything - payments, DeFi, NFTs, metaverse. But Gora Network (GORA) is different. It doesn’t want to replace Bitcoin or compete with Ethereum. Instead, it’s building something quieter, more niche, and oddly essential: a custom data pipeline for blockchain apps that need real-world info - like sports scores, medical records, or supply chain updates - to work correctly.

What Exactly Does Gora Network Do?

Imagine you’re building a smart contract that pays out money when the Boston Red Sox win a game. Or one that releases a drug shipment only after a temperature sensor confirms it stayed cold. These aren’t fantasy ideas - they’re real use cases. But blockchains can’t see outside their own systems. That’s where oracles come in.

Oracles are bridges. They take data from the real world - stock prices, weather, flight statuses - and feed it into smart contracts. Most oracles, like Chainlink, offer generic price feeds. Gora Network says: “What if you need something more specific?”

Gora lets developers build custom oracles. Not just “what’s the price of ETH?” but “what’s the exact humidity level in Warehouse B in Tokyo?” or “did Patient X take their medication at 8 AM?” It’s like going from a generic weather report to a hyper-local sensor network built just for your app.

This isn’t theory. Gora’s tech is designed for industries where precision matters: healthcare, sports betting, logistics, and fintech. If your project needs data that no one else is feeding into blockchains, Gora gives you the tools to make it happen.

How Does GORA Work Technically?

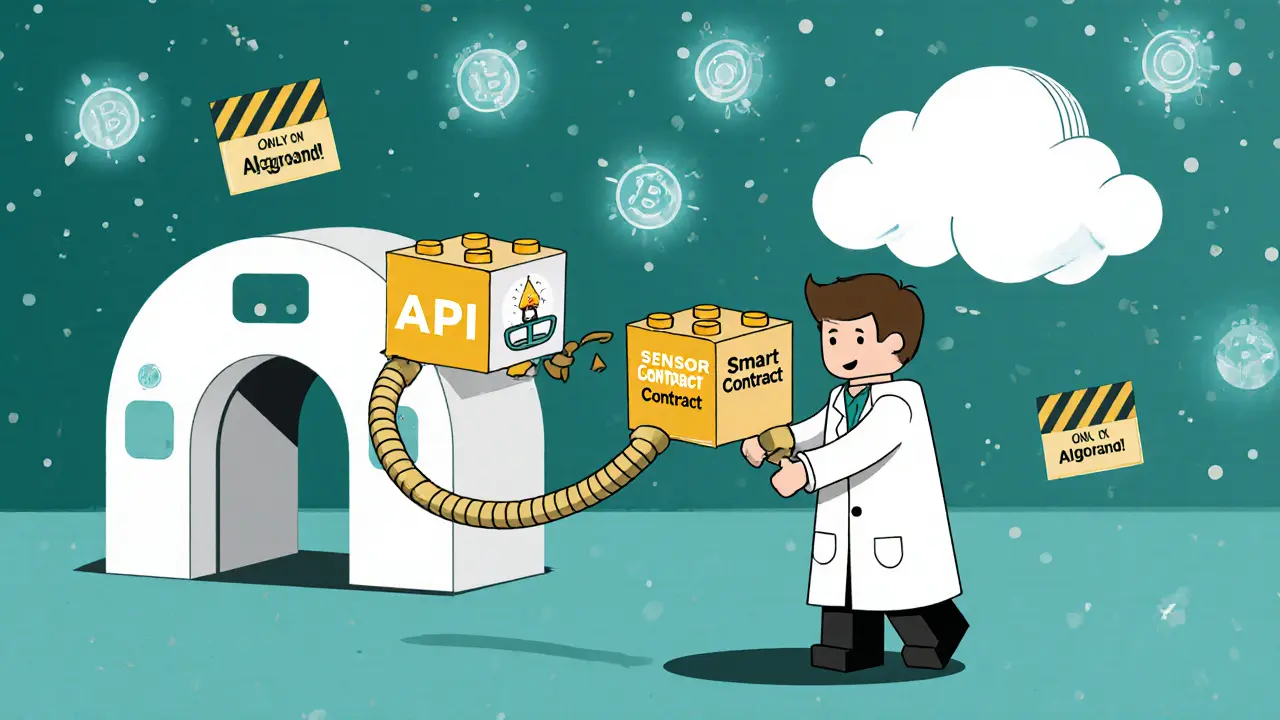

Gora Network runs on Algorand, a fast, low-cost, energy-efficient blockchain known for its pure proof-of-stake system. That means transactions are quick, cheap, and secure - important when you’re sending sensitive data like medical records or financial triggers.

The platform’s architecture is modular. Think of it like Lego blocks. You pick the data source (API, sensor, database), choose the format, and connect it to your smart contract. No need to wait for someone else to build a connector for your exact use case. You build it yourself - or hire someone to help.

Developers report it takes 2-3 weeks to integrate Gora into a project if you’re experienced with blockchain. That’s longer than Chainlink, which has ready-made templates for common data types. But Gora’s flexibility makes up for it - if you need something unusual, you’re not stuck.

And Gora isn’t stopping at Algorand. Their roadmap includes expanding to Base and Starknet by mid-2026. That’s critical. Right now, if you’re not on Algorand, you can’t use Gora. That limits adoption. Moving to other chains could change that.

GORA Token: Supply, Distribution, and Economics

The GORA token is the fuel for the network. It’s used to pay for data requests, reward validators who confirm data accuracy, and eventually, for governance.

There are 100 million GORA tokens total. As of late 2023, about 38 million are in circulation. That means over 60% are still locked up - in team wallets, private sales, or vesting schedules. This is a red flag for some investors. If those tokens unlock all at once, the price could drop hard.

Early buyers paid between $0.30 and $0.45 per token during public sales. As of November 2025, GORA trades around $0.011. That’s a steep drop from initial prices - but not unusual for small-cap crypto projects.

Trading volume is tiny - around $340 per day. That’s not a sign of weakness. It’s a sign of obscurity. There are only 393 wallet holders. Compare that to Chainlink, which has tens of thousands. Low volume means one big buyer or seller can swing the price dramatically. That’s why many users on CoinGecko warn: “Easy to manipulate.”

Who’s Using Gora Network? Real Projects

There aren’t many. That’s the truth. As of late 2023, only about seven live integrations were documented. Most are small projects on Algorand:

- DuelNow - A gaming platform using Gora to verify match outcomes.

- Mc2 Finance - A DeFi lending protocol using Gora for collateral data.

- Paal - A supply chain tracker for pharmaceuticals.

- Threebalance - A wallet service integrating Gora for income verification.

That’s it. No Fortune 500 companies. No major exchanges. No big-name partnerships. That’s the biggest hurdle. Chainlink powers DeFi giants like Aave and Synthetix. Gora is still in the garage phase.

But here’s the counterpoint: those seven projects? They’re not trying to compete with Uniswap. They’re solving real, boring, niche problems. That’s where Gora’s value lies - not in hype, but in utility.

How Does Gora Compare to Chainlink and Others?

Chainlink is the 800-pound gorilla. It’s multi-chain, has hundreds of integrations, and is trusted by big players. But it’s generic. It’s great for ETH/USD prices. Not so great for “was this MRI scan approved by Dr. Lee?”

Gora doesn’t try to beat Chainlink. It tries to coexist. Think of it like this:

- Chainlink = A highway for common data (prices, exchange rates).

- Gora = A custom delivery van for specialized data (medical logs, sports stats, sensor readings).

Most apps use Chainlink. But if you need something specific, Gora might be your only option. That’s its niche. And niche doesn’t mean useless. It means targeted.

But here’s the catch: if Gora doesn’t expand beyond Algorand and attract more developers, it stays a curiosity. Not a necessity.

Is Gora Network Worth It? Pros and Cons

Pros:

- True customization - build oracles for any data type, not just prices.

- Fast and cheap on Algorand - low fees, high speed.

- Strong technical foundation - modular design, easy to upgrade.

- Real-world use cases - healthcare, logistics, gaming aren’t just buzzwords here.

Cons:

- Extremely low liquidity - price swings easily.

- Only on Algorand for now - limits adoption.

- Only 393 holders - tiny community, low network effect.

- 60% of tokens still locked - big dilution risk ahead.

- Limited documentation and support - you’re mostly on your own.

What’s Next for Gora Network?

The roadmap is clear - and ambitious:

- Launch on Base and Starknet (mid-2026).

- Integrate with RociFi for credit score data.

- Build proof-of-concept for smart agents using Gora data.

- Transfer full control to a DAO - meaning token holders vote on upgrades and treasury use.

If they pull off the DAO and multi-chain expansion, Gora could become a serious player in specialized oracles. If they don’t? It’ll fade into obscurity like hundreds of other small crypto projects.

There’s no guarantee. But the idea is solid. The world needs more than price feeds. It needs accurate, secure, industry-specific data on blockchains. Gora is one of the few trying to build that.

Should You Buy GORA?

If you’re looking for a quick flip - skip it. The volume is too low. The risk is too high.

If you’re a developer building a niche blockchain app that needs custom data - check it out. The tools are there. The docs are rough, but usable.

If you believe the future of blockchain is in real-world data - not just money - then Gora is worth watching. It’s not the next Bitcoin. But it might be the next tool that lets blockchains do something they’ve never done before.

Right now, Gora Network is a bet on specialization. And sometimes, the smallest tools make the biggest difference.

Is Gora Network (GORA) a good investment?

GORA is not a typical investment. With only $340 in daily trading volume and 60% of tokens still locked, it’s highly volatile and easy to manipulate. It’s not suitable for casual investors. Only consider it if you understand blockchain oracles and are comfortable with high-risk, low-liquidity assets.

Where can I buy GORA coin?

GORA is currently available on a few smaller exchanges, including MEXC and Bitrue. It’s not listed on Coinbase, Binance, or Kraken. Always verify the token contract address before buying - scams are common with low-cap tokens.

Can Gora Network replace Chainlink?

No, and it doesn’t try to. Chainlink dominates general-purpose oracles. Gora focuses on custom, industry-specific data feeds. They serve different needs. Think of Gora as a specialist doctor, not a general practitioner.

Why is GORA’s price so low?

GORA’s low price reflects its tiny market cap ($2.6M), low trading volume, and high token supply. It’s not undervalued - it’s under-adopted. The price will only rise if more developers use it and more people start holding it long-term.

Does Gora Network have a future?

Its future depends on two things: expanding to other blockchains (Base, Starknet) and securing real partnerships in healthcare, logistics, or gaming. If they succeed, Gora could become essential for niche blockchain apps. If they don’t, it’ll remain a footnote in crypto history.

Comments (14)

taliyah trice

November 24, 2025 AT 00:18

Gora is the quiet kid in class who actually knows how to fix the projector

sky 168

November 25, 2025 AT 20:33

Real-world data on chain is the future. Not another meme coin. This is the stuff that matters.

Charan Kumar

November 27, 2025 AT 09:48

Algorand is solid but why not build on Ethereum? Too late to the game. Gora needs to move fast or die

Roshan Varghese

November 28, 2025 AT 15:06

60% tokens locked? Classic rug pull setup. They'll dump after listing on Binance. Mark my words 😈

Kaitlyn Boone

November 29, 2025 AT 23:42

393 holders. $340 volume. This isn't innovation. It's a graveyard for naive investors who think niche = valuable

diljit singh

December 1, 2025 AT 07:27

Chainlink has 1000x the adoption. Gora is a toy for devs who can't figure out how to use existing tools. Stop chasing unicorns

Natalie Reichstein

December 2, 2025 AT 08:28

They say 'specialized' like it's a virtue. It's just a cover for lack of demand. No one needs this. Not really.

Kris Young

December 2, 2025 AT 15:38

It’s important to note that Gora’s modular design allows for true customization-something Chainlink simply can’t match. This isn’t just a side project; it’s a foundational shift.

Frank Verhelst

December 3, 2025 AT 13:09

People are sleeping on this. Imagine a world where your insulin pump talks to a blockchain to auto-adjust dosage. Gora makes that real 🚀

James Edwin

December 4, 2025 AT 07:22

Low volume doesn't mean dead. It means early. Look at Ethereum in 2015. Quiet projects build the future.

Rob Sutherland

December 5, 2025 AT 11:43

Maybe the real question isn’t whether Gora will succeed-but whether we’re ready for a world where blockchains don’t just track money, but truth. That’s the quiet revolution.

Leisa Mason

December 6, 2025 AT 13:17

Seven integrations? That’s not a project. That’s a demo day reject. Anyone investing here is either delusional or working for the team

Marilyn Manriquez

December 8, 2025 AT 08:31

The future of blockchain lies not in speculation but in solving real problems like medical data integrity and supply chain transparency. Gora is one of the few projects addressing this with precision and purpose. It may not be flashy but it is necessary.

True innovation rarely shouts. It works quietly in the background until the world realizes it can’t function without it.

Comparing Gora to Chainlink is like comparing a scalpel to a hammer. One cuts through complexity with surgical accuracy. The other smashes everything in sight.

The fact that it’s only on Algorand is a limitation, not a flaw. It allows for focused development and rapid iteration.

Expanding to Base and Starknet will be the true test. If they execute, this could become the backbone for enterprise-grade decentralized applications.

The tokenomics are risky, yes, but all early-stage infrastructure projects carry dilution risk. The key is whether the utility grows faster than supply.

Most crypto projects chase hype. Gora chases accuracy. That’s a rare and valuable trait.

Imagine a future where your insurance claim is automatically processed because your wearable synced your vitals to a verified oracle. That’s not sci-fi. That’s Gora’s potential.

Low trading volume reflects low public awareness, not low value. The real users aren’t traders-they’re developers building systems that save lives.

The DAO transition is critical. If governance becomes truly decentralized, trust will follow. Without it, the project remains vulnerable to centralization.

This isn’t about price. It’s about infrastructure. And infrastructure takes time.

Don’t buy GORA to get rich. Buy it because you believe in the quiet work of making blockchain useful.

History favors the builders, not the speculators.

Devon Bishop

December 8, 2025 AT 23:40

wait i just checked and the gora contract on mexc has a typo in the address lol. dont buy unless you verify the real one. almost got scammed